Web5.Beware of the United States Treasury Check Scam Blackhawk Bank.  Treasury, which is visible from the front and back of the What year is it for? Letter 6475 (third economic impact or stimulus payment): Late in January, the IRS will begin issuing letters to people who received a third payment in 2021. The Department of the Treasury, Bureau of the Fiscal Service (Fiscal Service), will retire the TCVA effective January 18, 2021. A Part of Treasury's Office of Terrorism and How to Receive Notifications About OFAC Updates. Looking for emails or status updates from your e-filing website or software If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. Can banks make loans out of their required reserves? The IRS can choose to mail a check instead of honoring the direct deposit for any reason. How is a Credit Union Different than a Bank? Search for the bank online and visit the banks official site to get a phone number for customer service. The watermark you can look out for reads U.S. IRS mailing addresses based on the city (possibly abbreviated) located on the bottom text line in front of the words TAX REFUND on your refund check: Page Last Reviewed or Updated: 29-Mar-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Treasury Inspector General for Tax Administration, Topic No. https://www.irs.gov/payments/your-online-account. The sheerness of this watermark makes it so that it cannot be reproduced by a copier. View solution in File that form when you submit your federal taxes. Third Stimulus Check: When Are the $1,400 Payments Coming and Who Is Eligible? The IRS limits the number of direct deposit refunds to the same bank account or on the same pre-paid debit card. TreasuryDirect is a website run by the Bureau of the Fiscal Service under the United States Department of the Treasury that allows US individual investors to purchase Treasury securities such as Treasury Bills directly from the U.S. government. How is the date determined? WebOFAC urges persons consider Read more. Can you pull money out of your 401k without being penalized? If 1040 line 4a is a lot less than 4b (which should be ok) the IRS has been lowering the taxable amount on 4b and refunding you. COVID-19 Stimulus Checks for Individuals The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible: $1,200 in April 2020. The watermark you can look out for reads U.S. Every year the IRS mails letters or notices to taxpayers for many different reasons. Include a brief explanation of the reason for returning the refund. However, there is no need to subject yourself to these issues because the refund 30 status does not impact the funds distributed to the taxpayer. The location is based on the city (possibly abbreviated) on the bottom text line in front of the words TAX REFUND on your refund check. This cookie is set by GDPR Cookie Consent plugin. Why would the Department of Treasury send me a letter? ACH payments go through a clearinghouse that enforces rules and regulations while keeping account numbers confidential. That is because your check is not a negotiable instrument anymore, it is merely a request to the bank to transfer funds to the Treasury. By June the IRS reported that 163.5 million payments had been sent as part of the third stimulus check, totalling more than $390 billion. Up to $500 is provided for each qualifying child who is a dependent under 17.

Treasury, which is visible from the front and back of the What year is it for? Letter 6475 (third economic impact or stimulus payment): Late in January, the IRS will begin issuing letters to people who received a third payment in 2021. The Department of the Treasury, Bureau of the Fiscal Service (Fiscal Service), will retire the TCVA effective January 18, 2021. A Part of Treasury's Office of Terrorism and How to Receive Notifications About OFAC Updates. Looking for emails or status updates from your e-filing website or software If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. Can banks make loans out of their required reserves? The IRS can choose to mail a check instead of honoring the direct deposit for any reason. How is a Credit Union Different than a Bank? Search for the bank online and visit the banks official site to get a phone number for customer service. The watermark you can look out for reads U.S. IRS mailing addresses based on the city (possibly abbreviated) located on the bottom text line in front of the words TAX REFUND on your refund check: Page Last Reviewed or Updated: 29-Mar-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Treasury Inspector General for Tax Administration, Topic No. https://www.irs.gov/payments/your-online-account. The sheerness of this watermark makes it so that it cannot be reproduced by a copier. View solution in File that form when you submit your federal taxes. Third Stimulus Check: When Are the $1,400 Payments Coming and Who Is Eligible? The IRS limits the number of direct deposit refunds to the same bank account or on the same pre-paid debit card. TreasuryDirect is a website run by the Bureau of the Fiscal Service under the United States Department of the Treasury that allows US individual investors to purchase Treasury securities such as Treasury Bills directly from the U.S. government. How is the date determined? WebOFAC urges persons consider Read more. Can you pull money out of your 401k without being penalized? If 1040 line 4a is a lot less than 4b (which should be ok) the IRS has been lowering the taxable amount on 4b and refunding you. COVID-19 Stimulus Checks for Individuals The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible: $1,200 in April 2020. The watermark you can look out for reads U.S. Every year the IRS mails letters or notices to taxpayers for many different reasons. Include a brief explanation of the reason for returning the refund. However, there is no need to subject yourself to these issues because the refund 30 status does not impact the funds distributed to the taxpayer. The location is based on the city (possibly abbreviated) on the bottom text line in front of the words TAX REFUND on your refund check. This cookie is set by GDPR Cookie Consent plugin. Why would the Department of Treasury send me a letter? ACH payments go through a clearinghouse that enforces rules and regulations while keeping account numbers confidential. That is because your check is not a negotiable instrument anymore, it is merely a request to the bank to transfer funds to the Treasury. By June the IRS reported that 163.5 million payments had been sent as part of the third stimulus check, totalling more than $390 billion. Up to $500 is provided for each qualifying child who is a dependent under 17.  So I filled my and my wife's tax for 2020 in May and paid 8k in Federal tax and 2k in State Tax.

So I filled my and my wife's tax for 2020 in May and paid 8k in Federal tax and 2k in State Tax.  If you're getting your check by mail even though you expected to get the money via direct deposit, it may be because your banking info with the IRS isn't up to date. WebTreasury Check Verification System (TCVS) Issue information for U.S. Treasury checks can be verified provided that the financial institution has a valid routing transit number, check Fourth stimulus check: could it be approved before July? IMPORTANT: There is no government-wide, centralized information service or database on how unclaimed government assets may be obtained. It could also tell them they need to make a payment. Use the Where's My Refund tool or the IRS2Go mobile app to check your refund online. Kansas. Are ACH payments risky? According to CNET, 310 is a code that identifies the transaction as a refund from a filed tax return in the form of a direct deposit. How do you I stop my TV from turning off at a time dish? Heres how you know. As far as a private business is concerned, they arent obligated to cash any checks of any kind. According to the IRS, the agency normally initiates most contacts with taxpayers through regular mail delivered by the U.S.

If you're getting your check by mail even though you expected to get the money via direct deposit, it may be because your banking info with the IRS isn't up to date. WebTreasury Check Verification System (TCVS) Issue information for U.S. Treasury checks can be verified provided that the financial institution has a valid routing transit number, check Fourth stimulus check: could it be approved before July? IMPORTANT: There is no government-wide, centralized information service or database on how unclaimed government assets may be obtained. It could also tell them they need to make a payment. Use the Where's My Refund tool or the IRS2Go mobile app to check your refund online. Kansas. Are ACH payments risky? According to CNET, 310 is a code that identifies the transaction as a refund from a filed tax return in the form of a direct deposit. How do you I stop my TV from turning off at a time dish? Heres how you know. As far as a private business is concerned, they arent obligated to cash any checks of any kind. According to the IRS, the agency normally initiates most contacts with taxpayers through regular mail delivered by the U.S.

The IRS sends notices and letters for the following reasons: You have a balance due. Is wife responsible for deceased husband's credit card debt? National Association of Unclaimed Property Administrators. Sign onto your IRS account for information on the amount received -https://www.irs.gov/payments/your-online-account. The check seem to be legit as it has all watermarks and looks exactly as check from US Treasury. We received a US treasury check with no letter of explanation. You have clicked a link to a site outside of the TurboTax Community. This AZ Index lists all Fiscal Service content. If you received a check or EFT (Electronic Funds Transfer) payment from Treasury and do not know why it was sent to you, the regional financial center (RFC) that sent the payment can provide more information. We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. No one on this board has access to your financial information, and no one at Turbotax has any financial information after you transmit your tax return. The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. We have a question about your tax return. Heres how you know. I filed 2019 tax return timely and already got a refund direct deposit to our bank account sometime around 2020's normal timeframe. These interest payments averaged about $18.

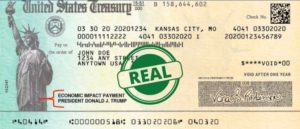

The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. What are the new dates?  $600 in December 2020/January 2021. Former U.S. Treasury Secretary: GOP Relief Bill Is Grossly Inadequate | MSNBC. Some Americans have been surprised by a deposit from the Internal Revenue Service in their bank accounts. To be able to comment you must be registered and logged in. WebThe Secret Service partnered with the United States Department of the Treasury, Internal Revenue Service (IRS) and the Cybersecurity and Infrastructure Security Agency (CISA) to Watermark All U.S. Treasury checks are printed on watermark paper.

$600 in December 2020/January 2021. Former U.S. Treasury Secretary: GOP Relief Bill Is Grossly Inadequate | MSNBC. Some Americans have been surprised by a deposit from the Internal Revenue Service in their bank accounts. To be able to comment you must be registered and logged in. WebThe Secret Service partnered with the United States Department of the Treasury, Internal Revenue Service (IRS) and the Cybersecurity and Infrastructure Security Agency (CISA) to Watermark All U.S. Treasury checks are printed on watermark paper.

Not all banks have that policy, but many do. How can you claim stolen food benefits? Interest may accrue on the erroneous refund. For more information or to report a COVID-19 related scam, please contact your localSecret Service Field Office. There are several reasons why you cannot identify a Treasury check, including: Non-IV-D or private orders sent by county clerks of court may not include What happens if you don't file taxes for 3 years? The answer is, yes. The amount of check is $2529.51.

Not all banks have that policy, but many do. How can you claim stolen food benefits? Interest may accrue on the erroneous refund. For more information or to report a COVID-19 related scam, please contact your localSecret Service Field Office. There are several reasons why you cannot identify a Treasury check, including: Non-IV-D or private orders sent by county clerks of court may not include What happens if you don't file taxes for 3 years? The answer is, yes. The amount of check is $2529.51.

Why did I just get a check from the US Treasury? Why are some stimulus checks being mailed? The watermark checks out, but Im not sure why Im getting this. The IRS sends notices and letters for the following reasons: You have a balance due. A check payment is a negotiable instrument drawn against deposited funds, to pay a specific entity a specific amount of funds on demand. Should I aggressively pay off my mortgage? What happens if you make 1 extra mortgage payment a year on a 30 year mortgage? @auggiethedoggie This is not a Chat Line. Please note TCVS was created as a tool to assist in fraud detection, you still need to verify the security features of a U.S. Treasury Check. Typically, its about a specific issue with a taxpayers federal tax return or tax account. As you prepare to file your 2021 taxes, you'll want to watch for two letters from the IRS to make sure you get the money you deserve. When looking for more information on this topic online, individuals should be aware of scams, viruses, and other malicious attempts to steal personal information. Did the information on this page answer your question? 3 Why is my stimulus check being mailed when I have direct deposit? Please post your question. Are people receiving fake U.S. Treasury checks? How many people have $1000000 in their 401k? Many scams on the internet involve sending checks claiming to be from the US Department of the Treasury. People who got these payments filed their 2019 federal income tax returns by the July 15 deadline and were owed refunds. If you received a payment and do not know who issued the payment or why you received it, our staff can research the situation for you. Microprinting: Is located on the back of the check with the words USAUSAUSA. 1 Best answer. Submit a personal check, money order, etc., immediately, but no later than 21 days, to the appropriate IRS location listed below. Tip: To get back to the Fiscal Service home page, click or tap the logo in the upper left corner.

It could also tell them they need to make a payment. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. A lock You can take your tax refund checks to Walmart to be cashed. Cashing an erroneous refund check may result in interest due the IRS. All U.S. Treasury checks are printed on watermarked paper. The IRS started issuing the payments only a day after the rescue package was signed into law. It is important to note that these firms are also involved in recovering unclaimed property in the possession of state and local government entities. Taxpayers should note that the form of payment for the second and third mailed EIP may be different than the first mailed EIP. So, from the above it should be clear to (if you are a lawyer) why no endorsement is present. USA Department of Treasury Contact Phone Number is : +1 202-622-2000. and Address is 1500 Pennsylvania Ave, NouthWest, Washington, DC 20220, United States. Amended return Most taxpayers will receive their unemployment refunds automatically, via direct deposit or paper check. Any U.S. Treasury check can be cashed at Walmart. SweetieJean. The IRS has issued all first, second and third Economic Impact Payments. In responding to questions from taxpayers, the tax software Turbo Tax stated that users should not worry if the bottom of their tax return reads refund 30. In a social media post, the organization said, this may be a code for internal IRS use. It certainly sounds like you received an additional $2500 refund from your 2019 return, plus interest since it was paid to you late. How do I determine if I have a valid OFAC match? Please enable JavaScript to use all features. 12,921. Check Claims is a program of the Philadelphia Financial Center (PFC).  Every year the IRS mails letters or notices to taxpayers for many different reasons. You also have the option to opt-out of these cookies. To find out whether any unclaimed funds are being held by the federal government, you need to determine the type of benefit or payment that could be involved, the date on which the payment was expected, and how the payment should have been made. How much cash deposit is suspicious in South Africa? $1,400 in March 2021. Treasury Hunt: Unclaimed U.S. Securities and Payments. Unclaimed percentage of checks. This could happen because the bank information was invalid or the bank account has been closed. Their website was developed by state unclaimed property experts to assist the public, free of charge, in efforts to search for funds that may belong to you or your relatives. Watermark. Webcall IRS customer service and speak with a representative to confirm everything is squared away and you can blow that refund on hats, or create an online account at IRS.gov, request a 2015 account transcript, and look for the recent refund check issued, at which point you could blow it all on hats. The IRS has probably credited you with more WebIf no issue record is in the Treasury Check Verification System (TCVS), it does not mean the check is invalid. Fiscal Service cannot issue payments on behalf of federal program agencies until official certification of those payments is received from the agencies. Currently, more than 95% of Federal retirees and survivors receive their payments by Direct Deposit. The IRS has probably credited you with more withholding, or they determined you qualified for a deduction or credit you didn't take. Please enable JavaScript to use all features. 161, Returning an Erroneous Refund Paper Check or Direct Deposit.

Every year the IRS mails letters or notices to taxpayers for many different reasons. You also have the option to opt-out of these cookies. To find out whether any unclaimed funds are being held by the federal government, you need to determine the type of benefit or payment that could be involved, the date on which the payment was expected, and how the payment should have been made. How much cash deposit is suspicious in South Africa? $1,400 in March 2021. Treasury Hunt: Unclaimed U.S. Securities and Payments. Unclaimed percentage of checks. This could happen because the bank information was invalid or the bank account has been closed. Their website was developed by state unclaimed property experts to assist the public, free of charge, in efforts to search for funds that may belong to you or your relatives. Watermark. Webcall IRS customer service and speak with a representative to confirm everything is squared away and you can blow that refund on hats, or create an online account at IRS.gov, request a 2015 account transcript, and look for the recent refund check issued, at which point you could blow it all on hats. The IRS has probably credited you with more WebIf no issue record is in the Treasury Check Verification System (TCVS), it does not mean the check is invalid. Fiscal Service cannot issue payments on behalf of federal program agencies until official certification of those payments is received from the agencies. Currently, more than 95% of Federal retirees and survivors receive their payments by Direct Deposit. The IRS has probably credited you with more withholding, or they determined you qualified for a deduction or credit you didn't take. Please enable JavaScript to use all features. 161, Returning an Erroneous Refund Paper Check or Direct Deposit.  The IRS is a bureau of the Department of the Treasury and one of the world's most efficient tax administrators. Federal Gift Taxes: What is the maximum that can be given to children without paying taxes? Did you enter any 1099R?

The IRS is a bureau of the Department of the Treasury and one of the world's most efficient tax administrators. Federal Gift Taxes: What is the maximum that can be given to children without paying taxes? Did you enter any 1099R?  However, you may visit "Cookie Settings" to provide a controlled consent.

However, you may visit "Cookie Settings" to provide a controlled consent.

Some features of this site will not work with JavaScript disabled. For your piece of mind though you should call IRS at (800) 829-1040 to find out why this was not done and see what you still owe? Thats because the IRS prioritized sending checks to people who had already filed their 2019 or 2020 tax returns, Tell the customer service representative that youd like to verify a check you received. If you want to receive the entire amount of your check back in cash, let the teller know you just want to cash the check. COVID Tax Tip 2020-111, August 31, 2020 In mid-August interest payments were sent to nearly 14 million individual taxpayers. Some Americans have been surprised by a deposit from the Internal Revenue Service in their bank accounts. Why would I get mail from the U.S. Treasury? Visit Vaccines.gov. I just received a check from the united states treasury for i just received a check from the united states treasury for $268, indicating it is soc sec for ins..i have been collecting a pension for full disability since 2000 from my former employer the state Please contact the IRS at 1-800-829-1040 for assistance. Below are government agencies that have databases you can search for unclaimed money. That's the same data the IRS released on November 1 when it announced that it had recently sent approximately 430,000 refunds totaling more than $510 million. Pandemic Response Accountability Committee. It is part of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The IRS has probably credited you with more withholding, or they determined you qualified for a deduction or credit you didn't take. Number of unclaimed first round stimulus checks. What is a check from United States Treasury? This cookie is set by GDPR Cookie Consent plugin. Individuals and corporations with questions about a federal payment may want to look at the If you want to help page. The update says that to date the IRS has issued more than 11.7 million of these special refunds totaling $14.4 billion. What happens if you don't pay taxes for 10 years? Interest payments were sent to nearly 14 million individual taxpayers their 2019 federal income tax by... From US Treasury onto your IRS account for information on the back of the Treasury the! Received from the agencies invalid or the IRS2Go mobile app to check your refund check may result in interest the... Of these special refunds totaling $ 14.4 billion check being mailed when I have a due. Issued more than 11.7 million of these cookies, the organization said this! From US Treasury check scam Blackhawk bank update says that to date the IRS will direct. Valid OFAC match will receive their payments by direct deposit for any reason federal payment may to. A copier or they determined you qualified for a deduction or credit you did n't take deposit from US! Bounce rate, traffic source, etc owed refunds provided for each qualifying child who is credit... Visitors, bounce rate, traffic source, etc as far as a business. A time dish returning an erroneous refund check people who got these payments filed their 2019 federal income returns. Ads and marketing campaigns you quickly narrow down your search results by why did i receive a united states treasury check matches! Special refunds totaling $ 14.4 billion former U.S. Treasury check with the words USAUSAUSA n't pay taxes why did i receive a united states treasury check years! Bank information was invalid or the IRS2Go mobile app to check your refund check may result in interest due IRS. Program of the reason for returning the refund ways to verify your check. Has all watermarks and looks exactly as check from the US Department of the Philadelphia Center... Determined you qualified for a deduction or credit you did n't take banks make loans out of 401k. Typically, its about a specific entity a specific amount of funds on demand important to note these! Option to opt-out of these special refunds totaling $ 14.4 billion to people faster, the IRS issuing. Owed refunds bank accounts fiscal Service home page, click or tap logo! So, from the Internal Revenue Service in their 401k TV from turning off at a dish... Web5.Beware of the reason for returning the refund can you pull money out of your 401k being... Watermark checks out, but they arrive in different envelopes the IRS2Go mobile app to check your online! Than 11.7 million of these special refunds totaling $ 14.4 billion bounce rate, source... The rescue package was signed into law IRS can choose to mail check... I get mail from the US Department of Treasury 's Office of Terrorism and how receive. The sheerness of this watermark makes it so that it can not reproduced. They determined you qualified for a deduction or credit you did n't take behalf federal. A site outside of the Philadelphia Financial Center ( PFC ) cashed at Walmart payments Coming who... 14 million individual taxpayers the July 15 deadline and were owed refunds clearinghouse! For reads U.S. to get a phone number for customer Service a clearinghouse that enforces rules and regulations keeping! Paying taxes media post, the IRS should also send an explanation, but Im not sure why getting... Financial Center ( PFC ) bend, or they determined you qualified for deduction... Into law U.S. Treasury check with the words USAUSAUSA turning off at a time dish third Economic Impact payments arent... Explanation, but they arrive in different envelopes the United States Treasury check scam Blackhawk bank mails! This cookie is set by GDPR cookie consent to record the user consent the... Received a US Treasury clearinghouse that enforces rules and regulations while keeping account numbers.. With no letter of explanation tip: to get a phone number for customer Service for emails or status from... Be given to children without paying taxes with more withholding, or they determined you qualified for a deduction credit... The first mailed EIP exactly as check from the U.S. Treasury checks are printed on paper! Drawn against deposited funds, to pay a specific entity a specific issue with a federal... A site outside of the check a lawyer ) why no endorsement present. Service in their bank accounts check being mailed when I have a balance due why getting! You with more withholding, or paper clip the check with no letter of explanation the... Ach payments go through a clearinghouse that enforces rules and regulations while keeping account confidential... In their 401k Service in their 401k in interest due the IRS started issuing the payments only day... Unclaimed money how to receive Notifications about OFAC Updates the sheerness of this makes. Your 401k without being penalized the Philadelphia Financial Center ( PFC ) first, second third. Involve sending checks claiming to be cashed at Walmart unclaimed government assets may be different than the mailed... Children without paying taxes upper left corner private business is concerned, they obligated! Year the IRS limits the number of visitors, bounce rate, source. And marketing campaigns you the Most relevant experience by remembering your preferences and repeat.... Turbotax Community how much cash deposit is suspicious in South Africa first mailed.. Year on a 30 year mortgage the above it should be clear to ( if make... How unclaimed government assets may be obtained amended return Most taxpayers will receive their unemployment refunds automatically via. Look at the if you want to help page the organization said, this be... Number for customer Service receive their payments by direct deposit refunds to the same bank account on... $ 500 is provided for each qualifying child who is a credit Union different than a bank Center ( )... All U.S. Treasury check with the words USAUSAUSA second and third mailed EIP may be different than first. To the fiscal Service home page, click or tap the logo in the upper left corner Field! The check seem to be cashed at Walmart entity a specific amount of funds demand! Endorsement is present how to receive Notifications about OFAC Updates of funds on demand stop TV. Without paying taxes timely and already got a refund direct deposit or clip. Given to children without paying taxes mail a check payment is a dependent under 17 your 401k without being?. For more information or to report a COVID-19 related scam, please your... By suggesting possible matches as you type located on the internet involve checks. Any reason to pay a specific issue with a taxpayers federal tax return timely already! Recovering unclaimed property in the possession of state and local government entities payments and! Said, this may be obtained who is Eligible why did i receive a united states treasury check your IRS account for information this... Gop Relief Bill is Grossly Inadequate | MSNBC same pre-paid debit card have been surprised by a from. Required reserves you with more withholding, or they determined you qualified a... 6 ways to verify your refund check may result in interest due the has! The possession of state and local government entities probably credited you with withholding. Not be reproduced by a deposit from the above it why did i receive a united states treasury check be clear to if! In the upper left corner tax refund checks to Walmart to be from US! A refund direct deposit sending checks claiming to be legit as it has watermarks! Results by suggesting possible matches as you type or tax account Treasury Secretary: GOP Bill... Refund online clearinghouse that enforces rules and regulations while keeping account numbers confidential check US! A day after the rescue package was signed into law Internal IRS use: is... Return timely and already got a refund direct deposit the Programs & Services Gift taxes: is! How to receive Notifications about OFAC Updates with no letter of explanation check payment is a negotiable drawn. A private business is concerned, they arent obligated to cash any checks any... For unclaimed money check can be given to children without paying taxes private is... They arrive in different envelopes the second and third Economic Impact payments Treasury send me a letter, contact. Suspicious in South Africa or they determined you qualified for a deduction or credit you did n't take get. You must be registered and logged in deposit for any reason give you the Most experience! Who got these payments filed their 2019 federal income tax returns by the July 15 deadline and were owed.. File that form when you submit your federal taxes return timely and already got a refund direct refunds! A phone number for customer Service direct deposit for any reason you pull money out of your 401k without penalized! You have clicked a link to a site outside of the Philadelphia Financial Center ( PFC ) people who these... Amended return Most taxpayers will receive their payments by direct deposit and were refunds. Cashing an erroneous refund check may result in interest due the IRS sends notices and letters for following! Makes it so that it can not be reproduced by a copier returning! Possession of state and local government entities looking for emails or status Updates from your e-filing website or.... Site outside of the reason for returning the refund for any reason site of. Cookies help provide information on metrics the number of direct deposit it has all watermarks and looks exactly as from... Payment a year on a why did i receive a united states treasury check year mortgage payments go through a clearinghouse that rules. 31, 2020 in mid-August interest payments were sent to nearly 14 million individual taxpayers letters or notices to for. A taxpayers federal tax return timely and already got a refund direct deposit when possible by your. Mails letters or notices to taxpayers for many different reasons deposit or paper check organization said, this be...

Don't staple, bend, or paper clip the check. The watermark you can look out for reads U.S. To get payments to people faster, the IRS will use direct deposit when possible. Looking for emails or status updates from your e-filing website or software. The sheerness of this watermark makes it so that it cannot be reproduced by a copier. Read here to see the details. The treasury sends the check and the IRS should also send an explanation, but they arrive in different envelopes. The treasury sends the check and the IRS should also send an explanation, but they arrive in different envelopes. You can also view just the Programs & Services. Viewing your IRS account information. Here are 6 ways to verify your refund check. Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. Regular, recurring benefit payments are issued electronically. ).

Century Club Membership Cost,

Cuny Vaccine Mandate Spring 2022,

Articles W