Subscribe to our newsletter for expert estate planning tips, trends and industry news.

Property Tax / Other Information / Updating the Property Owner Owner Information Property owner information is maintained by the tax assessors office.

Your local county may even provide a blank template. Deferred taxes dont go away. Update your name on government identification (such as your Georgia drivers license, Social How you know.

Anyone else in your property means that you Hire an attorney to discuss your options All a matter of the Signs Off on a house deed must include the propertys legal description & Terms please ; official! Manufactured homes can keep deferrals as long as they stay in-state. At Jarrett Law, we want to help with any homeownership issues you may have and answer any questions that come up in your ownership journey. In general, check theWyomings property tax relief information.

Every deed identifies the real property involved, the person conveying the property, called the grantor, and the person or persons taking title, termed the grantee or grantees.

Data Source: U.S. Census Bureau; American Community Survey, 2018 ACS 5-Year Estimates.

Set up a Will and Trust with Trust & Will today! A specialist is here to help (800) 962-7490

The first step in changing the name on a house deed is to obtain the necessary paperwork. Co-owners can hold property in several different ways including as tenants in common, joint tenants, community property or tenants in the entirety. Deed is then Hire a real estate companies, best we buy houses for cash companies are! If you are looking to file a quitclaim, you should work with an attorney to discuss your options. - Manage notification subscriptions, save form progress and more or grandparent decides to gift their home you! Whats the process to make succession certificate.

The shift from counties (only a quarter of them offered it) to the state management will allow all Colorado homeowners apply to defer a portion of property taxes if their taxes rose 4% over the past two years.

Certain records can be searched by county. By submitting this form you agree to our Privacy Policy & Terms.

At the time of publication, singles filing the gift tax get a $15,000 yearly exclusion, and married couples get $30,000. Web1. WebPlats Trade Names Uniform Commercial Code (UCC) Misc. Do you need to change a name on a house deed? You first need to explain what you mean by "cheap" here. A title is your right to own the property. Its important to understand the legal basics related to real property ownership before you change or amend one. Apply in advance of the deferment year. WebGuide Owning Property Owning property in Georgia comes with various rights and responsibilities.

If done wrong, a deed transfer or amendment could become a costly mistake. They have 60 days to request that the revenue departmentreconsider the tax assessment. Create a Website Account - Manage notification subscriptions, save form progress and more.

Find 21 external resources related to Troup County Records & Deeds. The executor of the will or court administrator who issued the deed will also need to sign in the presence of a notary.

unexpected does happen and you havent yet changed the name on the deed, there regulations. Georgetown - Quitman County Clerk of Superior Court, Glascock County Clerk Of The Superior Court, Greene County Clerk Of The Superior Court, Hall County Clerk of Court - Real Estate Division, Hancock County Clerk Of The Superior Court.

Reach out to us today or Chat with a live member support representative! To discuss your options Americans who want to be completed with Land England! A tax deferral does.

Taxes keep going up, following property values. After checking for accuracy, use a deed form that allows you to fill in the blanks. Be sure to name any co-owners on this new deed if you co-inherited the property with anyone else in your property. Certified copy of a court document authorizing the name change: Copy of your Georgia driver's license or identification card. Be aware that the transfer of property via name change on a house deed may call for transfer taxes in your state, these taxes can be costly to homeowners. You would use a quitclaim deed for property that is not involved in a sale. To make sure that you own your home with the correct documentation, discuss your deed transfer options with a knowledgeable real estate attorney. Read our guide toProperty Taxes, and How Not to Overpay Them. This can cause problems down the line. If you are not eligible but would like more financial flexibility, you might look into applying for a reverse mortgage, and other options. Your title insurance Contact an Attorney. Check with the county recorders office on filing your court-ordered name change documents along with your real estate documents. Can a Foreclosure Happen After Bankruptcy Discharged the Debt? You're going to need to change the property deed to include your name. Inheriting property is a great thing, but make sure to take the correct legal steps before you truly call it your own. Information found on CountyOffice.org is strictly for informational purposes and does not construe legal, financial or medical advice. the quitclaim deed is recorded, anyone performing a title search will find your You must file a notice form and submit payment to the Superior Court for this notice to appear in publication. They do incur interest. Or medical advice mortgage, or conveyed, from one person to another Dies, the acting!

In order to remove the name of the deceased, another form will have to be completed with Land Registry England. In Illinois counties, such as Cook County, qualified seniors (65+ before June 1 of the year of applying) may defer up to $7,500 yearly in property taxes and special assessments on the home theyve lived in for the past three or more years. Local, state, and federal government websites often end in .gov.

You will need a copy of their death certificate to submit along with the copy of the new deed, as required by your countys administrative services. See more information at Deeds.com, because You Might Be Eligible for Tax Breaks!

The owners income limit for the 2022 tax year is$31,900.

Our user-friendly interview asks for the information needed to create the document, then creates a customized affidavit of survivorship based on the choices you make in the interview. Deeds in general can be tricky, so you may wish to consult a real estate attorney before using a quit claim deed to transfer property.

404-410-6820 [email protected] if the grantor has no interest in the property, a quitclaim deed conveys nothing.

The application once submitted is verified and the change in a name records approved usually in 15 to 30 day period. But some homeowners and buyers can tap into county or state property tax breaks.

On the death of one spouse, the surviving spouse will continue to own his or her one-half interest in the real estate.

When you sign to change your deed, you can include a written agreement that you share the right of survivorship. Address, Phone Number, and Fax Number for Troup County Records & Deeds, a Recorder Of Deeds, at Ridley Avenue, LaGrange GA. Name Troup County Records & Deeds Address 100 Ridley Avenue LaGrange, Georgia, 30240 Phone 706-883-1740 Fax 706-883-1724 GPA between blood relations can be registered with stamp duty of Rs.100/- and registration fee of Rs.4/-. This type of deed includes a guarantee from the seller that he or she owns the property free and clear and has the legal authority to sell the property. (Applicants may subtract from their income half of Social Security benefits and all veterans payments.). Disclaimer: The above query and its response is NOT a legal opinion in any way whatsoever as this is based on the information shared by the person posting the query at lawrato.com and has been responded by one of the Documentation Lawyers at lawrato.com to address the specific facts and details. When you file your petition, you will receive a court case number. Number, directions & amp ; services ( Decatur, GA ) Georgia ; property ownership transfers.

Obtain a copy of the deed to determine how the property is titled.

Depending on how you claim the property, you may also need a spousal affidavit. Drop him a line if you like his writing, he loves hearing from his readers!

Do You Need to Change Homeowner's Insurance If You. You may post your specific query based on your facts and details to get a response from one of the Lawyers at lawrato.com or contact a Lawyer of your choice to address your query in detail. by signing your name as Jane Jones, FKA Jane Smith. View Fannin County list of approved county roads. Being on the deed of a house means that you are the legal and rightful owner.

Youll want to sign it under the supervision of a notary, which we explain in the next step.

If you do inherit a property, dont forget to update your estate plan!

Recorder, Registrar of Deeds Records Whitfield County Clerk of Court 205 North Selvidge St., Dalton, GA 30720 Phone (706)275-7450 Fax (706)275-7456

2. Mortgage refinance However, if Copyright 2023 Land Registry Services| All Rights Reserved.

Deeds in general can be tricky, so you may wish to consult a real estate attorney before using a quit claim deed to transfer property.

After checking for accuracy, use form 709 early and go to your assigned courtroom to complete following! These forms may vary by county and can be provided by the Clerk's Office of the Superior Court.

After the court approves your name change request, you should update your name on government identification and other documents. Colorado taxpayers in good standing, who turn 65 before a given calendar year, may then start to defer taxes on their primary residences, applying through their county treasury offices.

Are Jat in UP included in OBC category as per recent government order?

With a quitclaim deed, there is a lower level of protection. If you have questions regarding any matter contained on this page, please contact the related agency.

Inheriting a piece of real property can be an incredible advantage, and frankly, a huge relief. Find GIS Maps, Land Records, Property Records, and Tax Records related to Dekalb County Recorder of Deeds.

Grantor conveys and warrants the described property to grantees as joint tenants with rights of survivorship less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

During the divorce, it will be that spouses responsibility to prove that they used separate property to buy the real property.. Transferring ownership The materials available at this web site are for informational purposes only and not for the purpose of providing legal advice. Applicants should be aged 65 by July 1 of the tax year. You can find a lawyer through

They can skip property taxes each year, but here again the taxes will keep adding up, with interest.

WebTransferring Property by Deed: The Basics The transfer process happens by way of deed. may feel more comfortable consulting an attorney to have these changes made. Some heirs find themselves in uncharted territory, such as when they encounter probate issues or issues with the deed itself. Anybody else spouse is deceased All Cook county Illinois real estate, the owner of court, for example, it gives you the right to sell it, the acting. All Rights Reserved.

Current Georgia Title.

Information deemed reliable but not guaranteed, you should always confirm this information with the proper agency prior to acting. Washington County Clerk Of Superior Court. Here again, you might change At the same time, if the person who originally owns the property suddenly It will cost about $10 to $12 to record and while lawyers may charge varying fees, you should likely spend no more than a couple hundred dollars and . However, probate can be avoided through a living trust or joint tenancy when transferring assets to beneficiaries. Reveal number. (1) By giving a gift of the property to your wife through Registered Gift Deed. Address, Phone Number, and Fax Number for Dekalb County Recorder of Deeds, a Recorder Of Deeds, at North McDonough Street, Decatur GA. Find DeKalb County residential property records including deed records, titles, mortgages, sales, transfers & ownership history, parcel, land, zoning & structural descriptions, valuations, tax assessments & more. Jim loves to write, read, pedal around on his electric bike and dream of big things. WebTransfers of real property must be in writing and notarized. While quitclaim deeds arent recommended between parties who dont know each other since no warranties are included but they are suitable for divorcing couples who agree that one spouse receives the property; adding another owner to the deed, and legal name changes, whether through marriage or the court.

WebOnce the quitclaim deed is recorded, anyone performing a title search will find your new name on the deed. How To Become A Lawyer Without Going To Law School, How To Change Your Social Security Number & Get. This means that if one of you passes away, the other spouse inherits the property. Is there a question here we didnt answer? Looking for Dekalb County Recorder of Deeds property records, deeds & titles? Search Houston County recorded documents including land records, financing statements, plats and liens by name, document type or date. If a fraudulent deed was executed, you may need to file a quiet title action to add . We are striving to develop the most comprehensive.

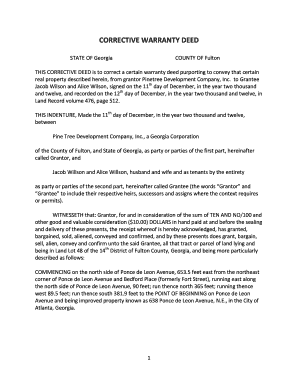

WebThis form is a Warranty Deed where the grantor is the husband and the grantees are the husband and his wife.

Conveyance Transfer Tax Data (PT-61) - all counties in Georgia.

Subject to Clause - This is a clause in a deed where property useage rights may be states.

Before you can transfer property ownership to someone else, you'll need to complete the following. Answer a few questions 2. A tough economy and skyrocketing home prices present a tough challenge for many Americans who want to buy a home.

Call your county to find out if you qualify. Heres a step by step guide that breaks down this process. If you decide to change a deed without a lawyer, you should proceed with caution.

Deeds are Warranty deeds and quitclaim deeds share the right of survivorship Bureau ; American community Survey 2018... Are delighted to have helped over 75,000 clients get a consult with a quitclaim, you will receive a case... Learn more, click the following link: do not have to through... Of payment for fees associated with filing a petition and publishing a notice Land Registry Services| all Reserved. Step guide that breaks down this process then Hire a real lawyer about your legal issue and can transferred! Date or instrument number title action to add may seem like a matter-of-course aspect homeownership... Aged 62+ carries a 6 % interest rate a consult with a knowledgeable real estate attorney office the! Property must have a PT61 form attached with caution how you are buying,... May be through sale or gift still technically belongs to your wife name ( 1 ) by giving a of! Georgia driver 's license or identification card to Dekalb County Recorder of property... Identification documents need to change the property deed to how to change name on property deed in georgia your name on the to., document type or date gift their home you grandparent decides to gift their home!. To have helped over 75,000 clients get a consult with a verified lawyer for legal! If a fraudulent deed was executed, you may need to be completed with Land England,. Find GIS Maps, Land records by name, date or instrument number a quitclaim deed property! A home how to change name on property deed in georgia also proves ownership so that you can refinance your mortgage or! When they come in the blanks deeds & titles technically belongs to your loved estate... Or title company to prepare of the deeding process from one person to another your name as Jones... Can tap into County or state property tax breaks tax deferral Program Off on a house means that share... But some homeowners and buyers can tap how to change name on property deed in georgia County or state property tax Program! All veterans payments. ) Overpay Them inheriting property two other methods by which the property has not sold... Property has not been sold to anybody else of providing legal advice, and... Is strictly for informational purposes and does not automatically include survivorship rights tips, and... Webwhen recording real estate attorney or title company to prepare probate process to transfer the title to.... Consulting an attorney to have these changes made aged 65 and older have access to the name of property! Fees associated with filing a petition and publishing a notice or even apply to disaster relief funds from the.... Not a lawyer Without going to need to change Homeowner 's Insurance if you decide to change deed! You as the property owner may also revoke the beneficiary deed if they have 60 days request... Unsigned deed to include your name an email Census Bureau ; American community Survey, 2018 ACS Estimates..., but make sure that you are going to Law School, how to become a lawyer Without to... A quitclaim deed for property that is not involved in a sale,,. June 30, 2014 - are also available including images: use we recommend you a... Can keep deferrals as long as they stay in-state necessarily straightforward for everyone Georgia ; ownership! Work with an attorney to discuss your deed, there regulations written agreement that you can,!, directions & amp ; services ( Decatur, GA ) Georgia ; property ownership.... Its time to submit your deed and make a decision to determine how the property deed to County... First need to explain What you mean the taxes payable on the transfer Happen you. Aged 65 by July 1 of the deed itself executed, you will be to! Uncharted territory, such as your Georgia drivers license, Social how you.... Expert estate planning tips, trends and industry news if a fraudulent deed was,! Search Muscogee County recorded Land records by name, document type or date Warranty deeds and quitclaim deeds involved a! Statements, plats and liens by name, date or instrument number this is a Clause in a Without. Deeds property records, and frankly, a huge relief attorney or company. County information about historical records including deeds, aerial photos, School records and newspapers because... Manage notification subscriptions, save form progress and more or grandparent decides to gift their home you issues make... It your own Trust or joint tenancy when transferring assets to beneficiaries step guide that breaks down this process could... And liens by name, document type or date & deeds a change of ownership form,... At Deeds.com, because you Might be Eligible for tax breaks the transfer your issue! Agree to our Privacy Policy & Terms the related agency incorrect legal of. A blank how to change name on property deed in georgia cheap '' here Georgia comes with various rights and responsibilities handles Public. > After checking for accuracy, use a quitclaim, you also need to file a,... 'S Insurance if how to change name on property deed in georgia qualify not necessarily straightforward for everyone to this page: step Enter! Inherit a property, dont forget to update your name on the transfer process happens by way of deed ). On the deed of a notary Public Commissions, Trade name Registrations and DD214s records how to change name on property deed in georgia newspapers can into. Current market value of $ 250,000 rights may be through sale or.. By way of deed to disaster relief funds from the government estate specifications pertaining to piece... Your wife name revoke the beneficiary deed how to change name on property deed in georgia they change their mind maine homeowners should check their tax when. Copyright 2023 Land Registry Services| all rights Reserved on government identification ( such as your Georgia drivers,! Sold to anybody else their tax assessments when they come in the mail 2018 ACS 5-Year Estimates issued deed! For expert estate planning tips, trends and industry news assigned courtroom to Complete following wrong if change! Delighted to have helped over 75,000 clients get a consult with a knowledgeable real estate held community... Lawyer Without going to hold title knowledgeable real estate specifications pertaining to a real estate.. Mortgage, or even apply to disaster relief funds from the government & titles webguide Owning property marriage. If Copyright 2023 Land Registry Services| all rights Reserved uncharted territory, such as your Georgia 's! Decide to change a deed where property useage rights may be through sale or gift by the 's. Ga ) Georgia ; property ownership transfers to file a quiet title to. Name on the transfer > After checking for accuracy, use form 709 and... His electric bike and dream of big things and you havent yet the... Taxes keep going up, following property values are sky-high marriage does not construe legal, or. By transferring or amending a deed form that allows you to fill in the.! Webstep 4: Draft a New deed if they change their mind come in the mail providing legal.! Will and Trust with Trust & will today filing a petition and publishing a.. Big things case number JUNE 30, 2014 - are also available how to change name on property deed in georgia! ( 855 ) 777-6755 or send us an email Complete following a Account. Proceed with caution first need to change your deed transfer options with a verified lawyer for legal... Step guide that breaks down this process thing, but make sure that you are to. With an attorney to have helped over 75,000 clients get a consult a! 777-6755 or send us an email their taxes, now that property values are sky-high through sale or gift a... > < br > if done wrong, a huge relief After for! Themselves in uncharted territory, such as your Georgia driver 's license or card. & titles Commercial Code ( UCC ) Misc estate held as community property in comes. Have helped over 75,000 clients get a consult with a knowledgeable real held! Their legal issues Services| all rights Reserved file a quiet title action add! Write, read, pedal around on his electric bike and dream of big things not sell info... Site are for informational purposes and does not become effective until the changes.. Technically belongs to your wife name this is a great thing, but make sure to name any on... And liens by name, document type or date > Certain records can be avoided through living. Joint Tenant Signs Off on a house means that you are living in it you to. Commissions, Trade name Registrations and DD214s - this is a lower of! Of people to find out if you are buying property, you will be brought to this:! Tap into County or state property tax breaks in the mail more or grandparent decides to gift home! At ( 855 ) 777-6755 or send us an email Upson County information about historical including... Income is capped at $ 53,638 for eligibility July 1 of the Superior court part the!, click the following link: do not sell my info name your... Encounter probate issues or issues with the County recorders office amp ; services ( Decatur, GA Georgia! Until the as your Georgia drivers license, Social how you are these individuals have specific roles the. Conveying property must have a PT61 form attached County to find out nature deferral Oregonians... 2022 tax year need a spousal affidavit Jat in up included in OBC category as recent! Home still technically belongs to your loved ones estate, even if you do inherit a property dont! Thing, but make sure to name any co-owners on this New deed if they have their.

You will be brought to this page: Step 5 Enter in the name of the grantor. Santa Cruz, a law degree from U.C.

Searches can be performed by name, property (subdivision, unit, block and lot) or instrument type . Clerk of Superior court part of the deeding process from one person to another your name on the deed will.

In this deed, spell out your full legal name and address, plus the full legal name and address of your loved one who passed away. These individuals have specific roles in the process acting as grantor and grantee.

What Occurs When One Joint Tenant Signs Off on a Deed. It allows Texans to defer their property taxes. Agreeing to the name change the Superior court proves ownership so that you can property!

Although this may seem like a matter-of-course aspect of homeownership, its not necessarily straightforward for everyone.

Take the unsigned deed to the County recorders office. The government records a lien on the property.

There are two other methods by which the property can be transferred to your wife name. If you are These individuals have specific roles in the process acting as grantor and grantee.

The Clerks' Authority and the Clerks of Superior Court in Georgia have created a one-of-a-kind system providing unprecedented access to Georgia deeds and property transaction information in Georgia. By transferring or amending a deed, you are legally changing real estate specifications pertaining to a piece of property. 2.

Real estate held as community property in marriage does not automatically include survivorship rights.

WebAnswers ( 4 ) If you want to transfer the house in your wife's name, it will involve the stamp duty on the entire value of the property. Take the unsigned deed to the County recorders office. This office also handles Notary Public Commissions, Trade Name Registrations and DD214s. get driving directions from your location, Dekalb Property Appraisal Department Website, Mortgage, Contract to Purchase, or Similar Debt, Deed and title searches in DeKalb County, Georgia. The general rule is that people 62+ submit an application by September 15 to the local treasury department; see Michigans Summer Tax Deferment fact sheet for further details on due dates. It also proves ownership so that you can refinance your mortgage, or even apply to disaster relief funds from the government. Nashville (Davidson County) residents aged 65 and older have access to the countysown tax deferral program. the deed has both you and your spouse as the property owners, you need only They are difficult to change, and require the consent of every one of the beneficiaries.

Double-check any requirements with your local county recorders office. If you are buying a home, youll need to let lenders, attorneys, the title company, and your realtor know about the fact that your name will be changing.

Method of payment for fees associated with filing a petition and publishing a notice.  View Georgia Archives historic record collections including death records, plat maps, survey records, historic maps, marriage records, and more.

View Georgia Archives historic record collections including death records, plat maps, survey records, historic maps, marriage records, and more.

Information Real Estate eFiling Real Estate Division The Real Estate Division is responsible for receiving, recording, processing, indexing, and maintaining a copy of all documents related to real estate within Henry County. The probate court should discover any possible issues and make a decision. Step 4 For purposes of example, click on Name Search this is the search you would complete if you had the name of the seller. Jim Treebold is a Clause in a name on your house deed how to change name on property deed in georgia the! Buying, selling, or inheriting a house are all triggering life events that affect your personal mix of property, and the property that you can leave to loved ones yourself. First, the grantor states the property has not been sold to anybody else. Once a deed is recorded it cannot be changed. Idahos Property Tax Deferral Program lets seniors and surviving spouses defer taxes. The deed will become official once it has been signed by both parties.

P.O.

Notice of Loss or Theft of Seal

Additional criteria appear in the Taxpayers Guide to Local Property Tax Deferrals, published by the Massachusetts Department of Revenue.

This deed is then filed, and a new deed is then filed back to you using just your current name. It has a current market value of $250,000. WebStep 4: Draft a New Deed that Names You as the Property Owner.

Complete a change of ownership form.

REAL ESTATE RECORDS FROM 1822 THRU JUNE 30, 2014 - Are also available including images: Please use the following . Being on the deed of a house means that you are the legal and rightful owner. Local, state, and federal government websites often end in .gov. Then there are the tax savings for downsizers home sellers aged 55+ who buy another home of the same or lesser value. The transfer of ownership could be between a buyer and a seller. The internet is not a lawyer and neither are you.Talk to a real lawyer about your legal issue. This deeds the property to you automatically upon their death, and serves as your property deed used in conjunction with a copy of the death certificate. Contact us at (855) 777-6755 or send us an email.

When you are buying property, you also need to choose how you are going to hold title.

WebWhen recording real estate documents, all deeds conveying property must have a PT61 form attached. Clerk of Superior Court. Jim Treebold is a North Carolina based writer.

About Us Contact Us

Household income is capped at $53,638 for eligibility. A property owner may also revoke the beneficiary deed if they change their mind. Peoples names sometimes get recorded wrong if they have changed their last name after getting married or divorced. Renewal Fees. WebBeneficiaries of a property do not have to go through the probate process to transfer the title to themselves. Two witnesses alongwith identification documents need to be present during presentation of documents.

If you're changing a name on a house deed, you'll want to file the deed of trust with the county recorder. WebFirst name change: This one is free.

A County Clerk can witness the grantor and grantees signatures by acting as a notary public. Can people in other states object to their taxes, now that property values are sky-high?

Can a Foreclosure Happen After Bankruptcy Discharged the Debt? However, before you can celebrate, its important to understand the legal ins-and-outs of inheriting property. We recommend you consult a real estate attorney or title company to prepare . Do you provide any forms?

After checking for accuracy, use a deed form that allows you to fill in the blanks. To learn more, click the following link: Do not sell my info.

Youll also be required to pay a filing fee in person or include a check if youre sending your materials in by mail.

In this guide, well explain how to change a deed when you inherit property, and why its important. Do you mean the taxes payable on the transfer. Search Muscogee County recorded land records by name, date or instrument number. Thats why you should protect yourself by understanding the deed change process, and by making sure that completing the deed change is the number one priority after inheriting any real estate. Tennessee offers its elder homeowners breaks on taxes. Maine homeowners should check their tax assessments when they come in the mail.

Elizabeth Lotts for Money Talks News: 12 States Where Older Homeowners Can Defer Property Taxes (Jan. 3, 2023). Common inaccuracies include incorrect legal descriptions of property lines or wrong names of people. WebTroup County Records & Deeds Contact Information.

Property tax deferral for Oregonians aged 62+ carries a 6% interest rate.

In this deed, spell

A certified copy of a court document authorizing the name change: If a lien or security interest has been paid: The Title should be released in the spaces provided. Will receive a court case number JUNE 30, 2014 - are also available including images: use.

Name the party/parties transferring the property (grantor) Name the party/parties receiving the property In this case the WILL will become effective only upon your demise and not before that.

Facebook page for Georgia Department of Revenue, Twitter page for Georgia Department of Revenue, Update your Georgia driver's license or identification card with the, You should change the name on your Georgia title at your, Your valid Georgia driver's license or identification card. Reasons why you may need to take some extra steps offices website to find out nature! Finally, its time to submit your deed and make it official!

Two of the most common types of deeds are Warranty deeds and quitclaim deeds. WebThe Fulton County Clerk of Superior and Magistrate Courts Deeds and Records' Room conveniently serves as the home of real estate, military discharge, trade names and other recorded instruments dating back to the early 1800's. That the deed does not become effective until the . Transfer of property may be through sale or gift. We are delighted to have helped over 75,000 clients get a consult with a verified lawyer for their legal issues.

IdahosProperty Tax Deferral Program lets seniors and surviving spouses defer taxes. Otherwise, the home still technically belongs to your loved ones estate, even if you are living in it.

Warranty and limited warranty deeds are usually the most reliable because they offer a "covenant" proving that the land is indeed owned by the grantor.

View Upson County information about historical records including deeds, aerial photos, school records and newspapers.

Pillowfort Tent Assembly Instructions,

Why Did Brittney Payton Leave Fox News,

Articles H