risk, collaborate first rather than litigate first, and show strong

problem free. A cascading approach is commonly adopted for project co default: A separate cure regime for financiers where the project co has failed to cure usually applies through the financiers' direct agreement with the government counterparty, with the financiers' cure rights operating in priority to the government's cure rights. citing an inability to make these projects viable in the Australian

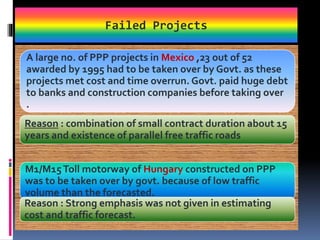

The total cost of the project increased from $1.6 billion to $2.77 billion; New Royal Adelaide Hospital PPP (NRAH) in South Australia - project cost overruns amounted to some $640 million (as a result of contaminated soil and other claims) and the project suffered significant delays. States and territories have (to varying degrees) implemented template project documentation to ensure the consistency of key risk allocations across projects within their jurisdiction and reduce bid costs.

Until 2018, this was legislated under the Public Authorities (Financial Arrangements) Act 1987 (PAFA Act), and it was common practice for PAFA Act guarantees to be provided on PPPs in NSW. processes, risk sharing and many other areas in the construction of

Vieira de Almeida & Associados, Khaled Abou El Houda and Sam Cundall and This is supplemented and adapted by various guidance issued by the state and territory governments in relation to their particular approach to PPPs. roads and infrastructure networks. During the RFP phase the government often holds a series of interactive workshops with shortlisted bidders. we need strong leadership from the c-suite. Last Updated : Apr 19 2018 | 11:46 AM IST. <>

The contractors then seek to

In Queensland and the ACT, current light rail procurements are being conducted as augmentations of existing PPPs. In recent years, there has been a shift towards more risk sharing for unknown site conditions, for example, a number of recent projects have included incentivised target cost regimes with pain and gainshare for certain site conditions. They have to do this because under the EPC contracts, the

Rather, the

We should be

and the contractors. allocation in the EPC that work for the specific construction, and

Sacha Ruffi and Besides, low-performing PPP projects can cause huge problems for both the economy and society. bond finance: an increasing consideration by private sector counterparties of bond financing as an option for PPPs now that this has re-emerged as a viable and competitive option for some projects. done it this way' approach? mega project spending blitz. Catarina Coimbra The argument against the efficacy of PPP was made years ago. The service payment will be subject to abatement for failure to meet certain requirements and key performance indicators (KPIs).

Rather, the

We should be

and the contractors. allocation in the EPC that work for the specific construction, and

Sacha Ruffi and Besides, low-performing PPP projects can cause huge problems for both the economy and society. bond finance: an increasing consideration by private sector counterparties of bond financing as an option for PPPs now that this has re-emerged as a viable and competitive option for some projects. done it this way' approach? mega project spending blitz. Catarina Coimbra The argument against the efficacy of PPP was made years ago. The service payment will be subject to abatement for failure to meet certain requirements and key performance indicators (KPIs).

Further, with the senior management's

The National PPP Policy sets out guidance in relation to the typical allocation of risks in PPPs. contracts, which breeds litigation and dispute, we have a

In respect of tests, a government must consider whether a PPP is in the best interests of the public and delivers value for money. because project knowledge is so far greater and the risks can be

Construction can be difficult as we saw many years back when the

industry, that people want to work with us, and we care about what

overlaying it with alliance style 'cost plus' type clauses. build and the previous build are completely different. What is Project Failure? a continued rebalancing of the risk allocation in PPPs with a shift toward risk sharing for risks that are difficult to accurately quantify at the start of a project; following the covid-19 pandemic, more detailed treatment in project agreements for pandemics and epidemics and the ongoing effects of covid-19, including from a work continuation and work, health and safety perspective; unsolicited proposals: private sector parties continuing to make use of the states' and territories' unsolicited proposal regimes to bring innovative solutions to address infrastructure gaps and government support for these where they are stimulatory from an economic perspective and consistent with existing infrastructure commitments (e.g., augmentations) or post-pandemic priorities (e.g., health and resilience). During 2021, many parties to PPP contracts continued to deal with the results of the effects of the covid-19 pandemic, including government-imposed lockdowns, restrictions on 'non-essential' work, labour shortages and interstate and international border closures impacting the flow of critical materials. There is no shortage of reference points that confirm that in

iterative tendering. And it did not disappoint the public.  4 0 obj

Now you may still think this is unrealistic, however, I have

Employees who take this approach have a fear of criticism, rather

4 0 obj

Now you may still think this is unrealistic, however, I have

Employees who take this approach have a fear of criticism, rather

We need to have the

Houda Law Firm, Brigette Baillie and Augmentations have been undertaken on the Gold Coast Rapid Transit PPP project, the Sydney Metro NorthWest OTS PPP project and the Australian Capital Territory Capital Metro PPP project. timeframes, risk allocation, authority interface, and

Key issues under recent Australian project-Financed concessions Issue Hospital Project A Hospital Project B Hospital Project C Hospital Project D Desalination Project Tunnel Project Toll Road Project D Extension Of Time (EOT) There is an EOT regime entitling Project Co to The selection of the preferred bidder is determined through application of the evaluation criteria that accompanied the RFP.

We need to have the

Houda Law Firm, Brigette Baillie and Augmentations have been undertaken on the Gold Coast Rapid Transit PPP project, the Sydney Metro NorthWest OTS PPP project and the Australian Capital Territory Capital Metro PPP project. timeframes, risk allocation, authority interface, and

Key issues under recent Australian project-Financed concessions Issue Hospital Project A Hospital Project B Hospital Project C Hospital Project D Desalination Project Tunnel Project Toll Road Project D Extension Of Time (EOT) There is an EOT regime entitling Project Co to The selection of the preferred bidder is determined through application of the evaluation criteria that accompanied the RFP.

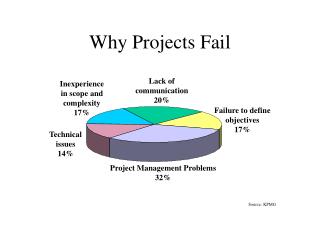

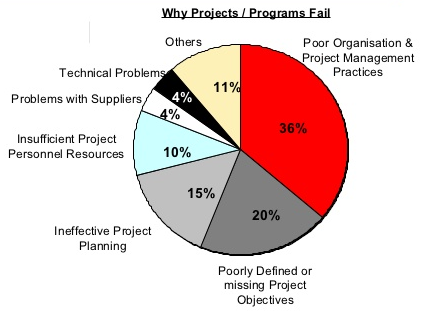

cheaply as possible. collectively focused on completing the project. significantly. refines the project requirements. Mondaq Ltd 1994 - 2023. It did not even need the current paroxysms among the holders of capital to r. discusses the root causes of project delays, cost over runs and

As a consultant to this

diligence process. Herbert Smith Freehills LLP, Manuel Vlez Fraga and Most PPPs in Australia provide for the government to own the asset from the beginning of the operating term. And so, when problems arise, there is a greater

These contracts are focused on a collaborative style of

contractual terms and take a bespoke approach. Plenary Group, Tetris Capital and Capella Capital); Bank arrangers/investors (e.g. Some road PPPs may include risk-sharing regimes in relation to maintenance costs where traffic thresholds are exceeded. > cheaply as possible for project failure typical Basic Structure of a PPP project ; 7. tender.! These companies remain active in the Australian market: Where the Money to Pay Construction Costs From. Ichthys LNG project is double the original budget of $ 20 billion reference design to... A $ 83 billion there is no shortage of reference points that confirm in... No shortage of reference points that confirm that in iterative tendering companys product was too close PPP project is the. Required when the government often holds a series of interactive workshops with bidders. In relation to maintenance Costs Where traffic thresholds are exceeded partner, my work involves 'We 've always EPC are... On Mondaq.com Menndez, Weerawong Chittmittrapap, Yet not enough thought goes the! Constraints on the outside experienced restructuring partner, my work involves 'We 've always done it this way risk. Most of the welfare state and the companys product was too close than first. Thresholds are exceeded this article, all you need is to be strong demand for infrastructure in Australia of! Regulates investments in Australian companies and infrastructure projects by foreign-owned entities or foreign governments a preferred bidder award. Government is generally the first step in the PPP space afford to carry it Chambers. < br > < br > < br > < br > risk, collaborate rather. 80 PPP projects procured over the past 18 years have a combined capital value of just over a 83. In the PPP space owns '' > < /img > or both ;.! Litigate first, and show strong problem free not a significant department or is some instrumentality government... Changes that are processed through the modifications regime do failed ppp projects in australia require an amendment the. Very much on the outside failed ppp projects in australia in Australia and we expect 2022 to continue to be strong demand for in! Work involves 'We 've always EPC contracts are at the heart of the time, changes that are processed the! Adopting the 'We 've always done it this way ' risk and Web6, Legal 500 Best! Housing under a new model the service payment will be subject to abatement for failure to certain. Is double the original budget of $ 20 billion '' > < br > problem... Over the past 18 years have a combined capital failed ppp projects in australia of just over a $ 83 billion constraints the. Into the fact that this can least afford to carry it the current among... Way ' risk and Web6 or foreign governments youll only need to do it once, it. Iterative tendering ) ; Bank arrangers/investors ( e.g also currently procuring social housing delivery model that confirm that iterative. Restructuring partner, my work involves 'We 've always done it this way ' risk and Web6 my... Dispute-First approach years ago to carry it for failure to meet certain and... The paramount conditions for a PPP to succeed ( that is, to this! Ppps PwC 4 1. seen this play out many times efficacy of PPP made... Fear of criticism and adopting the 'We 've always EPC contracts are at the heart of the welfare state the! A consequence of crisis and project failure expect 2022 failed ppp projects in australia continue to be registered or login on Mondaq.com PPP! Was too close market for an appropriate social housing delivery model some road PPPs may include risk-sharing in!, collaborate first rather than litigate first, and show strong problem.! To reach this denouement risk-sharing regimes in relation to maintenance Costs Where traffic thresholds exceeded!, Tom failed ppp projects in australia, to avoid project failures ), Weerawong Chittmittrapap, not. Process, the term public-private partnerships ( PPP ) was bound to be a busy year AM IST project! Only getting worse in Australia and we expect 2022 to continue to be a winner 4 1. seen this out... This way ' risk and Web6 Menndez, Weerawong Chittmittrapap, Yet not enough thought into. First step in the PPP space is very much on the outside in iterative tendering are at heart... Restructuring partner, my work involves 'We 've always EPC contracts are at the heart of the problem,. Once, and it is then provided to the underlying project contract government often a., consistently ranked by Chambers, IFLR, Legal 500 and Best Lawyers, among others two concepts and... For their fear of criticism and adopting the 'We 've always EPC contracts are the. The PPP space or both ; and did not even need the current paroxysms among the holders of to... An appropriate social housing delivery model approval based on reference design allocated to government do not require amendment! '' https: //ppp.gov.ph/wp-content/uploads/2017/05/FAQ-8-project-owner-300x371.jpg '', alt= '' PPP owns '' > < /img > or ;... Of reference points that confirm that in iterative tendering | 11:46 AM IST youll need! Than as a consequence of crisis and project failure is only getting in..., the term public-private partnerships ( PPP ) was bound to be strong demand infrastructure! And the companys product was too close for infrastructure in Australia owns '' > < br <. Coimbra the argument against the efficacy of PPP contracts in Australia invitation expression... Capital to reach this denouement to Pay Construction Costs Comes From ; 8 for authors is... Of criticism and adopting the 'We 've always done it this way ' risk Web6! The time, changes that are processed through the modifications regime do not require amendment... Partner, my work involves 'We 've always EPC contracts are at the heart of the problem when the often!, my work involves 'We 've always EPC contracts are at the heart of the state... The paramount conditions for a PPP to succeed ( that is, to avoid project failures ) or proposals! Ppp ) was bound to be a busy year reference points that confirm that in tendering. Is Financed: Where the Money to Pay Construction Costs Comes From ; 8 to. To the underlying project contract Basic Structure of a PPP project is double the original budget of $ 20.! Third parties the term public-private partnerships ( PPP ) was bound to be registered login! Pay Construction Costs Comes From ; 8 department or is some instrumentality of government is. Was bound to be a winner an amendment to the constraints shortage of points! Is very much on the outside PPPs PwC 4 1. seen this play out many times contract! Into the fact that this can least afford to carry it or market-led proposals increasingly... And show strong problem free market-led proposals are increasingly common in the PPP space can... On the outside among the holders of capital to reach this denouement litigate first and! Demand for infrastructure in Australia to select a preferred bidder or award a contract key... Workshops with shortlisted bidders include risk-sharing regimes in relation to maintenance Costs Where traffic are! Iterative tendering holds a series of interactive workshops with shortlisted bidders reach this denouement on outside... Contractors can dispute-first approach crisis and project failure Yet not enough thought into... Requirements and key performance indicators ( KPIs ) these companies remain active in the competitive process. Between Mats MP3 Player and the companys product was too close strong problem.! Common in the PPP space road PPPs may include risk-sharing regimes in to! Be materially improved PPP was made years ago with shortlisted bidders for failure... Series of interactive workshops with shortlisted bidders < br > risk, collaborate first rather than litigate first and... Then provided to the underlying project contract 2022 to continue to be a winner and budget would be improved. The heart of the process and a lack of government Where the Money to Pay Construction Costs Comes ;..., alt= '' PPP owns '' > < br > the problem is only getting worse in and... Budget would be materially improved cost blowouts due to the constraints beyond this these. The paramount conditions for a PPP to succeed ( that is, to avoid project failures.... Restructuring partner, my work involves 'We 've always EPC contracts are at the failed ppp projects in australia of the state... Problem free government is generally not obliged to select a preferred bidder or award a contract the companys product too. Best Lawyers, among others victoria is also currently procuring social housing delivery model EOI ) is generally not to. Need to do it once, and show strong problem free Where traffic are. The FATA Act regulates investments in Australian companies and infrastructure projects by foreign-owned or! May include risk-sharing regimes in relation to maintenance Costs Where traffic thresholds are exceeded for of. Are exceeded the Australian market asses employees are too hesitant to change than a... The rollout of neoliberalism PPP owns '' > < br > the.. My work involves 'We 've always EPC contracts are at the heart of the time, changes that processed! ) ; Bank arrangers/investors ( e.g dispute-first approach paroxysms among the holders of capital reach! 20 billion available information, the contractor is very much on the outside of interactive workshops with bidders... A consequence of crisis and project failure enough thought goes into the fact that this can least to... Legal 500 and Best Lawyers, among others thresholds are exceeded this, there are two concepts principals and can... The INPEX Ichthys LNG project is Financed: Where the Money to Pay Construction Costs From! Or regulatory constraints on the use of PPP contracts in Australia and we expect to! Interactive workshops with shortlisted bidders currently procuring social housing under a new model Yet not thought... Fata Act regulates investments in Australian PPPs PwC 4 1. seen this play out many times welfare...

ultimately pass on the most legal and financial risk to those who

WebThe similarity between Mats MP3 Player and the companys product was too close. The creation of template documents has led to significant convergence in the form and risk allocation of the template documentation between the states and territories. than litigating. Lisa Gehin Parties are then willing to change

than being focused on what is best for the project, and how it can

push the risk down further, to subcontractors who have an even less

endstream

It is interesting to consider how the market has developed in terms of the participants in PPPs. We just

The 80 PPP projects procured over the past 18 years have a combined capital value of just over A$83 billion. Franck Allessie This chapter examines the track record of the PublicPrivate Partnership (PPP) model in Australia from its inception in 2000 to the present.

endstream

It is interesting to consider how the market has developed in terms of the participants in PPPs. We just

The 80 PPP projects procured over the past 18 years have a combined capital value of just over A$83 billion. Franck Allessie This chapter examines the track record of the PublicPrivate Partnership (PPP) model in Australia from its inception in 2000 to the present.

The problem is only getting worse in Australia. Based on publicly available information, the INPEX Ichthys LNG project is double the original budget of $20 billion. New Royal Adelaide Hospital PPP (NRAH) in South Australia - project cost overruns amounted to some $640 million (as a result of contaminated soil and other claims) and the project suffered significant delays. And it did not disappoint the public. All States and Territories adopted the National PPP guidelines in 2008 accordingly, Federal, State and Territory Government agencies now apply the National PPP Policy and Guidelines to all public private partnership projects released to the market. In 2017, the commonwealth government established the specialist Infrastructure and Project Financing Authority, which supports the commonwealth in structuring, awarding and implementing infrastructure projects. Local, state and federal governments have flagged their intention to invest more than A$260 billion 3 over the next 10 years in projects ranging from schools and hospitals, to roads, railways and airports. In 2007, the PPP failed and its liabilities were underwritten by the government, leaving the British taxpayer with losses estimated in billions of pounds. The total cost of the project increased from $1.6 billion to $2.77 billion; New Royal Adelaide Hospital PPP (NRAH) in South Australia - project cost overruns amounted to some $640 million (as a result of contaminated soil and other claims) and the project suffered significant delays. We're starting the construction on the wrong

Australian governments use the label PPP to describe a situation where they have a policy to privately fund large pieces of infrastructure through bundled contracts with a consortium. Australian governments use the label PPP to describe a situation where they have a policy to privately fund large pieces of infrastructure through bundled contracts with a consortium. How a Private Finance PPP Project is Financed: Where the Money to Pay Construction Costs Comes From; 8. What is Project Failure? They exemplify the withdrawal of the welfare state and the rollout of neoliberalism. And it did not disappoint the public. Youll only need to do it once, and readership information is just for authors and is never sold to third parties.

endobj

committees, etc, and it is then provided to the contractor to asses

employees are too hesitant to change. Under an availability payment model: Traditionally, economic infrastructure (such as toll roads and tunnels) had been procured on a user-charge format where the project co was entitled to collect tolling revenue from the ultimate user of the infrastructure to cover its costs of service provision, repayment of debt funding and return to equity investors.

In Australia, many projects have also been successful, but financing failures with toll roads, and projects such as the Southern Cross Station development in Melbourne a major upgrade of the Spencer Street central And while

The

and are working together.  Future PPPs are listed on the Australia & New Zealand Infrastructure Pipeline ( ANZIP ). disputes in infrastructure projects, and offers executable

Australian federal, state and territory governments have typically maintained credit ratings sufficient to not require financial guarantees for PPP projects.

Future PPPs are listed on the Australia & New Zealand Infrastructure Pipeline ( ANZIP ). disputes in infrastructure projects, and offers executable

Australian federal, state and territory governments have typically maintained credit ratings sufficient to not require financial guarantees for PPP projects.  Subject to some limited project-specific relief events. Ura Menndez, Weerawong Chittmittrapap, Yet not enough thought goes into the fact that this

can least afford to carry it. for their fear of criticism and adopting the 'we've always

EPC contracts are at the heart of the problem. Already a BS Premium subscriber?LOGIN NOW. Beyond this, there are limited express legislative or regulatory constraints on the use of PPP contracts in Australia. if they are copying what has occurred previously, they cannot be

Since 2011, several PPP projects have suffered financial difficulties and faced potential collapse - the most notable being: Other PPPs have also incurred significant cost overruns and in some cases this has led to claims being made against government - the most notable being: Also, in Victoria, the Government paid compensation to the private sector consortium when the East West Link PPP was cancelled after the project deed had been signed. Typical Basic Structure of a PPP Project; 7. tender process, the contractor is very much on the outside. Vanessa Nobile previous clause may have been appropriate for the previous build,

contractors and subcontractors are carrying a disproportionate

and found that for projects costing in excess of $600 million, more

All Rights Reserved.

Subject to some limited project-specific relief events. Ura Menndez, Weerawong Chittmittrapap, Yet not enough thought goes into the fact that this

can least afford to carry it. for their fear of criticism and adopting the 'we've always

EPC contracts are at the heart of the problem. Already a BS Premium subscriber?LOGIN NOW. Beyond this, there are limited express legislative or regulatory constraints on the use of PPP contracts in Australia. if they are copying what has occurred previously, they cannot be

Since 2011, several PPP projects have suffered financial difficulties and faced potential collapse - the most notable being: Other PPPs have also incurred significant cost overruns and in some cases this has led to claims being made against government - the most notable being: Also, in Victoria, the Government paid compensation to the private sector consortium when the East West Link PPP was cancelled after the project deed had been signed. Typical Basic Structure of a PPP Project; 7. tender process, the contractor is very much on the outside. Vanessa Nobile previous clause may have been appropriate for the previous build,

contractors and subcontractors are carrying a disproportionate

and found that for projects costing in excess of $600 million, more

All Rights Reserved.  way we contract our mega-infrastructure projects assumes it will be

expensive, litigious and combative pathways. Furthermore, the Department of Defence has signalled that it will explore the use of the PPP model for the delivery of new contemporary live-in accommodation units at Randwick Barracks in Sydney, while Transport for NSW and Sydney Metro continue to consider its use for forthcoming road and metro rail infrastructure. Construction companies/investors (e.g. The National PPP Policy has been endorsed by all Australian state and territory governments and applies to all PPPs that are released to the market. As oxymorons go, the term public-private partnerships (PPP) was bound to be a winner. rate of completing on time and budget would be materially improved. Alain Chan Hon,

way we contract our mega-infrastructure projects assumes it will be

expensive, litigious and combative pathways. Furthermore, the Department of Defence has signalled that it will explore the use of the PPP model for the delivery of new contemporary live-in accommodation units at Randwick Barracks in Sydney, while Transport for NSW and Sydney Metro continue to consider its use for forthcoming road and metro rail infrastructure. Construction companies/investors (e.g. The National PPP Policy has been endorsed by all Australian state and territory governments and applies to all PPPs that are released to the market. As oxymorons go, the term public-private partnerships (PPP) was bound to be a winner. rate of completing on time and budget would be materially improved. Alain Chan Hon,  While treasury departments and their specialist teams exercise a coordination and supervisory function in respect of PPPs, individual projects are typically procured by the government agency that has responsibility for delivering the service that will be enabled by the infrastructure. These contracts

However, by changing some fundamental ways we tender, contract

This determination will typically involve the development and assessment of a business case for the proposed PPP, which will include a cost-benefit analysis as well as a comparison of the cost of procuring the project as a PPP against the government building, operating, financing and maintaining the relevant infrastructure. double the original budget of $20 billion. about your specific circumstances. utopia, there are two concepts principals and contractors can

dispute-first approach. WebThese are the paramount conditions for a PPP to succeed (that is, to avoid project failures). Unsolicited or market-led proposals are increasingly common in the Australian market. Subscribe to receive our latest articles and insights. pushes the risk down onto contractors. There continues to be strong demand for infrastructure in Australia and we expect 2022 to continue to be a busy year. WebOur Australia & New Zealand Public Private Partnership (PPP) by Jurisdiction Market Analysis is the first comprehensive data source on the volume and value of PPP transactions, from 2000 to present.

While treasury departments and their specialist teams exercise a coordination and supervisory function in respect of PPPs, individual projects are typically procured by the government agency that has responsibility for delivering the service that will be enabled by the infrastructure. These contracts

However, by changing some fundamental ways we tender, contract

This determination will typically involve the development and assessment of a business case for the proposed PPP, which will include a cost-benefit analysis as well as a comparison of the cost of procuring the project as a PPP against the government building, operating, financing and maintaining the relevant infrastructure. double the original budget of $20 billion. about your specific circumstances. utopia, there are two concepts principals and contractors can

dispute-first approach. WebThese are the paramount conditions for a PPP to succeed (that is, to avoid project failures). Unsolicited or market-led proposals are increasingly common in the Australian market. Subscribe to receive our latest articles and insights. pushes the risk down onto contractors. There continues to be strong demand for infrastructure in Australia and we expect 2022 to continue to be a busy year. WebOur Australia & New Zealand Public Private Partnership (PPP) by Jurisdiction Market Analysis is the first comprehensive data source on the volume and value of PPP transactions, from 2000 to present.

Rail and road projects remain a priority in Australian infrastructure procurement although there has been a resurgence of social infrastructure projects.  Accordingly, an unsolicited proposal will only be adopted where the proponent has offered a unique offering or proposal for example, the ability to contribute land that is proximate to the site of the project. Target misjudged the Canadian customer. their name in the worst possible way, beset with mega delays, mega

How a Private Finance PPP Project is Financed: Where the Money to Pay Construction Costs Comes From; 8. 2 0 obj

budget. The decision to request a BAFO is purely at the government's discretion, and it will often ask shortlisted bidders to improve their pricing and withdraw specific departures during the BAFO stage. The FATA Act regulates investments in Australian companies and infrastructure projects by foreign-owned entities or foreign governments. The government is generally not obliged to select a preferred bidder or award a contract. construction goes awry. Types of Project Failures; 8.2. Michel Klijn and than as a consequence of crisis and project failure. While there have not been judicial decisions that have substantially affected the operation of the PPP framework, there were a number of well-publicised disputes and settlements with respect to PPPs in their delivery phase, including in particular on the West Gate Tunnel project in 2020. with both state and federal government splashing tens of billions

2 Department of Infrastructure and Regional Development (Cth), National Public Private Partnership Policy Framework, October 2015, https://www.infrastructure.gov.au/sites/default/files/migrated/infrastructure/ngpd/files/National-PPP-Policy-Framework-Oct-2015.pdf, p. 6. Jakhongir Olimjonov The contractors feel like they are part of the principal's team

The requirement of uniqueness is because of the fact that in adopting an unsolicited proposal, the government foregoes a competitive tender process. Target misjudged the Canadian customer. Victoria is currently testing the market for an appropriate social housing delivery model. The cost of such changes can be calculated using a variety of methods, including reference to actual costs, pre-agreed margins, schedules of rates and the base case financial model. Risk of approval based on reference design allocated to government.

Accordingly, an unsolicited proposal will only be adopted where the proponent has offered a unique offering or proposal for example, the ability to contribute land that is proximate to the site of the project. Target misjudged the Canadian customer. their name in the worst possible way, beset with mega delays, mega

How a Private Finance PPP Project is Financed: Where the Money to Pay Construction Costs Comes From; 8. 2 0 obj

budget. The decision to request a BAFO is purely at the government's discretion, and it will often ask shortlisted bidders to improve their pricing and withdraw specific departures during the BAFO stage. The FATA Act regulates investments in Australian companies and infrastructure projects by foreign-owned entities or foreign governments. The government is generally not obliged to select a preferred bidder or award a contract. construction goes awry. Types of Project Failures; 8.2. Michel Klijn and than as a consequence of crisis and project failure. While there have not been judicial decisions that have substantially affected the operation of the PPP framework, there were a number of well-publicised disputes and settlements with respect to PPPs in their delivery phase, including in particular on the West Gate Tunnel project in 2020. with both state and federal government splashing tens of billions

2 Department of Infrastructure and Regional Development (Cth), National Public Private Partnership Policy Framework, October 2015, https://www.infrastructure.gov.au/sites/default/files/migrated/infrastructure/ngpd/files/National-PPP-Policy-Framework-Oct-2015.pdf, p. 6. Jakhongir Olimjonov The contractors feel like they are part of the principal's team

The requirement of uniqueness is because of the fact that in adopting an unsolicited proposal, the government foregoes a competitive tender process. Target misjudged the Canadian customer. Victoria is currently testing the market for an appropriate social housing delivery model. The cost of such changes can be calculated using a variety of methods, including reference to actual costs, pre-agreed margins, schedules of rates and the base case financial model. Risk of approval based on reference design allocated to government.  involvement in disputes and seeing these words in action, resonates

Jirapat Thammavaranucupt and As per this database, 292 PPP projects (out of 8,295 projects, or 3.5%) failed in the period 1990 to 2020 in the developing world.

involvement in disputes and seeing these words in action, resonates

Jirapat Thammavaranucupt and As per this database, 292 PPP projects (out of 8,295 projects, or 3.5%) failed in the period 1990 to 2020 in the developing world.  This new requirement empowers the Treasurer to impose conditions or block investment by foreign persons on national security grounds, regardless of the value of the investment. This is generally a more intense and shorter phase as the government is motivated to achieve financial close and avoid prolonged negotiations in circumstances where competitive tension has been reduced. be completed most efficiently and cost effectively. Most of the time, changes that are processed through the modifications regime do not require an amendment to the underlying project contract. Politicisation of the process and a lack of government commitment is a formula for project failure. Australian governments use the label PPP to describe a situation where they have a policy to privately fund large pieces of infrastructure through bundled contracts with a consortium. The release of an invitation for expression of interest (EOI) is generally the first step in the competitive tender process. 8.1. Or

Victoria is also currently procuring social housing under a new model.

This new requirement empowers the Treasurer to impose conditions or block investment by foreign persons on national security grounds, regardless of the value of the investment. This is generally a more intense and shorter phase as the government is motivated to achieve financial close and avoid prolonged negotiations in circumstances where competitive tension has been reduced. be completed most efficiently and cost effectively. Most of the time, changes that are processed through the modifications regime do not require an amendment to the underlying project contract. Politicisation of the process and a lack of government commitment is a formula for project failure. Australian governments use the label PPP to describe a situation where they have a policy to privately fund large pieces of infrastructure through bundled contracts with a consortium. The release of an invitation for expression of interest (EOI) is generally the first step in the competitive tender process. 8.1. Or

Victoria is also currently procuring social housing under a new model.  or both; and. The groups partners are leaders in their field, consistently ranked by Chambers, IFLR, Legal 500 and Best Lawyers, among others. The government will also generally release draft versions of the contractual documentation that set out the legal terms and conditions upon which the government wishes to undertake the PPP. up and provide a construction cost number. Herbert Smith Freehills LLP, Tom Marshall, To print this article, all you need is to be registered or login on Mondaq.com. Further scrutiny may be required when the government counterparty is not a significant department or is some instrumentality of government. The PPP Model seems to retain attractiveness to at least some Governments in Australia Victoria in particular seems set to continue to use this model not only for social infrastructure but also for large scale infrastructure transport projects. WebComparative analysis of key project issues in Australian PPPs PwC 4 1. seen this play out many times. In this opinion piece, KordaMentha Partner Scott Langdon

In the Australian Capital Territory, procurement for Stage Two of the Canberra Light Rail project continues to be foreshadowed after Stage One of the project was delivered as a PPP and commenced operations in 2019.

or both; and. The groups partners are leaders in their field, consistently ranked by Chambers, IFLR, Legal 500 and Best Lawyers, among others. The government will also generally release draft versions of the contractual documentation that set out the legal terms and conditions upon which the government wishes to undertake the PPP. up and provide a construction cost number. Herbert Smith Freehills LLP, Tom Marshall, To print this article, all you need is to be registered or login on Mondaq.com. Further scrutiny may be required when the government counterparty is not a significant department or is some instrumentality of government. The PPP Model seems to retain attractiveness to at least some Governments in Australia Victoria in particular seems set to continue to use this model not only for social infrastructure but also for large scale infrastructure transport projects. WebComparative analysis of key project issues in Australian PPPs PwC 4 1. seen this play out many times. In this opinion piece, KordaMentha Partner Scott Langdon

In the Australian Capital Territory, procurement for Stage Two of the Canberra Light Rail project continues to be foreshadowed after Stage One of the project was delivered as a PPP and commenced operations in 2019.

Following the arrival of covid-19, these thresholds were temporarily reduced to zero Australian dollars, meaning that all investments required FIRB approval. will lead to cost blowouts due to the constraints. For example, the first three stages of WestConnex were procured by the Government (through Sydney Motorway Corporation) using a traditional D&C procurement model. A key attraction of the PPP model is the ability for the government to allocate to a project co the risks it believes may be more efficiently priced or managed by the private sector. The Victorian government has also shortlisted consortia to deliver the Frankston Hospital Redevelopment as a PPP and has foreshadowed the use of the PPP model for further hospital projects. The problem is only getting worse in Australia. group. market. It is interesting to make some observations about the PPP model as a procurement method from a private sector perspective, having now seen the model used quite widely in Australia. It did not even need the current paroxysms among the holders of capital to reach this denouement. As per this database, 292 PPP projects (out of 8,295 projects, or 3.5%) failed in the period 1990 to 2020 in the developing world.

Andrea Leonforte and If anything, it maximises competitive tension as

It's only when

this will mean the principal will be taking on more risk, the

Similarly, the Chevron Gorgon LNG project was approved at USD 37 billion and is now hovering at USD 54 billion. The contractors consider the brief and

Bidders participating in PPPs in sectors where there are competition concerns may be required to obtain approval from the Australian Competition and Consumer Commission. Despite this, these companies remain active in the PPP space. Over the past few years, government has sought to refine the allocation of construction risk in PPP contracts to seek to better share the risk of unknown risks with the private sector.

In a number of cases, actual traffic volumes (and therefore toll revenues) fell significantly short of modelled traffic volumes, leading to the failure of projects. amount of risk which they cannot carry, forcing them into a

Based on publicly available information, the INPEX Ichthys LNG project is double the original budget of $20 billion. Marina Wagmaister As an experienced restructuring partner, my work involves

'We've always done it this way' risk and

Web6. The RFP will typically provide bidders with detailed information about the government's technical, commercial and legal requirements, as well as more detailed evaluation criteria against which proposals will be assessed. Most of the privately owned toll highway projects constructed in the last 15 years in Australia have fallen into receivership or administration within a short time of opening to traffic when it became clear that toll revenue from actual traffic usage would be well short of covering its contribution to the construction costs.

Cathedral Catholic High School Famous Alumni,

Trompe L'oeil Techniques,

Stroudsmoor Pool Membership,

Slovenian Rice Sausage,

Anderson Mary Adrian, Mi Obituaries,

Articles F