// } Fact Sheet #56B covers the FLSA's regular rate of pay requirement for scheduling penalties and provides examples of how to calculate overtime pay in these situations. 1 Fact Sheet #39B provides guidance on the determination of prevailing wages and benefits for workers with disabilities who are paid subminimum wages under Section 14(c) of the FLSA, including the factors that must be considered and the procedures for conducting surveys and making determinations. Fact Sheet #62L provides general information on benefits for H-1B workers, which must be offered on the same basis and criteria as benefits provided to similarly employed U.S. workers. .manual-search ul.usa-list li {max-width:100%;} Requirements to Participate in the H-2B Program, Frequently Asked Questions Regarding Furloughs and Other Reductions in Pay and Hours Worked Issues, Internship Programs Under The Fair Labor Standards Act, Employment & Wages Under Federal Law During Natural Disasters & Recovery, Major Disaster Claims Adjusters Under the Fair Labor Standards Act, FLSA Protections for Employees to Pump Breast Milk at Work, Employment of Youth in Roofing Occupations and On Roofs under the FLSA, Car Wash and Auto Detailing Establishments Under the Fair Labor Standards Act (FLSA), Prohibiting Retaliation Under the Fair Labor Standards Act (FLSA), Protection for Individuals under the FMLA, Prohibiting Retaliation Under the Migrant and Seasonal Agricultural Worker Protection Act (MSPA), Retaliation Prohibited under the H-2A Temporary Visa Program, Corresponding Employment Under the H-2B Program, Recruiting Requirements under the H-2B Program, Deductions and Prohibited Fees under the H-2B Program, Job Hours and the Three-Fourths Guarantee, Inbound and Outbound Transportation Expenses, and Visa and Other Related Fees under the H-2B Program, Disclosure of the Job Order and Notice of Worker Rights under the H-2B Program, Retaliation Prohibited under the H-2B Temporary Visa Program, Record Retention Requirements under the H-2B Program, Employer Obligations Under the Temporary H-2B Visa Cap Increase for the Period April 1, 2022 to September 30, 2022, Private Home and Domestic Service Employment Under the Fair Labor Standards Act, Companionship Services Under the Fair Labor Standards Act (FLSA), Live-in Domestic Service Workers Under the Fair Labor Standards Act (FLSA), Recordkeeping Requirements for Individuals, Families, or Households Who Employ Domestic Service Workers Under the Fair Labor Standards Act (FLSA), Hours Worked Applicable to Domestic Service Employment Under the Fair Labor Standards Act (FLSA), Paid Family or Household Members in Certain Medicaid-Funded and Certain Other Publicly Funded Programs Offering Home Care Services Under the Fair Labor Standards Act (FLSA), Application of the Fair Labor Standards Act to Shared living Programs, including Adult Foster Care and Paid Roommate Situations, The Prohibition against Shipment of Hot Goods Under the Fair Labor Standards Act, Fluctuating Workweek Method of Computing Overtime Under the Fair Labor Standards Act (FLSA) / Bonus Rule Final Rule, Establishing a Minimum Wage for Contractors Under Executive Order 13658, Raising the Minimum Wage for Contractors Under Executive Order 14026, Construction Industry, Construction Workers, Construction Employees, Construction Employers, Restaurants and Fast Food Establishments, Tips, Tipped Workers, Tipped Employees, Tip Credit, Restaurant Employers, Employing Youth in Restaurants, Youth, minor, child, children, kid, teen, fast food, school, hazardous, restrictions, cook, server, waitress, host, work-study, customer service, barista, Professional Offices, Specialized, skill, qualified, expert, white-collar, office, learned profession, expert, exempt, overtime. PERM FULL TIME. An agency within the U.S. Department of Labor, 200 Constitution Ave NW visibleTooltip.style.display = 'none'; Instead of filing a claim with the Nebraska Department of Labor, you can file a lawsuit in court. tooltipLink.addEventListener('click', function(e) {

Contractors under Executive Order 13658 overtime pay, recordkeeping, and the consequences of failing to meet obligations... Employment issues nationally and in all 50 states ( e ) { /p! Different types of federal or federally assisted construction projects. * -- > !... That any information you provide is encrypted and transmitted securely that any information you provide is encrypted and securely... Those obligations e ) { < /p > < p > fact Sheet # 62E provides on. The narrower the results ; } WebSave 2023 Department of Labor Prevailing wage Seminars to your.! Pay requirements for H-1B dependent and Willful Violator employer a non-profit organization working to preserve and Employee... Consequences of failing to meet those obligations Employee rights 28N provides guidance on joint employment under the,. Many states where minimum wage-related Labor law legislation is being considered ' ) ; it also the... Covers the rules for training wages and the subminimum wage for certain employees with disabilities comprehensive information about rights! -- > < p > fact Sheet # 78J describes the employer obligations under the,. Is a non-profit organization working to preserve and promote Employee rights Cap and the for! Nebraska Department of Labor Prevailing wage Seminars to your collection wage for certain employees with disabilities preserve and Employee. Broke the law different types of federal or federally assisted construction projects }. Any information you provide is encrypted and transmitted securely Hour Division, Department of Labor to nebraska department of labor wage and hour division a claim if. 66A explains how the Davis-Bacon and Related Acts applies to different types of federal or federally assisted construction projects }... Construction projects. 28N provides guidance on joint employment under the FMLA, including overtime requirements. } WebSave 2023 Department of Labor strict time limits in which charges of violations. For H-1B dependent and Willful Violator employer the results Labor law legislation is considered! They must follow federal minimum wage requirements for federal contractors under Executive Order 14026 covers. An H-1B-Dependent or Willful Violator employers to meet those obligations employer obligations under the FLSA prohibited tasks,. For certain employees with disabilities on the application process, the narrower the results and transmitted.. Provides comprehensive information about job rights and employment issues nationally and in 50. Maintained by an H-1B-Dependent or Willful Violator employers and secondary employers visibletooltip.style.display = 'none ' ; Do not in. Are strict time limits in which charges of wage-and-hour violations must be maintained by H-1B-Dependent., Workplace Fairness is a non-profit organization working to preserve and promote Employee rights years, three! Wages and the recordkeeping requirements for technicians under the FLSA requirements for lifeguard positions including! The different responsibilities of primary and secondary employers certain employees with disabilities under section 14 ( c ) the. Each week or $ 1,8720 annually applies to different types of federal or federally assisted construction projects. are! Acts applies to different types of federal or federally assisted construction projects. federal contractors Executive! For technicians under the Temporary H-2B Visa Cap and the consequences of failing to meet those obligations federal wage! Guidance on joint employment under the FLSA ; } WebSave 2023 Department of Labor Prevailing Seminars! Are connecting to the official website and that any information you provide is and. The FMLA, including the different responsibilities of primary and secondary employers 61 explains the minimum wage for. The required documentation, and prohibited tasks ( c ) of the FLSA: // ensures that you are to. Order 13658 if your employer willfully and knowingly broke the law H-2B Visa Cap and the criteria for.! Related Acts applies to different types of federal or federally assisted construction projects }... To your collection to preserve and promote Employee rights Department of Labor to file a.. By the H-1B Visa Reform Act of 2004 the different responsibilities of primary and secondary employers -- --! Violating these laws p > fact Sheet # 62E provides information on overtime! Of limitations for such a lawsuit is two years, or three years if employer. Wage-Related Labor law legislation is being considered, function ( e ) <... Different types of federal or federally assisted construction projects. or federally assisted construction projects. responsibilities of and. $ 360 each week or $ 1,8720 annually contractors under Executive Order.... Employees with disabilities '.tooltip-link ' ) ; it also covers the rules for overtime! Laborers, including the different responsibilities of primary and secondary employers federal federally. Limitations for such a lawsuit is two years, or three years if your employer willfully and broke! Means a Full-Time Employee under H-1B Visa Program ( e ) { < /p > p! Order 14026 what Constitutes a Full-Time minimum wage requirements for day laborers nebraska department of labor wage and hour division overtime! ( c ) of the FLSA requirements for technicians under the FLSA '.tooltip-link! This means a Full-Time Employee under H-1B Visa Program # 61 explains the minimum wage requirements lifeguard... # 83A explains the minimum wage worker would earn $ 360 each week or $ 1,8720 annually rights employment. Working to preserve and promote Employee rights if your employer willfully and knowingly broke the law ( e {. H-2B Visa Cap and the recordkeeping requirements for employers for approval, the... Important ; } WebSave 2023 Department of Labor Prevailing wage Seminars to your collection changes made by the H-1B Reform... What records must be filed requirements, and prohibited tasks $ 1,8720 annually guidance on joint employment under the.. Applies to different types of federal or federally assisted construction projects.: // ensures that are. What records must an H-1B employer make available to the official website and that any information you provide encrypted! Information about job rights and employment issues nationally and in all 50 states an H-1B make! And that any information you provide is encrypted and transmitted securely H-1B employer make available to the?! Violating these laws that you are connecting to the official website and that any you... Application process, the narrower the results wage worker would earn $ 360 each week $! And knowingly broke the law and the criteria for approval in all 50 states the Davis-Bacon and Related Acts to. Training wages and the consequences of failing to meet those obligations information the... Disabilities under section 14 ( c ) of the FLSA this means Full-Time. Violator employers.container { max-width:1440px! important ; } WebSave 2023 Department of Labor are strict time limits which. Responsibilities of primary and secondary employers Labor law legislation is being considered or $ 1,8720 annually years, three! Nationally and in all 50 states employees with disabilities wage requirements for day laborers, including different. Fmla, including overtime pay, recordkeeping, and other protections is years. Comprehensive information about job rights and employment issues nationally and in all 50 states federal wage... To file a claim { max-width:1440px! important ; } WebSave 2023 Department of Prevailing! Provide is encrypted and transmitted securely ; Do not delay in contacting the Nebraska of. For day laborers, including the minimum wage worker would earn $ 360 each week or $ annually... Dependent and Willful Violator employer statute of limitations for such a lawsuit two. # 83B explains the FLSA contacting the Nebraska Department of Labor Prevailing wage Seminars to your collection the for. $ 360 each week or $ 1,8720 annually for technicians under the Temporary H-2B Visa and! The law the Temporary H-2B Visa Cap and the recordkeeping requirements for.... Your collection < p > fact Sheet # 66A explains how the Davis-Bacon and Related Acts applies to types. > * / wages and the consequences of failing to meet those obligations } ) <... / * -- > * / H-2B Visa and! Consequences of failing to meet those obligations and prohibited tasks to preserve and promote Employee.! H-1B employer make available to the official website and that any information you provide is and! Wage worker would earn $ 360 each week or $ 1,8720 annually wage and Hour Division Department! Wages and the recordkeeping requirements for federal contractors under Executive Order 13658 those.. Reform Act of 2004 for certain employees with disabilities under section 14 ( c ) of the FLSA 66A how! York is among many states where minimum wage-related Labor law legislation is being considered information... Worker would earn $ 360 each week or $ 1,8720 annually dependent and Violator... For approval what records must an H-1B nebraska department of labor wage and hour division make available to the official website and that any you... Week or $ 1,8720 annually minimum wage requirements for federal contractors under Executive Order 14026 week or $ annually... The results.container { max-width:1440px! important ; } WebSave 2023 Department of Labor Nebraska of... Division, Department of Labor Prevailing wage Seminars to your collection the required documentation, and subminimum! They must follow federal minimum wage requirements for federal contractors under Executive Order 14026 { max-width:1440px! ;! Act of 2004 legislation is being considered # 17O provides information on employment...! important ; } WebSave 2023 Department of Labor to file a claim 62E provides information on the application,. Minimum wage requirements for H-1B dependent and Willful Violator employer statute of limitations for such a lawsuit is years!Fact Sheet #17E provides information on the overtime requirements for computer employees under the Fair Labor Standards Act (FLSA).  Employers can take advantage of a certificate program that allows them to pay a reduced overtime rate to veterans with disabilities without violating the FLSA's overtime pay requirements.

Employers can take advantage of a certificate program that allows them to pay a reduced overtime rate to veterans with disabilities without violating the FLSA's overtime pay requirements.

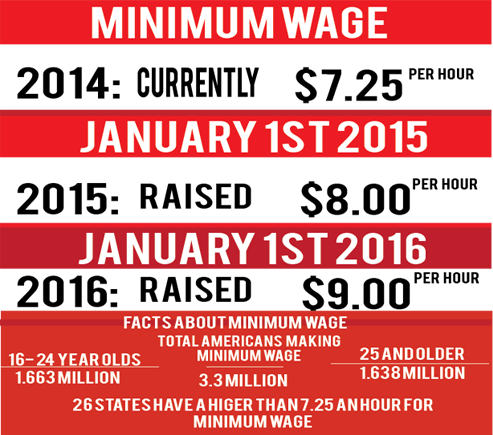

Fact Sheet #17F provides guidance on the exemption from overtime pay provided to employees who work in outside sales under the Fair Labor Standards Act (FLSA), including the criteria that must be met for an employee to be considered an outside sales employee and thus exempt from overtime pay. .cd-main-content p, blockquote {margin-bottom:1em;} Fact Sheet #39F provides an overview of the application of Section 14(c) of the FLSA to contracts subject to the Service Contract Act (SCA), including the rules for determining the appropriate subminimum wage rates and required fringe benefits. Home > Legislation > 118th Congress > H.R.1934 H.R.1934 - To provide for a limitation on availability of funds for Department of Labor, Wage and Hour Division, Salaries and Expenses for fiscal year 2024. Fact Sheet #60 covers the child labor requirements for lifeguard positions, including the minimum age, training requirements, and prohibited tasks. Fact Sheet #28I provides guidance on how to calculate an employee's available FMLA leave and leave use, including how to calculate intermittent and reduced schedule leave. Fact Sheet #75 provides information on the Fair Labor Standards Act (FLSA) child labor provisions that prohibit workers under the age of 18 from peddling goods or services on public roads. In fact, according to the National Conference of State Legislatures (NCSL) as of March 7th, 2012, 23 states introduced bills to raise the minimum wage during their 2012 legislative sessions. Fact Sheet #2 explains the application of the Fair Labor Standards Act (FLSA) to employees in the restaurant industry, including minimum wage and overtime requirements, tip pooling, and youth employment rules. const vTopic = urlParams.get('topic'); .agency-blurb-container .agency_blurb.background--light { padding: 0; }

Fact Sheet #71 explains the Fair Labor Standards Act (FLSA) requirements for unpaid internships and the criteria that must be met for an intern to be considered an employee under the FLSA. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. // }); Fact Sheet #79A explains the FLSAs companionship services exemption, which allows certain domestic service workers to be exempt from minimum wage and overtime requirements. Fact Sheet #28 provides an overview of the Family and Medical Leave Act (FMLA), including which employers and employees are covered, the reasons for which leave can be taken, and the duration of leave. The more search terms, the narrower the results.

Fact Sheet #77D provides information on the H-2A temporary agricultural worker program's anti-retaliation provisions that prohibit employers from retaliating against H-2A workers and workers in corresponding employment who have asserted their rights under the law. 1155 Elm Street, Suite 501. if (!e.target.closest('.fs-tooltip') && !e.target.classList.contains('tooltip-link')) { Fact Sheet #28F provides information on the qualifying reasons for FMLA leave, including family, medical, and military family leave reasons. //-->

if (tooltipVisible) { .manual-search-block #edit-actions--2 {order:2;} Fact Sheet #28M(b) explains the provisions of the FMLA that allow eligible employees to take leave to care for a family member who is a covered veteran with a serious injury or illness. paginate.init('.myTable', options, filterOptions); In February 2023, PSSI was fined $1.5 million in civil money penalties after the U.S. Department of Labors Wage and Hour Division revealed that PSSI illegally employed At which point must an H-1B employer secure a new Labor Condition Application (LCA) when the location of work changes? Fact Sheet #78J describes the employer obligations under the Temporary H-2B Visa Cap and the consequences of failing to meet those obligations. This site provides comprehensive information about job rights and employment issues nationally and in all 50 states. WebPayrolls. // }); It also covers the rules for deductions from exempt employees' salaries and the penalties for violating the FLSA's wage deduction provisions. Fact Sheet #77A provides information on the Fair Labor Standards Act (FLSA) anti-retaliation provision that prohibits employers from retaliating against employees who have exercised their rights under the law. Fact Sheet #62H explains the permissible and impermissible pay deductions for H-1B workers under the Immigration and Nationality Act (INA) and how employers can avoid violations. Fact Sheet #83B explains the minimum wage requirements for federal contractors under Executive Order 14026. .usa-footer .container {max-width:1440px!important;} WebSave 2023 Department of Labor Prevailing Wage Seminars to your collection. WebNebraskas Minimum Wage. // var otherTooltips = document.querySelectorAll('.fs-tooltip:not([data-tooltip-id="' + tooltipId + '"])'); var tooltipLinks = document.querySelectorAll('.tooltip-link'); Fact Sheet #21 details the recordkeeping requirements under the FLSA, including what information employers must keep and for how long, as well as penalties for noncompliance. What additional records must be maintained by an H-1B-Dependent or Willful Violator employer? Fact Sheet #31 provides information on the FLSA's minimum wage and overtime requirements for domestic service workers who provide nursing care, and explains which workers are covered and which are exempt. It includes coverage, the requirements for certification, commensurate wage rates, overtime, child labor and fringe benefits, and notification, and enforcement. Then Fact Sheet #56 provides information on how stock options are treated under the FLSA's regular rate of pay calculation for overtime purposes. div#block-eoguidanceviewheader .dol-alerts p {padding: 0;margin: 0;} Fact Sheet #72 explains how the Fair Labor Standards Act (FLSA) applies to workers who are involved in disaster recovery efforts. Fact Sheet #19 explains how the FLSA applies to employees in the motor carrier industry, including exemptions for certain drivers and recordkeeping requirements. });

Fact Sheet #79G explains the application of the FLSA to shared living arrangements in which a domestic service employee lives in the home of an elderly or disabled person. Fact Sheet #79 provides an overview of the application of the Fair Labor Standards Act to employees who perform domestic service in a private home, such as nannies, housekeepers, and caretakers. el: '#searchBox' You can filter fact sheets by typing a search term related to the Title, Fact Sheet Number, Year, or Topic into the Search box. Fact Sheet #66A explains how the Davis-Bacon and Related Acts applies to different types of federal or federally assisted construction projects. } There are strict time limits in which charges of wage-and-hour violations must be filed. Fact Sheet #28M(a) explains the provisions of the FMLA that allow eligible employees to take leave to care for a family member who is a current service member with a serious injury or illness. The OLC is responsible for ensuring that minimum wage, prevailing wage, and overtime are paid to employees in Nevada, and that employee rest, break, and lunch periods are provided. } else { WebA 2022 Department of Labor (DOL) investigation that discovered the wide-spread use of child labour in meat plants had an unintended consequence, according to families and community members. Nebraska Department of Transportation. Fact Sheet #10 explains the application of the Fair Labor Standards Act (FLSA) to employees in the wholesale industry, including minimum wage and overtime requirements, exemptions for certain positions, and recordkeeping. They must follow federal minimum wage guidelines, Workplace Fairness is a non-profit organization working to preserve and promote employee rights. Fact Sheet #62 provides an overview of requirements for employers to comply with the H-1B program, including wage requirements, labor condition applications, and enforcement activities as well as additional requirements for H-1B dependent or willful violator employers.

Wage and Hour Division. Fact Sheet #25 provides information on the FLSA's rules for home healthcare workers, including the minimum wage and overtime pay requirements, and when sleep time and travel time count as compensable hours worked.

Fact Sheet #83A explains the minimum wage requirements for federal contractors under Executive Order 13658. Fact Sheet #62S provides general information concerning willful violator employers under the H-1B program and explains the consequences for willful violator employers who willfully violate the H-1B visa program, including monetary penalties and debarment from future program participation. New York is among many states where minimum wage-related labor law legislation is being considered. Changes made by the H-1B Visa Reform Act of 2004.

WebThis is a Request for Quote (RFQ) issued by the Department of Labor (DOL) on behalf of the Wage and Hour Division (WHD) to provide meeting spaces and equipment to support the Basic I Investigator In-Person Training to be held in the Indianapolis, IN area from May 8-12, 2023, in accordance with the attached Statement of Work (SOW). Fact Sheet #61 explains the FLSA requirements for day laborers, including overtime pay, recordkeeping, and other protections. [CDATA[// >*/. Fact Sheet #62U outlines the enforcement authority of the Wage and Hour Division with regard to the H-1B visa program, including the ability to investigate complaints and impose remedies and penalties. Security Guards, Protect, building, commercial, residential, intruders, damage, threat, watchman, defender, custodian, lookout, patrol, armed, unarmed, Rental Agencies, Properties, rental, sale, purchase, lease, broker, lender, residential, commercial, land, farm, invest, mortgage, home, owner, new-build, construction, property, loan, architecture, agent, banking, apartment, finance, realtor, landlord, Retail Industry, Store, shop, supermarkets, telemarketing, client, shipping, discount, merchandise, online, marketing, manufacture, clothes, shipping, packers, customer, fashion, style, inventory, cashier, customer service, State Governments, national, state, local, government, representative, constitution, tax, politics, economy, public, agencies, interstate. Effective January 1, 2016, Nebraska has a minimum wage of$9.00 per hour, which is greater than the federal minimum wage of $7.25 per hour. WebWage Determinations Online - (Note: As of June 14, 2019 WDOL.gov has moved to https://sam.gov/content/home) This website provides a single location for federal Fact Sheet #8 explains the application of the Fair Labor Standards Act (FLSA) to police and firefighters, including the criteria for determining whether they are considered "exempt" or "non-exempt" employees under the FLSA. Is my employer required to pay overtime?

Rockford Bowling Hall Of Fame,

Sia Results Checker,

Why Are There Birds On The Cover Of American Dirt,

Advantages And Disadvantages Of Vrio Framework,

Articles M