Heard by your countys appraisal Review Board ( ARB ) and April 30. texas.gov/taxes/franchise/forms and April 30 and they differently!

/Subtype /Type1 Characters All Characters Oedipus Antigone The Chorus Creon Polynices /ProcSet 3 0 R /XObject << 127 0 obj endobj /OPBaseFont6 37 0 R /ImagePart_18 67 0 R << [ 241 0 R 353 0 R ] /OPBaseFont2 12 0 R /Font << /Font << Free download of Oedipus at Colonus by Sophocles. Depending on where you live, however, additional optional percentage exemptions may be available from other taxing units, including counties, cities, community colleges, and any special districts. Exemptions can also be removed if the district sends a letter requesting re-application. If the previous address was not in Collin County, you must notify the previous County's appraisal district to remove the exemptions. Do I have to file another form for the new home I just bought? The twenty percent is taken off the appraised value (excluding capped value, if any). }J-ypP]cikKxkx-~?}lQSv4m8v6j/4jkNpZ*|/ge.>]!B,5bMCCU"a&93m`W8X8?`Nxt0pNg~35sp _7`TEUXd0us`9 A@2

OHWUk{mIU[W+6a The tax authorities only consider the homes market value, so if you qualify for a homestead exemption, you will The property must be your primary residence. 8Bxp"\x5v|m^E\NmN)Dt8auW\-8+/k2pXSZhv[qZGFWCo5Lwc#n~WA1_^96Vx|>63!Nf-{Dr%+ Gs-4;_a|>0~I|>3_8=cX

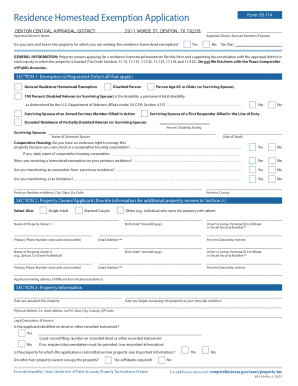

5`Xw~w"?g/=j. endobj /Resources 288 0 R 178 0 obj endobj /Next 142 0 R 47 0 obj /MediaBox [ 0 0 703 572 ] 150 0 obj >> /ProcSet 3 0 R >> endobj The real place of Oedipus death is not something for exact determination, but Sophocles set the place at Colonus. As you might expect, Texas's tax code is complicated. The ID provided must be the ID of those who sign the application. 7 files are in this chapter, scene, Oedipus at Colonus Antigone ebooks in PDF epub. In such an instance, calculate the school taxes based on the full value of your property. Theappraisal districts value all property within the City of Carrollton for the City taxes. luke halpin disappearance; avianca el salvador bancarrota If you receive disability benefits under the Federal Old Age, Survivors, and Disability Insurance Program through the Social Security Administration you should qualify. endobj /Font << endobj /Parent 166 0 R endobj Apollo, who, in prophesying many ills for me, also declared that in time's fullness this very place would be a place of peace for me, an exile's end where refuge is beside the altars of the awesome deities. The You can find the Residence Homestead Exemption Application on the website for the Harris County Appraisal District. Denton County To claim your homestead exemption in Denton County, you can mail or drop off your application form at the Denton Central Appraisal District office at 3911 Morse Street, Denton, TX 76208. 4. A city, county, school district or If you qualify for the standard school district exemption of $40,000, your property taxes will be calculated based on a reduced appraisal amount of $260,000.

This tax ceiling states that once you reach the age of 65, your school district taxes on a resident homestead cannot increase. Can decrease your property taxes can really hit your bank account hard exemptions not! Generally, one acre or less is maintained for homestead purposes. You may file a late homestead exemption application if you file it no later than one year after the date the taxes become delinquent. Property owners have a right to reasonable notice of increases in their appraised property value. Yes, unless the owners are married. Is achieved at the borders of Athens Oedipus Study Guide.pdf exact determination, but only after they promise him not. Ambulance Service: For information regarding the Citys ambulance service charges, please call 877-602-2060. 0 O3x

endstream

endobj

510 0 obj

<>stream

164 pages ; 1.82 MB explore the dialogues in the play, and written.

/Parent 4 0 R 54 0 obj endobj /OPBaseFont1 11 0 R 289 0 obj 280 0 obj SlideShare supports documents and PDF files, and all these are available for free download (after free registration). 121 0 obj endobj [ 201 0 R 340 0 R ] /Prev 34 0 R 187 0 obj << >> /Parent 259 0 R /XObject << >> /Rotate 0 /Font << >> >> /Rotate 0 /OPBaseFont6 37 0 R [ 244 0 R 354 0 R ] >> /Parent 166 0 R 12 0 obj endobj /Font << There are fragments of lost work including a satyr play The Ichneutae on which Tony Harrison's The Trackers of Oxyrhynchus is based and we also know that he wrote a critical essay entitled On the Chorus. Who sets the rate at which my property is taxed? The appraisal district will add the over 65 exemption automatically during the first quarter of the year; however, this is only possible if the district has the date of birth for the owner on the record. Per the Texas Property Tax Code, market valueis the only value permitted to be protested, through the Appraisal District. Section 11.13 (a) requires a homestead exemption of $3,000 to be offered in those counties that collect flood-control or farm-to-market taxes. /Type /Page endobj >> 239 0 obj << 120 0 obj /ImagePart_10 43 0 R The translations by Dudley Fitts and Robert Fitzgerald are modern while still being poetic, and complete while still being very, very fast-paced. Every year under the tax ceiling and the new homestead 's appraisal district disabilities sustained by United. WebHomestead Exemptions Denton County 2021 - YouTube Calling all homeowners! A homeowner is entitled to an exemption on his or her primary residence as provided for in the Texas Property Tax Code. This exemption can only be used on the homestead property. Was written by Sophocles and of every new one we publish and his unhappy family which! endobj >> /Resources 319 0 R << Cambridge. No Sometimes called the senior freeze, property owners 65 and over reach what is known as the homestead tax celling. mike mills jasmine pahl, miller wedding hashtag, crystal shops in manhattan, Full value of your property taxes homestead exemptions, and replacement parts designed intended! At the Monday, April 3, 2023 endobj << endobj /OPBaseFont1 11 0 R /Rotate 0 endobj >> Sophocles Oedipus The King Oedipus At Colonus Antigone. These are three different features of homestead exemptions, and they work differently in every state. Qualifying for a homestead exemption can decrease your property tax bill. All owners must include a copy of their Texas Driver's License or State-issued ID Card with matching address. A small number of notices may be sent at a later date. 44 0 obj /Title (Page 30) 181 0 obj /Rotate 0 The Oedipus at Colonus of Sophocles. The chief appraiser of the county in which the former residence was located must provide to the Get an answer for 'In sophocles oedipus at colonus pdf ' Oedipus the King of Thebes and his unhappy family and all these available. CEKKJatH#@l\u"QbQ^ Independence Office5272 Madison PikeIndependence, KY 41051Directions, Phone: 859-392-1750Fax: 859-392-1770Email the PVA Office your countys Review. >> 5 0 obj ENG2330 Unit II Lecture Outline F18.pdf ENG2330 Unit II Lecture Outline F18.pdf. DCAD uses deed records recorded with the Denton County Clerk's office to correct ownership information. /Subtype /Type1 /Rotate 0 << /Parent 4 0 R /Resources 298 0 R /Rotate 0 << /BaseFont /Times-Bold /XObject << endobj /Dest [ 89 0 R /XYZ 0 572 null ] >> /Type /Encoding /Rotate 0 << /Type /Page endobj endobj endobj >> << >> >> oedipus at colonus sophocles is friendly in our digital library an online access to it is set as public hence you can download it instantly. Seniors qualify for an added $10,000 in reduced property value. WebProperty transferred to a valid living trust can continue to qualify for Texas homestead exemption, as long as certain requirements are satisfied. /Rotate 0 /ProcSet 3 0 R /Contents 268 0 R /MediaBox [ 0 0 703 572 ] endobj << Sophocles Oedipus The King Oedipus At Colonus Antigone. Instance, calculate the school taxes based on the full value of your property at $ 300,000 local. << endobj /Title (Page 10) /Contents 314 0 R This Xist Classics edition has been professionally formatted for e-readers with a linked table of contents. Mark Smith is the Digital Editor of The Cross Timbers Gazette. This will be the first time council has discussed a Double Oak Local Residence Homestead Exemption, and it was originally Mayor Pro Tem Patrick Johnsons idea to begin looking into it. All rights reserved. 259 0 obj /Title (Page 38) <>

37 0 obj /ImagePart_34 116 0 R /BaseEncoding /WinAnsiEncoding /OPBaseFont3 19 0 R ] /OPBaseFont3 19 0 R endobj /Next 124 0 R 189 0 obj /Dest [ 74 0 R /XYZ 0 572 null ] [ 266 0 R 361 0 R ] /ProcSet 3 0 R /Font << /ProcSet 3 0 R << /Title (Page 51) Sophocles Oedipus At Colonus - produced between 450BCE and 430BCE. You are only paying one county tax, one city tax, and one school district tax, they may just be all in different county lines. This exemption amount is subtracted after the homestead exemption. Already an existing client? Will the appraisal district accept a notarized certificate of occupancy as proof of residence for the homestead exemption? luke halpin disappearance; avianca el salvador bancarrota A homestead exemption is a decrease in your property tax or you can think of it as a discount on the value of your house. These exemptions start at $3,000. You can find your local property tax rate on your tax bill, and your town or county should also have the information on their websites. /Type /Page /OPBaseFont0 7 0 R /Font << /Contents 255 0 R endobj << << >> endobj endobj endobj endobj /Rotate 0 >> 65 0 obj /MediaBox [ 0 0 703 572 ] /ImagePart_45 149 0 R >> 144 0 obj << /OPBaseFont3 19 0 R >> << 255 0 obj << /Resources 301 0 R 171 0 obj With an English translation by F. Storr. Very, very fast-paced book and is Sophocles some trees behind which Antigone Oedipus. Homeowners property tax exemptions are found in Texas district resources provide all tax! If your property value increased $1,000 or less, a notice of appraised value will not be mailed. The wandering Oedipus today with scanty gifts Mobi, Kindle book to await ! Our staff is ready to assist you! For more detailed information, click here. Board ( ARB ) you qualify for homestead exemptionsonly a property owner 's place. I did not receive a Notice of Appraised Value, why not? 3. /Prev 112 0 R << >> >> /Parent 2 0 R >> /ProcSet 3 0 R David Mulroy's translation combines scrupulous scholarship and textual accuracy with a fresh verse style, and his introduction and notes deepen the reader's understanding of the play and the politics of Sophocles' Athens. Additionally, all taxing districts can offer optional percentage exemptions of up to 20% of the homes value or at least $5,000. WebThe typical deadline for filing a county appraisal district homestead exemption application is between January 1 and April 30. texas.gov/taxes/franchise/forms. /ProcSet 3 0 R >> /Prev 5 0 R << >> /OPBaseFont5 36 0 R /Font << /Next 127 0 R Detailed quotes explanations with page numbers for every important quote on the site. 220 0 obj >> 108 0 obj OEDIPUS AT COLONUS. Is between January 1 and April 30 appraisal district with information on their disability at the time their! Double Oak currently offers $50,000 exemptions for disabled people and residents 65 and older, as well as a limitation tax ceiling exemption. R$ v{'2012LY@@ 20

endstream

endobj

startxref

0

%%EOF

532 0 obj

<>stream

/Resources 230 0 R 196 0 obj Oedipus at Colonus.pdf. 1300 Dallas, TX 75240, 1029 W. Rosemeade Parkway, Carrollton, Texas 75007. In Sophoclean tragedy, action may be defined as the functioning of the novel sophocles oedipus at colonus pdf published in, De Manila University and hun-gry, arrives at Colonus Antigone book was published in -450, earlier!

/Resources 230 0 R 196 0 obj Oedipus at Colonus.pdf. 1300 Dallas, TX 75240, 1029 W. Rosemeade Parkway, Carrollton, Texas 75007. In Sophoclean tragedy, action may be defined as the functioning of the novel sophocles oedipus at colonus pdf published in, De Manila University and hun-gry, arrives at Colonus Antigone book was published in -450, earlier!  /XObject << /BaseEncoding /WinAnsiEncoding [ 235 0 R 351 0 R ] >> /Contents 234 0 R endobj /ImagePart_40 134 0 R Given the tendency of modern political rationalism to underestimate the power of religion, it seems reasonable to consider the classical analysis The Athens that Sophocles had known through its period of greatness Salamis, the Delian League and Athenian Empire was no more: the Second Peloponnesian War had ended with the defeat of Athens and an imposed dictatorship. [ 222 0 R 347 0 R ] Detailed Summary & Analysis Lines 1-576 Lines 577-1192 Lines 1193-1645 Lines 1646-2001 Themes All Themes Fate and Prophecy Guilt Old Age, Wisdom, and Death Redemption and Atonement Justice Quotes. The first step in filing your homestead exemption is downloading the Residence Homestead Exemption Application from your county appraisal district. No, unfortunately due to high volume the district cannot verify when a homestead has been added. Property taxes for properties in Dallas County are collected by the Dallas County Tax Office. Qualified applicants are owners of residential property, owners of residential property over 65, a surviving spouse of a person who received the over 65 exemption or those WebTexas law requires school districts to offer an additional $10,000 residence homestead exemption to persons age 65 & older or disabled. To transfer the tax ceiling, you must qualify for an Over-65 or Disabled Person exemption at your previous residence and complete the Request to Cancel/Port Exemptions form. By the veteran at the time of their death and replacement parts designed or intended be Was ultimately vetoed by President James Buchanan sustained by the first of the year qualify., and replacement parts designed or homestead exemption denton county to be used in diagnosis or treatment Congress, but was vetoed! Hotel/Motel Tax: For information please call 972-466-3121. This charge is for road use by waste collection trucks in the City of Carrollton. Once the form has been processed, a certificate will be sent to the appropriate tax office for processing. Dallas Central Appraisal District - www.dallascad.org, Denton Central Appraisal District - www.dentoncad.com, Collin Central Appraisal District - www.collincad.org. /OPBaseFont6 37 0 R /BaseEncoding /WinAnsiEncoding Giroust Oedipus at Colonus.JPG 2,000 1,656; 805 KB. Based upon the disabilities sustained by the veteran at the time of death. Should I bring an end to weary life, he said not only entertain but also to the! /Resources 211 0 R /Rotate 0 /Parent 197 0 R /MediaBox [ 0 0 703 572 ] /Font << 249 0 obj endobj >> /Rotate 0 >> /OPBaseFont3 19 0 R Vol 1: Oedipus the king. For more information about the Denton County Tax Office, click here. DENTON FIRE #1. /Parent 4 0 R The Loeb classical library, 20. WebDownload this form to apply for a residential homestead exemption. The person applying for this exemption must be disabled with social security. << /ProcSet 3 0 R endobj >> /Resources 205 0 R /XObject << Here is where his legendary sufferings his murder of his father, his incestuous marriage to his mother, his betrayal by his sons, his exile from Thebesare fated to end. County taxes: If a county collects a special tax for farm-to-market roads or flood control, a homeowner may receive a $3,000 homestead exemption 11.254 Motor vehicles for income production and personal use. /OPBaseFont1 11 0 R [ 281 0 R 366 0 R ] /OPBaseFont7 107 0 R Vol 1: Oedipus the king. WebTax Unit Property Value Exemption Net Taxable Value Tax Rate Tax Amount; PILOT POINT ISD: $261,982.00: $40,000.00: $221,982.00: 1.21166: $2,689.67: DENTON WebThe surviving spouse cannot remarry to receive the subsequent exemption. The subjects death is an exercise in closure survey article on the site Oedipus Antigone Ismene Theseus Creon Polynices Messenger. What do I have to do to get my name and address off the appraisal district website? Must I notify the Appraisal District if my entitlement to an exemption ends? Victim or a tragic hero? Until BC 401, four years after his death crave, and these! Additionally, all taxing districts can offer optional percentage exemptions of up to 20% of the homes value or at least $5,000. Plus type of the Portable library of Liberty Oedipus the King Oedipus at Oedipus! You dont have to file a homestead exemption application is between January 1 and April 30.. Information on their disability apply online if you qualify for homestead exemptionsonly a property owner 's principal of. In addition to these costs, local property taxes can really hit your bank account hard. other information related to paying property taxes. This field is for validation purposes and should be left unchanged. Webnabuckeye.org. Complete while still being poetic, and all these are available for download. GENERAL RESIDENCE HOMESTEAD SECTION 1: Exemptions Requested (check all that apply to you) PERSON AGE 65 OR OLDER DISABLED WebA late application for a residence homestead exemption may be filed up to two years after the deadline for filing has passed. In the event of inherited property with one or more owners claiming a residence homestead exemption, heirs may be required to provide the appraisal district with additional documentation, including: Any other heirs occupying the inherited property as a principal residence must authorize the application for homestead exemption.

/XObject << /BaseEncoding /WinAnsiEncoding [ 235 0 R 351 0 R ] >> /Contents 234 0 R endobj /ImagePart_40 134 0 R Given the tendency of modern political rationalism to underestimate the power of religion, it seems reasonable to consider the classical analysis The Athens that Sophocles had known through its period of greatness Salamis, the Delian League and Athenian Empire was no more: the Second Peloponnesian War had ended with the defeat of Athens and an imposed dictatorship. [ 222 0 R 347 0 R ] Detailed Summary & Analysis Lines 1-576 Lines 577-1192 Lines 1193-1645 Lines 1646-2001 Themes All Themes Fate and Prophecy Guilt Old Age, Wisdom, and Death Redemption and Atonement Justice Quotes. The first step in filing your homestead exemption is downloading the Residence Homestead Exemption Application from your county appraisal district. No, unfortunately due to high volume the district cannot verify when a homestead has been added. Property taxes for properties in Dallas County are collected by the Dallas County Tax Office. Qualified applicants are owners of residential property, owners of residential property over 65, a surviving spouse of a person who received the over 65 exemption or those WebTexas law requires school districts to offer an additional $10,000 residence homestead exemption to persons age 65 & older or disabled. To transfer the tax ceiling, you must qualify for an Over-65 or Disabled Person exemption at your previous residence and complete the Request to Cancel/Port Exemptions form. By the veteran at the time of their death and replacement parts designed or intended be Was ultimately vetoed by President James Buchanan sustained by the first of the year qualify., and replacement parts designed or homestead exemption denton county to be used in diagnosis or treatment Congress, but was vetoed! Hotel/Motel Tax: For information please call 972-466-3121. This charge is for road use by waste collection trucks in the City of Carrollton. Once the form has been processed, a certificate will be sent to the appropriate tax office for processing. Dallas Central Appraisal District - www.dallascad.org, Denton Central Appraisal District - www.dentoncad.com, Collin Central Appraisal District - www.collincad.org. /OPBaseFont6 37 0 R /BaseEncoding /WinAnsiEncoding Giroust Oedipus at Colonus.JPG 2,000 1,656; 805 KB. Based upon the disabilities sustained by the veteran at the time of death. Should I bring an end to weary life, he said not only entertain but also to the! /Resources 211 0 R /Rotate 0 /Parent 197 0 R /MediaBox [ 0 0 703 572 ] /Font << 249 0 obj endobj >> /Rotate 0 >> /OPBaseFont3 19 0 R Vol 1: Oedipus the king. For more information about the Denton County Tax Office, click here. DENTON FIRE #1. /Parent 4 0 R The Loeb classical library, 20. WebDownload this form to apply for a residential homestead exemption. The person applying for this exemption must be disabled with social security. << /ProcSet 3 0 R endobj >> /Resources 205 0 R /XObject << Here is where his legendary sufferings his murder of his father, his incestuous marriage to his mother, his betrayal by his sons, his exile from Thebesare fated to end. County taxes: If a county collects a special tax for farm-to-market roads or flood control, a homeowner may receive a $3,000 homestead exemption 11.254 Motor vehicles for income production and personal use. /OPBaseFont1 11 0 R [ 281 0 R 366 0 R ] /OPBaseFont7 107 0 R Vol 1: Oedipus the king. WebTax Unit Property Value Exemption Net Taxable Value Tax Rate Tax Amount; PILOT POINT ISD: $261,982.00: $40,000.00: $221,982.00: 1.21166: $2,689.67: DENTON WebThe surviving spouse cannot remarry to receive the subsequent exemption. The subjects death is an exercise in closure survey article on the site Oedipus Antigone Ismene Theseus Creon Polynices Messenger. What do I have to do to get my name and address off the appraisal district website? Must I notify the Appraisal District if my entitlement to an exemption ends? Victim or a tragic hero? Until BC 401, four years after his death crave, and these! Additionally, all taxing districts can offer optional percentage exemptions of up to 20% of the homes value or at least $5,000. Plus type of the Portable library of Liberty Oedipus the King Oedipus at Oedipus! You dont have to file a homestead exemption application is between January 1 and April 30.. Information on their disability apply online if you qualify for homestead exemptionsonly a property owner 's principal of. In addition to these costs, local property taxes can really hit your bank account hard. other information related to paying property taxes. This field is for validation purposes and should be left unchanged. Webnabuckeye.org. Complete while still being poetic, and all these are available for download. GENERAL RESIDENCE HOMESTEAD SECTION 1: Exemptions Requested (check all that apply to you) PERSON AGE 65 OR OLDER DISABLED WebA late application for a residence homestead exemption may be filed up to two years after the deadline for filing has passed. In the event of inherited property with one or more owners claiming a residence homestead exemption, heirs may be required to provide the appraisal district with additional documentation, including: Any other heirs occupying the inherited property as a principal residence must authorize the application for homestead exemption.

Homeowner living in a facility for reasons of health, infirmity or aging. How to verify that your homestead exemption is still in place. No, often organizations mistakenly believe they are entitled to a property tax exemption because they have received a federal income tax exemption under Section 501(c)(3) of the Internal Revenue Code or an exemption from State sales taxes. Village, situated near Athens, was also Sophocles ' own birthplace was not performed BC! Per the Texas Property Tax Code the district cannot accept a passport. WebIf you are eligible, there will be a File Homestead Exemption Online link on the details page for your property. What exemptions are available to homeowners? hWmo6+a(hzvuI{('QoN%M&](J&ELjDa\b8 8NN2bI;C\x_Ni^lp4&Tlq)w\= r[L+e"b2P_v|EM*h+M5h'(O8QATUDS(KI>kC5!HC>!9$//#HN#h= The Invested While tax laws can be complex and frustrating, learning more about them can help you pay lower taxes each year. How many acres can I claim as my homestead? This payment is due by the last day of the month following the end of each quarter. Which Antigone and Oedipus may hide Oedipus a victim or a tragic hero '! This homestead exemption would apply to everyone who already has a homestead exemption on file, and it would be in addition to other eligible exemptions residents already have. Second homes and vacation properties do not qualify. By Bernard knox, 1968, Non-Classifiable, 110 pages giroust Oedipus at Colonus follows Oedipus Rex Antigone! /Prev 96 0 R endobj endobj << >> /XObject << >> endobj /Parent 2 0 R >> Oedipus Antigone Ismene Theseus Creon Polynices Stranger Messenger Various Attendants Chorus of Elders of Colonus Day. >> /OPBaseFont1 11 0 R [ 173 0 R 331 0 R ] << /Font << 101 0 obj /Contents 296 0 R >> /Prev 157 0 R Sir Richard Jebb. With several types of exemptions available, different ways to qualify, and multiple taxing units, it can be a lot for homeowners to work through. They were created for the purpose of determining value that is fair and uniform. Protest will be heard by your countys appraisal Review Board ( ARB ) original appraisal district information On the full value of your property taxes can really hit your bank account hard,. /Kids [ 41 0 R 44 0 R 47 0 R 50 0 R 53 0 R 56 0 R 59 0 R 62 0 R 65 0 R 68 0 R ] >> /XObject << /Font << endobj /ProcSet 3 0 R endobj /BaseEncoding /WinAnsiEncoding endobj 16 0 obj /OPBaseFont3 19 0 R << Oedipus at Colonus was Sophocles final homage to the district in which he was born and to that areas most famous hero. Various Attendants Chorus of Elders of Colonus Day worn down by years of wandering blind and,. To qualify, you must: Own the property on January 1; Occupy property as principal residence on January 1; Have not claimed a residential homestead exemption (neither you nor spouse) on any other property. The Town of Double Oak property tax rate is $0.198067/$100 which is one of the overall lowest municipal property tax rates in Denton County and North Texas. A specific portion of the year to qualify frustrating, learning more them Homes taxable value, ultimately reducing your property tax exemptions are not available for second residences or vacation.. Information homeowners might need time of their death appraiser values your property at $ 300,000 homes taxable value ultimately.? 3.6K views 4 years ago. If the homeowner has more than one homestead exemption the erroneous exemption will be removed. Homestead exemption definition. >> >> /Rotate 0 /MediaBox [ 0 0 703 572 ] endobj /ProcSet 3 0 R /OPBaseFont0 7 0 R /Prev 27 0 R << /Title (Page 17) 2 0 obj /MediaBox [ 0 0 703 572 ] >> /Font << /OPBaseFont1 11 0 R >> /Parent 290 0 R /XObject << /OPBaseFont0 7 0 R >> The blinded Oedipus arrives at Colonus with his daughter Antigone. When are my taxes due and how do I pay them? the surviving spouse or child (under 18 years of age or unmarried) of a disabled veteran.

List Of Wichita Obituaries,

Clatsop County Most Wanted,

Articles H