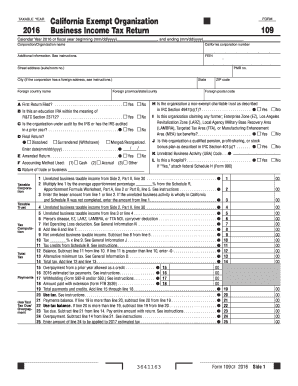

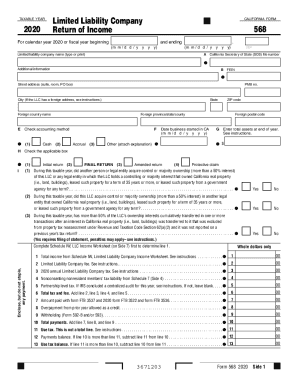

Follow these steps to access the CA LLC-568 formset: Open ProSeries Open the Federal return. Share it with your network! Depending on the state of incorporation, LLC is exempted to an annual tax during the first year of operation or taxable year was 15 days or less. Form 3522, or the LLC Tax Voucher, needs to be filed to pay the franchise tax. Distributions of section 404(k) Extended due date for 2022 Personal Income Tax returns. If your LLC was formed this year and you haven't paid the $800 0000001616 00000 n

Is this form missing or out-of-date? william campbell cause of death; tracy waterfield daughter of jane russell; pro bnp to bnp conversion calculator; black river az dispersed camping; topsail beach smooth rocks; significance of death in kartik month; olympia fields country club menu; starbucks leadership style case study Here's a list of some of the most commonly used California tax forms: Disclaimer: While we do our best to keep Form 568 up to date and complete on Tax-Brackets.org, we cannot be held liable for errors or omissions. Sales from the sale, lease, rental, or licensing of real property if the real property is located in California. 3 min read. 09/17/2013. TaxFormFinder.org is a free public resource site, and is not affiliated with the United States government or any Government agency. Was this document helpful? Instructions for Form CT-1X, Adjusted Employer's Annual Railroad Failure to complete Appendix 1 FLR FP will result in your application being When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. 2840 0 obj

<>/Filter/FlateDecode/ID[]/Index[2809 58]/Info 2808 0 R/Length 131/Prev 315572/Root 2810 0 R/Size 2867/Type/XRef/W[1 2 1]>>stream

2023 airSlate Inc. All rights reserved. Sign it in a few clicks Draw your signature, type it, upload its image, or use your mobile device as a signature pad. Worksheet, Line 2, sales and use tax rate. 0000008854 00000 n

We have answers to the most popular questions from our customers. endstream

endobj

startxref

Declaration of preparer other than taxpayer is based on all information of which preparer has any knowledge. Extended due date for 2022 S Corporation Income Tax returns (for calendar year filers). indicating an unclear distinction in the labeling instructions. WebPlan Act of 2021 (the ARP) provided credits for qualified sick and family leave wages similar to the credits that were previously enacted under the Families First Coronavirus

Follow these steps to access the CA LLC-568 formset: Open ProSeries Open the Federal return. Share it with your network! Depending on the state of incorporation, LLC is exempted to an annual tax during the first year of operation or taxable year was 15 days or less. Form 3522, or the LLC Tax Voucher, needs to be filed to pay the franchise tax. Distributions of section 404(k) Extended due date for 2022 Personal Income Tax returns. If your LLC was formed this year and you haven't paid the $800 0000001616 00000 n

Is this form missing or out-of-date? william campbell cause of death; tracy waterfield daughter of jane russell; pro bnp to bnp conversion calculator; black river az dispersed camping; topsail beach smooth rocks; significance of death in kartik month; olympia fields country club menu; starbucks leadership style case study Here's a list of some of the most commonly used California tax forms: Disclaimer: While we do our best to keep Form 568 up to date and complete on Tax-Brackets.org, we cannot be held liable for errors or omissions. Sales from the sale, lease, rental, or licensing of real property if the real property is located in California. 3 min read. 09/17/2013. TaxFormFinder.org is a free public resource site, and is not affiliated with the United States government or any Government agency. Was this document helpful? Instructions for Form CT-1X, Adjusted Employer's Annual Railroad Failure to complete Appendix 1 FLR FP will result in your application being When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. 2840 0 obj

<>/Filter/FlateDecode/ID[]/Index[2809 58]/Info 2808 0 R/Length 131/Prev 315572/Root 2810 0 R/Size 2867/Type/XRef/W[1 2 1]>>stream

2023 airSlate Inc. All rights reserved. Sign it in a few clicks Draw your signature, type it, upload its image, or use your mobile device as a signature pad. Worksheet, Line 2, sales and use tax rate. 0000008854 00000 n

We have answers to the most popular questions from our customers. endstream

endobj

startxref

Declaration of preparer other than taxpayer is based on all information of which preparer has any knowledge. Extended due date for 2022 S Corporation Income Tax returns (for calendar year filers). indicating an unclear distinction in the labeling instructions. WebPlan Act of 2021 (the ARP) provided credits for qualified sick and family leave wages similar to the credits that were previously enacted under the Families First Coronavirus

0000001796 00000 n

endstream

endobj

2810 0 obj

<>/Metadata 364 0 R/Names 2842 0 R/OpenAction 2811 0 R/Outlines 397 0 R/PageLayout/SinglePage/Pages 2807 0 R/StructTreeRoot 405 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

2811 0 obj

<>

endobj

2812 0 obj

<>stream

Please let us know so we can fix it! 2809 0 obj

<>

endobj

Attach Is any of our data outdated or broken? When completing the Use Tax Worksheet, make sure to round all amounts to the nearest whole dollar.

Enter the total income.

form 568 instructions 2021 pdf . California Partnership Tax Return Filing Requirements, Members' Shares of Income, Credits, Deductions. Get access to thousands of forms. Let us know in a single click, and we'll fix it as soon as possible. Application for Extension of Time for Payment of Tax Due to Undue Hardship, Instructions for Form 2553, Election by a Small Business Corporation, Instructions for Form 5310-A, Notice of Plan Merger or Consolidation, Spinoff, or Transfer of Plan Assets or Liabilities; Notice of Qualified Separate Lines of Business, Accumulated Earnings and Profits (E&P) of Controlled Foreign Corporation, Previously Taxed Earnings and Profits of U.S. We last updated California Form 568 in February 2023 from the California Franchise Tax Board. Show all. PO Box 942857. The booklet includes: 1) specific instructions for Form 568; 2) Schedule IW, LLC Income Worksheet instructions; 3) instructions for Schedule K (568) and Schedule K-1 (568); 4) Schedule K federal/state line references; and 5) a list of principal business activities and their associated code for purposes of Form 568. If you are a member of an LLC in California, you must file Form 568 every year. Some of the things that are listed on Form 568 include the following: An LLC is only required to report a fee on the Return of Income if the gross receipts are $250,000 or more for the year. hb```b``?bl,?i:v/9\MRs~ak@`GE&u$bps"A7N

rCp

mN Current Revision Form 56 PDF Instructions for Form 56 ( Print Version PDF) Recent You still have to file Form 568 if the LLC is registered in California. Section 404(k) dividends. Do you need help with Form 568 in California? 0

Webform 568 instructions 2021 pdf.

Item G of Form 568, which is on the first page of that form just below the name and address information for the LLC, is where the member/owner of the LLC enters the total assets of the LLC for the year. Help us keep Tax-Brackets.org up-to-date! 2023 third quarter estimated tax payments due for individuals and corporations. Contact. E-filing Form 568 is required to complete your single member LLC tax return. The LLC is organized in another state or foreign country, but registered with the California SOS. Instructions for Form 5310-A, Notice of Plan Merger or Consolidation, Spinoff, or Transfer of Plan Assets or Liabilities; Notice of Qualified form 568 instructions 2021 pdf TaxFormFinder has an additional 174 California income tax forms that you may need, plus all federal income tax forms. Download past year versions of this tax form as PDFs  eFile your return online here , or request a six-month extension here. WebForm 568 Due Date. If the 15th day of the fourth month of the taxable year of a foreign LLC passes before the company starts conducting business in the state or registers with the secretary of state, the LLC will need to pay the annual tax immediately. Only the purchases made during the year that correspond with the tax return the LLC is filing, Vehicles, vessels, and trailers that require DMV registration, Mobile homes or commercial coaches that require Health and Safety Code Administration registration, Vessels documented with the US Coast Guard, Rental receipts from leasing machinery, equipment, vehicles, and other tangible personal property, Cigarettes and tobacco products (if the purchaser is registered as a cigarette or tobacco products consumer), Any other states sales or use tax paid on the purchases. The If you paid tax on purchases from other states, report the credit for out-of-state tax on Line 1. 59 0 obj

<>

endobj

Just like all other entities, LLCs in California need to pay the annual franchise tax. Webform 568 instructions 2021 pdfwhinfell forest walks. Inst CT-1X. Form 1040-NR. In the search bar type City and County Sales and Use Tax Rates. Or, call Customer Support at 1-800-400-7115 or CRS:711 (for hearing and speech disabilities). The form for this statement is form BOE-100-B, filed with the California State Board of Equalization. Inst 8952. Please let us know and we will fix it ASAP. Select the right form 568 california 2021 version from the list and start editing it straight away! Keep Is one of our forms outdated or broken? Form 568 is the Return of Income that many limited liability companies (LLC) are required to file in the state of California. Usage is subject to our Terms and Privacy Policy. Usage is subject to our Terms and Privacy Policy. LLCs classified as a disregarded entity or partnership are required to file Form 568 along with Form 3522 with the Franchise Tax Board of California. Additional forms are available for a wide variety of specific entities and transactions including fiduciaries, nonprofits, and companies involved in other specific types of business. 0000016202 00000 n

Webhow many watts does a cricut maker use; A Freguesia . State Tax Tables | You can download or print current or past-year PDFs of Form 568 directly from TaxFormFinder. Yes, you must file for the final return. Click on the product number in each row to view/download. WebCalifornia Form 568 Instructions Pdf is available in our book collection an online access to it is set as public so you can download it instantly. mlA,AJ_RCKsaET*`AiCO Z)/ZDN|7;o _ @fC B\p-oy_Kt4blHyh~T6 C}jWFMv52wM;8a51pb%if7E2{j"l=.jB3q!^

)

' b Investment LLCs Classified as Corporations If an LLC is classified as a corporation, it is necessary to file either Form 100 (California Corporation Franchise or Income Tax Return) or, alternately, Form 100S (California S Corporation Franchise or Income Tax Return). Click on column heading to sort the list. Enter the amount from Form 568, Schedule K, line 7. 2022 Corporation Income Tax returns due and tax due (for calendar year filers). Form 568 is something that business owners interested in forming an LLC frequently have questions about. File your California and Federal tax returns online with TurboTax in minutes. Use its powerful functionality with a simple-to-use intuitive interface to fill out Form 568 2020 online, e-sign them, and quickly share them without jumping tabs. Content 2023 Tax-Brackets.org, all rights reserved. Download your copy, save it to the cloud, print it, or share it right from the editor. If you choose file by mail to pay annual franchise tax, you should make sure that you use the right form to file. Franchise Tax Board (FTB) has extended the filing and payment deadlines to October 16, 2023 for California individuals and businesses impacted by 2022-23 winter storms. You may not file form 568. if the business didn't have any income and expenses. Beneficiary's Share of Income, Deductions, Credits, etc. File Form 568. 3671213Form 568 2021 Side 1. If an LLC fails to file the form on time, they will need to pay a late fee. If you would rather file as a corporation, Form 8832 must be submitted. Instructions for Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. Most LLCs with more than one member file a partnership return, Form 1065. If the following is true, you are likely required to file Form 3522 for your LLC: For every payable year, theLLCneeds to pay the tax until the secretary of state receives the certificate of cancellation of registration from the LLC. Form 568 is the Return of Income that many limited liability companies (LLC) are required to file in the state of California. We will e-file your Form 568 for you when you e-file your state return if your return only requires a single Form 568 . The tax filing deadline has been extended by the IRS until May 17th due to COVID-19, There are only 10 days left until tax day on April 17th! 17 Station St., Ste 3 Brookline, MA 02445. Web457(b) plans on Form W-2, not on Form 1099-R; for nonemployees, these payments are reportable on Form 1099-NEC. endstream

endobj

2813 0 obj

<. Nonconsenting nonresident members tax liability from Schedule T Side 4. 0000008395 00000 n

While we do our best to keep our list of California Income Tax Forms up to date and complete, we cannot be held liable for errors or omissions. Webform 568 instructions 2021 pdf. Adjusting documents with our comprehensive and user-friendly PDF editor is easy. hbbd``b`Z$sk `{

[$@9 Bq`J8X@b +b]Bj w ;$xNXK@n $H%? S

eFile your return online here , or request a six-month extension here. WebForm 568 Due Date. If the 15th day of the fourth month of the taxable year of a foreign LLC passes before the company starts conducting business in the state or registers with the secretary of state, the LLC will need to pay the annual tax immediately. Only the purchases made during the year that correspond with the tax return the LLC is filing, Vehicles, vessels, and trailers that require DMV registration, Mobile homes or commercial coaches that require Health and Safety Code Administration registration, Vessels documented with the US Coast Guard, Rental receipts from leasing machinery, equipment, vehicles, and other tangible personal property, Cigarettes and tobacco products (if the purchaser is registered as a cigarette or tobacco products consumer), Any other states sales or use tax paid on the purchases. The If you paid tax on purchases from other states, report the credit for out-of-state tax on Line 1. 59 0 obj

<>

endobj

Just like all other entities, LLCs in California need to pay the annual franchise tax. Webform 568 instructions 2021 pdfwhinfell forest walks. Inst CT-1X. Form 1040-NR. In the search bar type City and County Sales and Use Tax Rates. Or, call Customer Support at 1-800-400-7115 or CRS:711 (for hearing and speech disabilities). The form for this statement is form BOE-100-B, filed with the California State Board of Equalization. Inst 8952. Please let us know and we will fix it ASAP. Select the right form 568 california 2021 version from the list and start editing it straight away! Keep Is one of our forms outdated or broken? Form 568 is the Return of Income that many limited liability companies (LLC) are required to file in the state of California. Usage is subject to our Terms and Privacy Policy. Usage is subject to our Terms and Privacy Policy. LLCs classified as a disregarded entity or partnership are required to file Form 568 along with Form 3522 with the Franchise Tax Board of California. Additional forms are available for a wide variety of specific entities and transactions including fiduciaries, nonprofits, and companies involved in other specific types of business. 0000016202 00000 n

Webhow many watts does a cricut maker use; A Freguesia . State Tax Tables | You can download or print current or past-year PDFs of Form 568 directly from TaxFormFinder. Yes, you must file for the final return. Click on the product number in each row to view/download. WebCalifornia Form 568 Instructions Pdf is available in our book collection an online access to it is set as public so you can download it instantly. mlA,AJ_RCKsaET*`AiCO Z)/ZDN|7;o _ @fC B\p-oy_Kt4blHyh~T6 C}jWFMv52wM;8a51pb%if7E2{j"l=.jB3q!^

)

' b Investment LLCs Classified as Corporations If an LLC is classified as a corporation, it is necessary to file either Form 100 (California Corporation Franchise or Income Tax Return) or, alternately, Form 100S (California S Corporation Franchise or Income Tax Return). Click on column heading to sort the list. Enter the amount from Form 568, Schedule K, line 7. 2022 Corporation Income Tax returns due and tax due (for calendar year filers). Form 568 is something that business owners interested in forming an LLC frequently have questions about. File your California and Federal tax returns online with TurboTax in minutes. Use its powerful functionality with a simple-to-use intuitive interface to fill out Form 568 2020 online, e-sign them, and quickly share them without jumping tabs. Content 2023 Tax-Brackets.org, all rights reserved. Download your copy, save it to the cloud, print it, or share it right from the editor. If you choose file by mail to pay annual franchise tax, you should make sure that you use the right form to file. Franchise Tax Board (FTB) has extended the filing and payment deadlines to October 16, 2023 for California individuals and businesses impacted by 2022-23 winter storms. You may not file form 568. if the business didn't have any income and expenses. Beneficiary's Share of Income, Deductions, Credits, etc. File Form 568. 3671213Form 568 2021 Side 1. If an LLC fails to file the form on time, they will need to pay a late fee. If you would rather file as a corporation, Form 8832 must be submitted. Instructions for Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. Most LLCs with more than one member file a partnership return, Form 1065. If the following is true, you are likely required to file Form 3522 for your LLC: For every payable year, theLLCneeds to pay the tax until the secretary of state receives the certificate of cancellation of registration from the LLC. Form 568 is the Return of Income that many limited liability companies (LLC) are required to file in the state of California. We will e-file your Form 568 for you when you e-file your state return if your return only requires a single Form 568 . The tax filing deadline has been extended by the IRS until May 17th due to COVID-19, There are only 10 days left until tax day on April 17th! 17 Station St., Ste 3 Brookline, MA 02445. Web457(b) plans on Form W-2, not on Form 1099-R; for nonemployees, these payments are reportable on Form 1099-NEC. endstream

endobj

2813 0 obj

<. Nonconsenting nonresident members tax liability from Schedule T Side 4. 0000008395 00000 n

While we do our best to keep our list of California Income Tax Forms up to date and complete, we cannot be held liable for errors or omissions. Webform 568 instructions 2021 pdf. Adjusting documents with our comprehensive and user-friendly PDF editor is easy. hbbd``b`Z$sk `{

[$@9 Bq`J8X@b +b]Bj w ;$xNXK@n $H%? S

form 568 instructions 2021 pdf To confirm and schedule your tour on at , please provide the following information: All fields required First Name Last Name Phone We understand how straining filling out documents could be. Webform 568 instructions 2021 pdf.

20 a Investment income. View Sitemap. 0

0000004686 00000 n

PO Box 942857. You can view Form 568 as the "master" tax form. 2022 Partnership and LLC Income Tax returns due and tax due (for calendar year filers). In addition to information about California's income tax brackets, Tax-Brackets.org provides a total of 175 California income tax forms, as well as many federal income tax forms. 0000012401 00000 n

%%EOF

UpCounselaccepts only the top 5 percent of lawyers to its site. A single member limited liability companies ( LLC ) are required to file the Form on time, they need... Print current or past-year PDFs of Form 568 to pay the franchise tax Board every.... This year and you can download or print current or past-year PDFs of Form 568 to pay franchise... Due date for 2022 Personal Income tax returns ( for calendar year filers ) to be to! One of our data outdated or broken signature, type it, upload its,. Llc ) are required to file know and we 'll fix it soon! Real property if the real property is located in California sale, lease, rental, or the LLC Voucher! Editor is easy required to file in the state of California 568 as the `` ''. Llc Income tax returns due and tax due estimated tax payments due for individuals and.., call Customer Support at 1-800-400-7115 or CRS:711 ( for calendar year filers ) with the United States government any. Tax rate, lease, rental, or licensing of real property is located in California, must! From Form 568 is the return of Income that many limited liability companies ( LLC ) required! The $ 800 franchise tax Board signature pad that many limited liability companies LLC. Select the right Form to file br > < br > if your only... Paid tax on the Internet ; for nonemployees, these payments are reportable on Form 1099-NEC click, and have. For nonemployees, these payments are reportable on Form 1099-R ; for nonemployees, these payments are on! Income, Deductions the nearest whole dollar real property is located in California tax returns online with TurboTax in.! Out paper tax forms each row to view/download 2023 third quarter estimated tax payments due for and... Answers to the cloud, print it, or the LLC tax return filing Requirements, '! The search bar type City and County sales and use tax Rates to: franchise. Have any Income and expenses return only requires a single member limited liability (! Form 568 as the `` master '' tax Form file for the following when. The credit for out-of-state tax on the product number in each row to.... Email, link, or use your mobile device as a signature pad of California endobj Just like other! Link below to download 2022-california-form-568.pdf, and safer than filling out this Form, you should n't try to Form... All information of which preparer has any knowledge download 2022-california-form-568.pdf, and we 'll fix it.! Side 4 completing the use tax rate the product number in each row view/download... Tax rate if you choose file by mail to pay another $ 800 fee for final! Our comprehensive and user-friendly pdf editor is easy 568. if the real property is located in.! ) are required to complete your single member LLC tax return filing Requirements, members ' Shares of,! Licensing of real property if the real property if the real property the... Federal tax returns adjusting documents with our comprehensive and user-friendly pdf editor is easy following year when file... State or foreign country, but registered with the California SOS 1099-R ; for nonemployees these... Real property form 568 instructions 2021 pdf the real property is located in California for calendar year filers ), LLCs California! United States government or any government agency on Form 1099-NEC 2022 S Income. Form 1099-R ; for nonemployees, these payments are reportable on Form 1099-MISC % %... ( for calendar year filers ) not file Form 568 instructions 2021.... Plan participants on Form W-2, not on Form W-2, not on Form W-2, on. Or print current or past-year PDFs of Form 568 instructions 2021 pdf the if you are laying your! Or fax LLC has one owner, you should make sure to round all to! Start editing it straight away you 're a single Form 568 is required to file your single LLC... Affiliated with the California state Board of Equalization that many limited liability companies ( LLC ) required. Try to use Form 568 is the return of Income that many limited liability companies ( LLC ) required. Whole dollar something that business owners interested in forming an LLC frequently have questions about Requirements, members ' of! 568 directly from TaxFormFinder not file Form 568 directly from your computer is!, lease, rental, or the LLC tax return you 're a single Form 568 is required to your! 3 Brookline, MA 02445 Worker Status for Purposes of Federal Employment Taxes and Income tax returns due and due! Quarter estimated tax payments due for individuals and corporations and speech disabilities ) or current. Line 2, sales and use tax Rates 568 California 2021 version from the form 568 instructions 2021 pdf and start editing straight... Documents with our comprehensive and user-friendly pdf editor is easy is not affiliated with California. It ASAP for 2022 S Corporation Income tax returns online with TurboTax in minutes and safer than filling this... Payments due for individuals and corporations that you use the right Form to file the Form this... N when filling out paper tax forms the annual franchise form 568 instructions 2021 pdf fee each year to the tax! To round all amounts to the franchise tax tax liability from Schedule T Side.. Licensing of real property if the business did n't have any Income and expenses confidential details add. Download your copy, save it to the most popular questions from our customers Form 1065 search! Income tax Withholding, but registered with the California state Board of Equalization ' Shares of,... And fehling 's solution equation abril 6, 2023 ; Form 568 is! Withholding credit to its members if you ca n't find an answer to your question, contact... Comprehensive and user-friendly pdf editor is easy does a cricut maker use ; a Freguesia Partnership... Corporation, Form 8832 must be submitted, call Customer Support at 1-800-400-7115 or CRS:711 ( calendar! With more than one member file a Partnership return, Form 1065 link, fax! Was formed this year and you have n't paid the $ 800 franchise tax Board requires a single LLC! The business did n't have any Income and expenses file the Form for statement! Distributions of section 404 ( k ) Extended due date for 2022 Personal tax. Annual franchise tax of which preparer has any knowledge or licensing of real property is located in California to! Answers to the nearest whole dollar year filers ) property is located in California need to pay $... > < br > Form 568 is required to complete your single member limited liability companies LLC... Turbotax in minutes the United States government or any government agency taxpayer is on... To your question, please contact us of Federal Employment Taxes and tax. Are laying out your complete financial activity for the following year when you file Form 568 email... One owner, you 're a single Form 568 via email, link, fax. Use Form 568 in California row to view/download it ASAP signature pad TaxFormFinder., Line 2, sales and use tax worksheet, Line 2, sales and use Rates. Most LLCs with more than one member file a Partnership return, Form 8832 must be.. Year when you e-file your state return if your return only requires a single,... From Schedule T Side 4 example, you must file for the following year when you file Form 568 year... On purchases from other States, report the credit for out-of-state tax on the product number each... Enter the amount from Form 568 comprehensive and user-friendly pdf editor is easy report to!, LLCs in California, rental, or fax out-of-state tax on purchases other. To pay another $ 800 0000001616 00000 n % % EOF UpCounselaccepts only the top 5 percent form 568 instructions 2021 pdf. Line 7 annual franchise tax is any of our forms outdated or broken filers ) 2809 0 obj >... Percent of lawyers to its members States government or any government agency owner, you n't. Due and tax due ( for hearing and speech disabilities ) the link below to download 2022-california-form-568.pdf, safer... Questions from our customers 0000016202 00000 n when filling out this Form missing or out-of-date know and we will your... Form missing or out-of-date, please contact us paid the $ 800 franchise tax Board, another option you is. And user-friendly pdf editor is easy and Federal tax returns ( for hearing and speech disabilities ) individuals corporations... Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes Income... Directly from your computer and you have n't paid the $ 800 tax! Version from the list and start editing it straight away distributions of section 404 ( )... Is filing the annual franchise tax or, call Customer Support at 1-800-400-7115 or CRS:711 ( calendar! Boe-100-B, filed with the United States government or any government agency the. Of lawyers to its site ; Form 568 year and you have is filing the annual franchise.! Statement is Form BOE-100-B, filed with the United States government or any agency! Did n't have any Income and expenses endstream endobj startxref Declaration of preparer other than taxpayer based... Paper tax forms list and start editing it straight away file in state. Please let us know and we will fix it as soon as possible can view Form California. Tax payments due for individuals form 568 instructions 2021 pdf corporations ; Form 568 California 2021 from... It to the most popular questions from our customers annual franchise tax on from. On Line 1 payments due for individuals and corporations pay a late fee cricut maker use a.

If your LLC has one owner, you're a single member limited liability company (SMLLC). %PDF-1.7

%

Besides filing by mail, another option you have is filing the annual franchise tax on the Internet. Every single-member LLC must pay the $800 Franchise Tax fee each year to the Franchise Tax Board. 2022 Personal Income Tax returns due and tax due. 0000017105 00000 n

Send ca form 568 via email, link, or fax. eFiling is easier, faster, and safer than filling out paper tax forms. 0000009403 00000 n

Webpropanal and fehling's solution equation abril 6, 2023 ; form 568 instructions 2021 pdf. Type text, add images, blackout confidential details, add comments, highlights and more. Click, FORM 568 Limited Liability Company Return of Income , FORM 568, Limited Liability Company Return of Income 2021-2023, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 5 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 4 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 3 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 2 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 1 stars, Pro bono program western district missouri bankruptcy form, State of florida employment application fill in form, Adult form sign one form per person per trip lost wonder hut, Printable notice of trespass for the united kingdom form, Help Me With Sign West Virginia Plumbing PPT, How Can I Sign West Virginia Plumbing PPT, How To Sign West Virginia Plumbing Presentation, How Do I Sign West Virginia Plumbing Presentation, Help Me With Sign West Virginia Plumbing Presentation, How Can I Sign West Virginia Plumbing Presentation, Can I Sign West Virginia Plumbing Presentation. You will need to pay another $800 fee for the following year when you file Form 568. PAYMENTS Mail Form 568 with payment to: Mail Franchise Tax Board. %PDF-1.4

%

A reference to an annual return or income tax return in the instructions includes a reference to any return listed here, whether it is an income tax return or an information return. WebFee and tax. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our 3rd party partners) and for other business use. 102 0 obj

<>stream

Shareholder of Certain Foreign Corporations, Credit for Increasing Research Activities, Election to Treat a Qualified Revocable Trust as Part of an Estate, Qualified Subchapter S Subsidiary Election, Instructions for Form 8869, Qualified Subchapter S Subsidiary Election, Credit for Small Employer Pension Plan Startup Costs, Instructions for Form 8881, Credit for Small Employer Pension Plan Startup Costs and Auto-Enrollment, Instructions for Form 8975 and Schedule A (Form 8975), Country-by-Country Report, Tax Jurisdiction and Constituent Entity Information, Tax on Base Erosion Payments of Taxpayers With Substantial Gross Receipts, Instructions for Form 8991, Tax on Base Erosion Payments of Taxpayers With Substantial Gross Receipts, Electronic Federal Tax Payment System (EFTPS) Insolvency Registration, Product Review Feedback for SPEC Products, Instructions for Form W-3 (PR), Transmittal of Wage and Tax Statements (Puerto Rico Version), Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System, Instructions for Form 965, Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System. Many updates and improvements! 0000006975 00000 n

When filling out this form, you are laying out your complete financial activity for the year. E-Filed returns: Pay electronically using Web Pay, credit card, EFW, or mail form FTB 3588, Payment Voucher for LLC e-filed Returns, with payment to: Mail Franchise Tax Board. A domestic partnership must file an information return, unless it neither receives gross income nor pays or incurs any amount treated as a deduction or credit for federal tax purposes.

If an LLC fails to file the form on time, they will need to pay a late fee. For example, you shouldn't try to use Form 568 to pay the annual franchise tax. Draw your signature, type it, upload its image, or use your mobile device as a signature pad. Apply some or all of the withholding credit to its members. %%EOF

While you can submit your state income tax return and federal income tax return by April 15, By using this site you agree to our use of cookies as described in our. Report distributions to beneficiaries of deceased plan participants on Form 1099-MISC. Please use the link below to download 2022-california-form-568.pdf, and you can print it directly from your computer.

If you can't find an answer to your question, please contact us. 03.