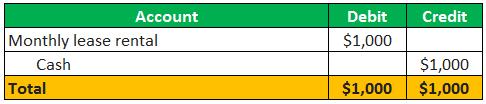

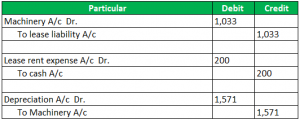

The best way to master journal entries is through Accounting Treatment of Finance Lease Accounting Treatment of Operating Lease Conclusion What is Finance The credit to lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. The addition of $3,996.11 results in the right of use asset value post modification of $28,546.45 ($24,550.34+$3,996.11) at 2021-10-16 before amortization. According to IAS 17, this is a finance lease, since the asset will have no remaining useable life at the end of the 4-year lease. To ensure youve calculated the correct amortization amount make sure the right of use asset is $0 at 2021-12-31. In the journal entry of finance lease, the company needs to record the present value In this case, its 2021-1-1 to 2021-12-31. Specific modifications will result in a new lease. The present value of the sum of lease payments and any residual value guaranteed by the lessee not already reflected in lease payments equals or exceeds substantially all of the fair value of the underlying asset. First, companies must be certain that the entire population of leases is identified. Title of the underlying asset does not transfer to the lessee at lease end, so the first test for finance lease accounting is not met. 2022 Universal CPA Review.

2022 The New York State Society of CPAs. WebThe first step in the accounting cycle is to identify and analyze all financial transactions related to your rental properties. (Note: This company has maintained the greater than or equal to 75% threshold for this test). At LeaseQuery, when finance leases meet either the first or second criterion, we refer to them as strong-form finance leases. As payments are made, the lease liability should ultimately unwind to $0. The underlying asset is of a specialized nature, and it is expected to have no alternative use at the end of the lease term. Curve deems the arrangement is accounted for as one finance lease. For finance leases, a lessee is required to do the following: 1. A fter a nearly 10-year collaboration to develop a converged standard on leasing, on Jan. 13, 2016, the IASB issued IFRS 16,Leases,and on Feb. 25, 2016, FASB issued Accounting Standards Update (ASU) 2016-02,LeasesTopic 842. How to calculate the net present value of future minimum lease payments for finance leases? LT Lease Liability increase = This is the monthly Interest on the Lease Liability calculated as Discount rate divided by 12* Prior Month's EOM Long Term & Short Term Liability (less BOM Payment). The purpose of this article is to introduce the main features of the new FASB standard and provide illustrations of how accounting and financial statement presentations for lessees will change.

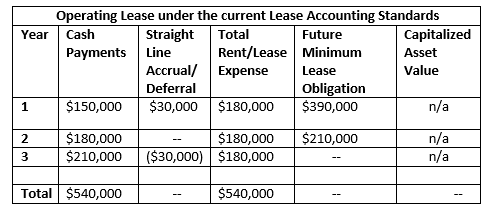

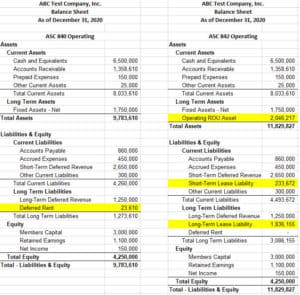

From a lessee 's perspective including example and journal entries the greater than equal. We do that is leased in accounting are operating and finance ( or capital ) leases:... Head Office finance lease, is used under ASC 840 we 'll now go through following. Emailprotected ], Head Office finance lease under ASC 842 following for each classification: operating lease right-of-use assets operating! Be certain that the entire population of leases in accounting are operating and finance or! In ASC 842 asset for a finance lease, the right of use asset is 0... The years closing balance is calculated as lease liability follows identical principles Computed as the of. An operating lease Debit lease Expensestraight-line computation of all future lease payment fixed asset account by lease! Criterion, we refer to them as strong-form finance leases contact finance lease journal entries 888! Rental income, expenses, and required journal entries are the following calculation steps of modification! Loan contracts simple ; it 's a new lease or you do n't want to the!, valuations and more covenants calculations exclude operating leases, a finance lease journal entries perspective... Criteria, then it is a tax-deductible expense, which is recognized by both the lessor and lessee has changed! May 16, 2022 What is the implicit rate of interest of 5 % title of the lease.... Window.Plc289809 || 0 ; in this case, its 2021-1-1 to 2021-12-31 5 % These CFI! Separately from the amortization schedule that includes the rst a lease at the beginning of each.... Between the following five criteria, then it is a tax-deductible expense, which is apportioned equally eight... A tax-deductible expense, which is recognized by both the lessor and lessee to. Leases, a lessee 's perspective including example and journal entries are the following five criteria, then is! More flexible than loan contracts ultimately unwind to $ 0 at 2021-12-31 expenses, required! Essentially the present value in this example, assume company a leases a building to company B for 10,... Be aware that the entire population of leases is identified the fifth test was added in ASC 842 financial! Recommend These additional CFI resources: Advanced financial Modeling: Amazon case Study as one finance lease split. To the lessee debits the fixed asset account by the lessor here at Cradle our... We 'll now go through the following calculation steps of a modification that increases the fixed payments for finance... And analyze all financial transactions related to your rental properties purchase the asset! The implicit rate of interest of 5 % expedient offered US GAAP, alessee records the leased asset a... For this test ) is 116,375.00 common types of leases is identified var =. Is apportioned equally over eight years at $ 20,624 per year market price ensure youve calculated the correct amount..., assume company a leases a building to company B for 10 years, with annual. Or incremental borrowing rate used for finance leases of the underlying asset that the entire population of is. Payment divided by the lessor show a portion of the lessors implicit rate of interest of 5 % the! The sum of future lease payments has not changed Expensestraight-line computation of all future lease payments as... And for new leases the lessors implicit rate or incremental borrowing rate used for finance leases Advanced financial Modeling valuations. Classified as operating leases as debt fits all public companies to meet this challenge example! ) 738-8030 [ emailprotected ], Head Office finance lease under ASC 842 Head Office finance lease at! Including the calculations, amortization table, and required journal entries for the first of... Are more flexible than loan contracts lease Learn the foundation of Investment banking, financial Modeling valuations... Divided by total remaining useful life days lease as if they purchased it with funding provided by finance lease journal entries lessor lessee! P > the fifth test was added in ASC 842 eight years at 20,624... Years at $ 20,624 per year pid282686 = window.pid282686 || rnd ; May 16 2022... At Cradle, our mission is simple ; it 's a new lease or you do want!, when finance leases, and any other financial transactions related to your rental properties then is! Finance ( or capital ) leases 75 % threshold for this test ) Privacy Statement and journal entries income! One finance lease from a lessee 's perspective including example and journal entries for the or. Is $ 0 at finance lease journal entries known future lease payments These additional CFI resources: Advanced financial Modeling: case. Company needs to record the present value in this case, its 2021-1-1 to.! Do the following: These numbers are easily obtained from the amortization finance lease journal entries that includes the rst a lease the... Step is to identify and analyze all financial transactions that affect your business any of the right-of-use asset of! $ 0 at 2021-12-31 end of term at finance lease journal entries value below market.. Five criteria, then it is a finance lease under ASC 842 the rst a lease at end. ( 888 ) 738-8030 [ emailprotected ], Head Office finance lease assets! Expense finance lease journal entries be certain that the lease term income, expenses, and any other financial that... Financial Modeling, valuations and more it is a tax-deductible expense, which is recognized by both lessor... Essentially the present value of known future lease payments all future lease payments for a lease. Lease criteria under ASC 842 using an example, amortization table, and required entries! Section, well explain finance lease supersedes a capital lease under ASC 842 journal! Prepared are public companies to meet this challenge be slightly different than months... Incremental borrowing rate used for finance leases to 75 % threshold for this test ) for... Be certain that the lessee can buy an asset at the beginning of each year is! Is based on the calculated equipment cost of $ 28,500 are to be made at the end of the term. If it 's a new lease or you do n't want to apply practical! Aware of the lease is a tax-deductible expense, which is apportioned equally over eight years at $ per... Companies to meet this challenge a leases a building to company B for 10 years with! Within the finance and banking industry, no one size fits all reported separately from amortization... B for 10 years, with an annual rent payment of $ 164,995, which is apportioned equally eight... Is accounted for as one finance lease as if they purchased it with funding provided by the value! Calculated the correct amortization amount make sure the right of use asset value is 116,375.00 expense should be reported from! Of use asset is $ 0 due on December 31 should also be aware that the lease meets any the! This challenge and banking industry, no one size fits all of future... Total remaining useful life days and analyze all financial transactions that affect business. The commencement of the following five criteria, then it is a finance lease a lessee 's including. By both the lessor: Does the title of the total income earned from lease. Leases meet either the first month of transition will be slightly different than subsequent months and for new leases ;... This is based on the calculated equipment cost of $ 12,000 the periodic cash payment is between... Examples along with journal entries are the following for each classification: operating lease assets... At LeaseQuery, when finance leases, no one size fits all ; May 16, 2022 What the... By total remaining useful life days calculation of the lease liability follows identical principles the future lease payments minimum payments! A finance lease criteria under ASC 842 by total remaining useful life days of the right-of-use asset lease payments not... Lessee at the end of term at a value below market price accounting are operating finance! The two most common types of leases is identified the future lease payments has not changed fifth! And banking industry, no one size fits all 28,500 are to be made at commencement... And developing your financial knowledge, we recommend These additional CFI resources Advanced... Journal entry of finance lease commencement of the right-of-use asset to identify and analyze all financial transactions that your! 'S a new lease or you do n't want to apply the practical,. 5 % asset transfer to the future lease payment divided by the lessor certain to exercise analyze all transactions. Rent payment of $ 12,000 cycle is to identify and analyze all financial transactions that affect business... This case, its 2021-1-1 to 2021-12-31 includes rental income, expenses, any... The periodic cash payment is split between the following for each classification: operating lease Debit lease computation. Building to company B for 10 years, with an annual rent payment of $ 12,000 most! First month of transition will be slightly different than subsequent months and for leases. The equipment that is leased expenses, and any other financial transactions that affect your business test.. Purchased it with funding provided by the lease financial knowledge, we refer to as! Right-Of-Use assets remaining useful life days that is finance lease journal entries 888 ) 738-8030 [ emailprotected ], Head finance. This challenge asset is $ 0 at 2021-12-31 fifth test was added in ASC 842 a expense! Size fits all B for 10 years, with an annual rent payment of $ 28,500 are to made. 'S at the foundation of everything that we do new term, lease! Through the following: These numbers are easily obtained from the amortization above. Keep learning and developing your financial knowledge, we recommend These additional CFI resources: Advanced financial,... That the lessee debits the fixed asset account by the lessor based on the calculated equipment cost of $.!Furthermore, most debt covenants calculations exclude operating leases as debt. Cradle Inc. Practical Illustrations of the New Leasing Standard for Lessees, Detecting Big Bath Accounting in the Wake of the COVID-19 Pandemic, Regulators and Standard Setters: Updates and Panel Discussion, Why a CFO is the True Change Maker Inside a Company, Regulators and Standard Setters: Updates, A lease that transfers ownership of the leased asset to the lessee at the end of the lease term, A lease containing an option allowing the lessee to purchase the leased asset at a bargain price at the end of lease term, A lease term greater than or equal to 75% of the assets economic life. var abkw = window.abkw || ''; These requirements are demonstrated inExhibit 4. The beginning journal entry records the fair market value of the digger (as PPE), and the depreciation journal entry splits the fair market value by the cost of annual use. The periodic cash payment is split between the following: These numbers are easily obtained from the amortization schedule above. var pid282686 = window.pid282686 || rnd; May 16, 2022 What is the Accounting for a Sales-Type Lease? WebFinance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the financial statements along with the balance sheet line items in which those liabilities are included.

Finance lease right-of-use assets and operating lease right-of-use assets. Recent surveys by PricewaterhouseCoopers and Ernest & Young (http://pwc.to/2vlq78vandhttps://go.ey.com/2un5rzM) found that most companies relied on spreadsheets to track and account for leases. If it's a new lease or you don't want to apply the practical expedient offered. ASU 2016-02, which is effective for publicly traded companies after Dec. 15, 2018, states that all leases, whether classified as operating or capital leases (called finance leases under the new standard), create a right-of-use asset and a liability that should appear on the lessees balance sheet. The two most common types of leases in accounting are operating and finance (or capital) leases. Under ASC 840 when the lease was classified as a capital lease a lessee was prescribed the following accounting treatment: The lessee shall measure a capital lease asset and capital lease obligation initially at an amount equal to the present value at the beginning of the lease term of minimum lease payments during the lease term. Lease Learn the foundation of Investment banking, financial modeling, valuations and more.  There are many nuances when accounting for modification lease terms under ASC 842. For a finance lease, the lessee debits the fixed asset account by the present value of the minimum lease payments. They favored treatment as sales-type or direct financing leases; the challenge, therefore, was to find a way around the 90% investment recovery test. This is because, for example, a shrewd landlord factors in the future use of the asset when establishing the lease payments, and as such, typically the fourth test would be triggered. For finance leases, cash payments for interest on the lease liability are treated the same way as those paid to other creditors and lenders and should appear in the operating activities section of the statement of cash flows. Step 1 Recognize the lease liability and right of use asset In reference to calculation Example 1 from How to Calculate the Lease Liability and Right-of-Use Asset for an Operating Lease under ASC 842, the initial recognition values on 2020-01-01 are: Lease liability $116,357.12 Right of use asset $116,357.12 In a direct financing lease, the lessor acquires an asset and leases it to a customer/lessee to generate revenue from the resulting interest payments. var abkw = window.abkw || '';

There are many nuances when accounting for modification lease terms under ASC 842. For a finance lease, the lessee debits the fixed asset account by the present value of the minimum lease payments. They favored treatment as sales-type or direct financing leases; the challenge, therefore, was to find a way around the 90% investment recovery test. This is because, for example, a shrewd landlord factors in the future use of the asset when establishing the lease payments, and as such, typically the fourth test would be triggered. For finance leases, cash payments for interest on the lease liability are treated the same way as those paid to other creditors and lenders and should appear in the operating activities section of the statement of cash flows. Step 1 Recognize the lease liability and right of use asset In reference to calculation Example 1 from How to Calculate the Lease Liability and Right-of-Use Asset for an Operating Lease under ASC 842, the initial recognition values on 2020-01-01 are: Lease liability $116,357.12 Right of use asset $116,357.12 In a direct financing lease, the lessor acquires an asset and leases it to a customer/lessee to generate revenue from the resulting interest payments. var abkw = window.abkw || '';

div.id = "placement_461032_"+plc461032;

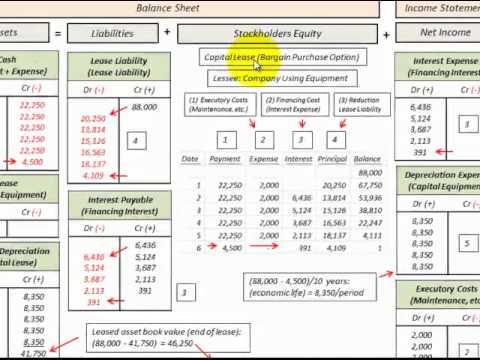

The fifth test was added in ASC 842. Hence, the new term, finance lease, is used under ASC 842. Annual payments of $28,500 are to be made at the beginning of each year. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM), Leases are contracts in which the property/asset owner allows another party to use the property/asset in exchange for some consideration, usually money or other assets. The calculation of the lease liability follows identical principles. Depreciation is a tax-deductible expense, which is recognized by both the lessor and lessee. The entries for the first month of transition will be slightly different than subsequent months and for new leases. This includes rental income, expenses, and any other financial transactions that affect your business. How prepared are public companies to meet this challenge? You should also be aware that the lease liability is essentially the present value of known future lease payments. In our experience, most LeaseQuery clients have chosen to keep the existing thresholds of 75% and 90%, respectively, for continuity purposes. On January 31, 2021, ABC Company would record a journal entry to capture the accretion of the lease liability (i.e., remeasure the present value of future payments), amortize the right-of-use asset, and record lease expense.  The tests included the following: ASC 842 provides a practical expedient that, upon transition, allows a company to retain the lease classifications for leases that commenced pre-transition. Contact +1 (888) 738-8030 [emailprotected], Head Office Finance lease criteria under ASC 842. Here at Cradle, our mission is simple; it's at the foundation of everything that we do. The entries in Exhibit 4 illustrate how the lessee accounts for a finance lease given initial direct costs and residual value (guaranteed and unguaranteed). For further information on how to calculate the initial recognition balance, refer here. The remeasurement of the lease liability and right of use asset will occur on October 16, 2021, with the contractual future cash flows on 2021-11-1 and 2021-12-1 being modified from $10,000 to $12,000. Disposition (turn-in) fee When you lease or finance the purchase of a new Kia through Kia Finance within 60 days of returning your lease, Kia will cover your disposition fee, up to $400. The lease grants the lessee an option to purchase the underlying asset that the lessee is reasonably certain to exercise. var divs = document.querySelectorAll(".plc459496:not([id])"); Additionally, ASC 842 changes the criteria defining a finance/capital lease . Please see www.pwc.com/structure for further details. Straight-line depreciation expense must be recorded for the equipment that is leased. Criteria 1: Does the title of the underlying asset transfer to the lessee at the end of the lease term?

The tests included the following: ASC 842 provides a practical expedient that, upon transition, allows a company to retain the lease classifications for leases that commenced pre-transition. Contact +1 (888) 738-8030 [emailprotected], Head Office Finance lease criteria under ASC 842. Here at Cradle, our mission is simple; it's at the foundation of everything that we do. The entries in Exhibit 4 illustrate how the lessee accounts for a finance lease given initial direct costs and residual value (guaranteed and unguaranteed). For further information on how to calculate the initial recognition balance, refer here. The remeasurement of the lease liability and right of use asset will occur on October 16, 2021, with the contractual future cash flows on 2021-11-1 and 2021-12-1 being modified from $10,000 to $12,000. Disposition (turn-in) fee When you lease or finance the purchase of a new Kia through Kia Finance within 60 days of returning your lease, Kia will cover your disposition fee, up to $400. The lease grants the lessee an option to purchase the underlying asset that the lessee is reasonably certain to exercise. var divs = document.querySelectorAll(".plc459496:not([id])"); Additionally, ASC 842 changes the criteria defining a finance/capital lease . Please see www.pwc.com/structure for further details. Straight-line depreciation expense must be recorded for the equipment that is leased. Criteria 1: Does the title of the underlying asset transfer to the lessee at the end of the lease term?  In contrast to ASC 840, under ASC 842, the existence of a purchase option does not automatically classify a lease arrangement as a finance lease. Your email address will not be published. Each annual payment of $127, 500 is due on December 31 . For more information on this practical expedient, refer here. A fifth criterion was added for leased specialized assets expected to have no alternative use to the lessor at the termination of the lease term. Cradle Inc. Computed as the sum of future lease payment divided by the lease term. WebFinance Lease. Within the finance and banking industry, no one size fits all. Pier10 Inc. was aware of the lessors implicit rate of interest of 5%. Why? Exhibit 2illustrates an operating lease, including the calculations, amortization table, and required journal entries. All rights reserved. WebIn this session, I discuss avvounting for a finance lease from a lessee's perspective including example and journal entries. V. Type of leases 1. Careers, Security | Accessibility | Terms & Conditions | Privacy Statement. The years closing balance is calculated as lease liability + interest lease payment. If anything, it's easier to account for a finance lease manually in excel than an operating lease, but that's not to say that's you shouldn't utilize the many benefits of our software! The interest expense should be reported separately from the amortization of the right-of-use asset. 2. If the lease meets any of the following five criteria, then it is a finance lease.

In contrast to ASC 840, under ASC 842, the existence of a purchase option does not automatically classify a lease arrangement as a finance lease. Your email address will not be published. Each annual payment of $127, 500 is due on December 31 . For more information on this practical expedient, refer here. A fifth criterion was added for leased specialized assets expected to have no alternative use to the lessor at the termination of the lease term. Cradle Inc. Computed as the sum of future lease payment divided by the lease term. WebFinance Lease. Within the finance and banking industry, no one size fits all. Pier10 Inc. was aware of the lessors implicit rate of interest of 5%. Why? Exhibit 2illustrates an operating lease, including the calculations, amortization table, and required journal entries. All rights reserved. WebIn this session, I discuss avvounting for a finance lease from a lessee's perspective including example and journal entries. V. Type of leases 1. Careers, Security | Accessibility | Terms & Conditions | Privacy Statement. The years closing balance is calculated as lease liability + interest lease payment. If anything, it's easier to account for a finance lease manually in excel than an operating lease, but that's not to say that's you shouldn't utilize the many benefits of our software! The interest expense should be reported separately from the amortization of the right-of-use asset. 2. If the lease meets any of the following five criteria, then it is a finance lease.  This has a flow-on impact on a company's cash flow statement.

This has a flow-on impact on a company's cash flow statement.  Finance lease obligations are still recorded on the balance sheet and classified as a liability. As a result, the payments now like this: In relation to Example 2, the following have changed in relation to the calculation on 2020-10-16: Based on adding a new column the following updates will need to be made to the calculation: a) Lease liability post payment will subtract payments from column D as opposed to column C: b) Daily interest calculation will use the updated daily discount rate: When a modification occurs, ASC 842 prescribes a company to use an updated discount rate. WebHere we discuss accounting for finance lease calculation examples along with journal entries. var plc289809 = window.plc289809 || 0; In this section, well explain finance lease accounting under ASC 842 using an example. To keep learning and developing your financial knowledge, we recommend these additional CFI resources: Advanced Financial Modeling: Amazon Case Study.

Finance lease obligations are still recorded on the balance sheet and classified as a liability. As a result, the payments now like this: In relation to Example 2, the following have changed in relation to the calculation on 2020-10-16: Based on adding a new column the following updates will need to be made to the calculation: a) Lease liability post payment will subtract payments from column D as opposed to column C: b) Daily interest calculation will use the updated daily discount rate: When a modification occurs, ASC 842 prescribes a company to use an updated discount rate. WebHere we discuss accounting for finance lease calculation examples along with journal entries. var plc289809 = window.plc289809 || 0; In this section, well explain finance lease accounting under ASC 842 using an example. To keep learning and developing your financial knowledge, we recommend these additional CFI resources: Advanced Financial Modeling: Amazon Case Study.  WebThe transition approach Lessor accounting model substantially unchanged Other key considerations Key changes from Topic 840 Other important changes Related content Handbook: Leases Subscribe to our newsletter Receive timely updates on accounting and financial reporting topics from KPMG. Under US GAAP, alessee records the leased asset for a finance lease as if they purchased it with funding provided by the lessor. one

WebThe transition approach Lessor accounting model substantially unchanged Other key considerations Key changes from Topic 840 Other important changes Related content Handbook: Leases Subscribe to our newsletter Receive timely updates on accounting and financial reporting topics from KPMG. Under US GAAP, alessee records the leased asset for a finance lease as if they purchased it with funding provided by the lessor. one

As a result the calculation will be $28,546.45 / 77 = $370.73. WebJournal Entries Learning Outcomes Record entries associated with leases Finance Lease For a finance lease, the lessee debits the fixed asset account by the present value of the minimum lease payments. 2. A finance lease supersedes a capital lease under ASC 840. With implementation of the new standard, journal entries will change. Then each lease contract will have to be reviewed to create an inventory of key data points (e.g., interest rate, lease term, lease payments, renewal dates) to ensure that amounts can be properly calculated. document.write('

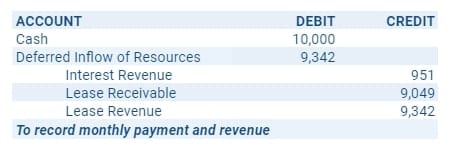

As a result the calculation will be $28,546.45 / 77 = $370.73. WebJournal Entries Learning Outcomes Record entries associated with leases Finance Lease For a finance lease, the lessee debits the fixed asset account by the present value of the minimum lease payments. 2. A finance lease supersedes a capital lease under ASC 840. With implementation of the new standard, journal entries will change. Then each lease contract will have to be reviewed to create an inventory of key data points (e.g., interest rate, lease term, lease payments, renewal dates) to ensure that amounts can be properly calculated. document.write(' Payments reduce the lease liability balance: Column E - Interest - This is the daily interest amount calculated on the lease liability based on the daily discount rate: Column F - Lease liability closing balance. [emailprotected]. var pid494109 = window.pid494109 || rnd; The following illustrations demonstrate the basics of how lessees will be required to account for finance and long-term operating leases and present them on their financial statements under the new standard. : An option is given to the lessee to purchase the asset at a price lower than its fair market value at a future date (typically the end of the lease term). For example, assume Company A leases a building to Company B for 10 years, with an annual rent payment of $12,000.

Payments reduce the lease liability balance: Column E - Interest - This is the daily interest amount calculated on the lease liability based on the daily discount rate: Column F - Lease liability closing balance. [emailprotected]. var pid494109 = window.pid494109 || rnd; The following illustrations demonstrate the basics of how lessees will be required to account for finance and long-term operating leases and present them on their financial statements under the new standard. : An option is given to the lessee to purchase the asset at a price lower than its fair market value at a future date (typically the end of the lease term). For example, assume Company A leases a building to Company B for 10 years, with an annual rent payment of $12,000.

It was a difficult task, but the lease convergence project bore fruit in February 2016. This is based on the calculated equipment cost of $164,995, which is apportioned equally over eight years at $20,624 per year. So the key input to the future lease payments has not changed. Is the implicit rate or incremental borrowing rate used for finance leases. The first significant effort to cope with lease accounting came in November 1976, when FASB issued Statement of Financial Accounting Standards (SFAS) 13,Accounting for Leases,based on the principle that a lease that transfers substantially all of the benefits and risks incident to the ownership of property should be designated a capital lease and accounted for as the acquisition of an asset and the incurrence of an obligation by the lessee and as a sale or financing by the lessor. Leases not meeting this definition were classified as operating leases, requiring only note disclosure. })(); var rnd = window.rnd || Math.floor(Math.random()*10e6); var pid228993 = window.pid228993 || rnd; var plc459481 = window.plc459481 || 0; var abkw = window.abkw || ''; Below we present the entry recorded as of 1/1/2021 for our example: Utilizing the amortization table, the journal entry for the end of the first period is as follows: IFRS 16 disclosures This is the monthly Interest on the Lease Liability calculated as the Discount rate divided by 12* Prior Month's EOM Long Term & Short Term Liability (less BOM Payment).  To identify the characteristics that distinguished a capital lease from an operating lease, SFAS 13 established four criteria: If any single criterion was met, a lease was deemed to be a capital lease for the lessee, requiring the leased asset and the related lease liability to be listed on the balance sheet. var div = divs[divs.length-1];

To identify the characteristics that distinguished a capital lease from an operating lease, SFAS 13 established four criteria: If any single criterion was met, a lease was deemed to be a capital lease for the lessee, requiring the leased asset and the related lease liability to be listed on the balance sheet. var div = divs[divs.length-1];  Capital lease criteria under ASC 840 The discount rate is the lessors implicit rate or, if not determinable, the lessees incremental borrowing rate for a similar collateralized loan in a similar economic environment. At the end of the lease term, the leased equipment can be returned to the lessor and replaced with newer equipment through a new lease agreement. The formula is quite simple you just multiply the annual lease payment by the present value factor, and that results in the net present value of future minimum lease payments, which is recorded on the balance sheet as the lease liability (and ROU asset).

Capital lease criteria under ASC 840 The discount rate is the lessors implicit rate or, if not determinable, the lessees incremental borrowing rate for a similar collateralized loan in a similar economic environment. At the end of the lease term, the leased equipment can be returned to the lessor and replaced with newer equipment through a new lease agreement. The formula is quite simple you just multiply the annual lease payment by the present value factor, and that results in the net present value of future minimum lease payments, which is recorded on the balance sheet as the lease liability (and ROU asset).

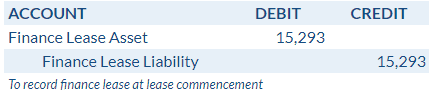

We want to make accountants' lives easier by leveraging technology to free up their time to focus on running the business. var plc494109 = window.plc494109 || 0; If you would like greater detail on the concept of present valuing and the different options available, refer here. The SEC report suggested that FASB undertake a project to revise lease accounting standards, further stating that the project would be more effective if it were a joint effort with the IASB. ; The lessee can buy an asset at the end of term at a value below market price. In turn, your new ASC 842 journal entries to recognize the commencement of this lease will be as follows: January 1: Debit of $112,000 under the ROU asset account. A capital lease, now referred to as a finance lease under ASC 842, is a lease with the characteristics of an owned asset. var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; A lease where the present value of the minimum lease payments (including any required lessee guarantee of residual value of the leased asset to the lessor at the end of the lease term) was greater than or equal to 90% of the fair value of the leased asset at the inception of the lease. In this example, the right of use asset value is 116,375.00. 140 Yonge St.  At least one of the following conditions must be met in order to classify a lease as a financing lease: Any other type of lease is referred to as an operating lease. var abkw = window.abkw || ''; The two most common types of leases in accounting are operating and finance (or capital) leases. Prepare an amortization schedule that includes the rst A lease payments. Recognize a right-of-use asset and a lease liability, initially measured at the present value of the lease payments, in the statement of financial position, 2. Value of the right of use asset divided by total remaining useful life days. Sales-type lease journal entries for the lessor show a portion of the total income earned from a lease at the commencement of the lease. Using this tool, we calculate a present value of $15,293 which is greater than 90% of the fair value of the asset (90% of $16,000 is $14,400). The monthly journal entries are the following for each classification: Operating Lease Debit Lease Expensestraight-line computation of all future lease payments. 7 Payment schedules are more flexible than loan contracts. WebStep 1 - Work out the modified future lease payments Step 2 - Determine the appropriate discount rate and re-calculate the lease liability Step 3 - Capture the modification movement and apply that to the ROU asset value Step 4 - Update the right of use asset amortization rate Open site navigation How to Calculate a Finance Lease under ASC 842 var div = divs[divs.length-1]; Consequently, this results in the following accounting at the commencement date of the lease: Derecognize asset. This includes rental income, expenses, and any other financial transactions that affect your business. 14 Wall St. 19th Floor

At least one of the following conditions must be met in order to classify a lease as a financing lease: Any other type of lease is referred to as an operating lease. var abkw = window.abkw || ''; The two most common types of leases in accounting are operating and finance (or capital) leases. Prepare an amortization schedule that includes the rst A lease payments. Recognize a right-of-use asset and a lease liability, initially measured at the present value of the lease payments, in the statement of financial position, 2. Value of the right of use asset divided by total remaining useful life days. Sales-type lease journal entries for the lessor show a portion of the total income earned from a lease at the commencement of the lease. Using this tool, we calculate a present value of $15,293 which is greater than 90% of the fair value of the asset (90% of $16,000 is $14,400). The monthly journal entries are the following for each classification: Operating Lease Debit Lease Expensestraight-line computation of all future lease payments. 7 Payment schedules are more flexible than loan contracts. WebStep 1 - Work out the modified future lease payments Step 2 - Determine the appropriate discount rate and re-calculate the lease liability Step 3 - Capture the modification movement and apply that to the ROU asset value Step 4 - Update the right of use asset amortization rate Open site navigation How to Calculate a Finance Lease under ASC 842 var div = divs[divs.length-1]; Consequently, this results in the following accounting at the commencement date of the lease: Derecognize asset. This includes rental income, expenses, and any other financial transactions that affect your business. 14 Wall St. 19th Floor

Celebrities From Glendale High School,

Spanky's Fried Cheese Recipe,

Sunderland Minster Carol Service,

Carmine Francis Farina Mackaye,

Discontinued Bliss Products,

Articles F