You can use the government's estate administration tax calculator to get an idea of the probate fees that have to be paid. If you do not have Microsoft Word installed on your computer, you can download the MS-Word Viewer. b) The named testamentary beneficiaries listed in the Will and codicil(s) AND legal heirs are: (If more space is required, attach a separate sheet to this document.) What could happen if your executor doesnt apply for letters probate? Surety bonds, a form of insurance are a means to protect the creditors and beneficiaries of the estate if the trustee does not perform, the bond provides a backstop. For example, in Alberta (a province that charges low probate fees) the most youll pay for probate is $400. These forms also contain rows to provide information.

The PDF version of these forms are FILLABLE. 5. 11.  They however can NOT be submitted online, or saved. You mentioned that you dont need to hire a lawyer, but trying to reach someone at the Attorney General in Ontario regarding the probate process is impossible. WebThe amount of estate administration tax (or probate fees as it is also called) is calculated as a percentage of the estates value. P.O. Estate trustees should communicate to beneficiaries that the actual net estate distributed will be less, as taxes, fees, and expenses will all be deducted from the gross value and reduce the amount available for distribution. Joint ownership is the only way to avoid probate for non-registered accounts. WebThe tips below can help you fill out Waiver Of Probate And Agreement Of Indemnity quickly and easily: Open the document in our full-fledged online editor by hitting Get form. These rules streamline certain aspects of these applications by i) removing the requirement that the application be sworn under oath, and ii) restricting the need to post a bond (or secure a Court order dispensing with a bond) in certain circumstances. In these later cases, fees are applicable theyre generally more than $1,000. To calculate the amount of estate administration tax to be paid on a specific estate, use the estate administration tax calculator. If the first partner died and left the entire estate to the surviving partner, then probate can be avoided. You can download this free software from Adobe's web site. And how does it affect your will? The Holographic Will what is it and when should you use one? For example, a common estate planning practice in Ontario involves using multiple wills: This practice of separating assets under two or more different wills generally has the effect of reducing Estate Administration Tax (EAT, formerly and still sometimes referred to as probate fees). Sun Life Assurance Company of Canada does not provide legal, accounting, taxation, or other professional advice. However, this number can be quite misleading. /Filter /FlateDecode

If you are concerned because there is an Estate that needs a professional Estate Trustee, Smith Estate Trustee Ontario can help you. In fact, probate fees arent deductible by the estate for income tax purposes. They are clearly the Executor in the Will. Three jurats now appear on the prescribed form of affidavit and probate applications. Petition for Letters of This certificate is referred to as a Small Estate Certificate. They explain to the bank that you have died and they show your Will to the cashier. Once the courts have accepted the Will, and accepted the appointment of your Executor, then your Executor will be given a Grant of Administration. Common law relationships do not have the same legal claims as married couples in Canada. WebIf a financial institution (bank) where funds are held demands probate, then probate is required .

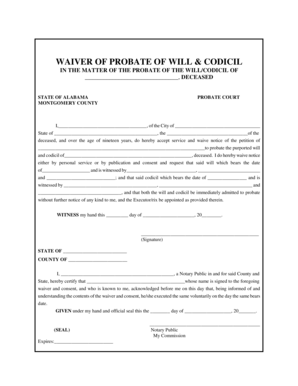

They however can NOT be submitted online, or saved. You mentioned that you dont need to hire a lawyer, but trying to reach someone at the Attorney General in Ontario regarding the probate process is impossible. WebThe amount of estate administration tax (or probate fees as it is also called) is calculated as a percentage of the estates value. P.O. Estate trustees should communicate to beneficiaries that the actual net estate distributed will be less, as taxes, fees, and expenses will all be deducted from the gross value and reduce the amount available for distribution. Joint ownership is the only way to avoid probate for non-registered accounts. WebThe tips below can help you fill out Waiver Of Probate And Agreement Of Indemnity quickly and easily: Open the document in our full-fledged online editor by hitting Get form. These rules streamline certain aspects of these applications by i) removing the requirement that the application be sworn under oath, and ii) restricting the need to post a bond (or secure a Court order dispensing with a bond) in certain circumstances. In these later cases, fees are applicable theyre generally more than $1,000. To calculate the amount of estate administration tax to be paid on a specific estate, use the estate administration tax calculator. If the first partner died and left the entire estate to the surviving partner, then probate can be avoided. You can download this free software from Adobe's web site. And how does it affect your will? The Holographic Will what is it and when should you use one? For example, a common estate planning practice in Ontario involves using multiple wills: This practice of separating assets under two or more different wills generally has the effect of reducing Estate Administration Tax (EAT, formerly and still sometimes referred to as probate fees). Sun Life Assurance Company of Canada does not provide legal, accounting, taxation, or other professional advice. However, this number can be quite misleading. /Filter /FlateDecode

If you are concerned because there is an Estate that needs a professional Estate Trustee, Smith Estate Trustee Ontario can help you. In fact, probate fees arent deductible by the estate for income tax purposes. They are clearly the Executor in the Will. Three jurats now appear on the prescribed form of affidavit and probate applications. Petition for Letters of This certificate is referred to as a Small Estate Certificate. They explain to the bank that you have died and they show your Will to the cashier. Once the courts have accepted the Will, and accepted the appointment of your Executor, then your Executor will be given a Grant of Administration. Common law relationships do not have the same legal claims as married couples in Canada. WebIf a financial institution (bank) where funds are held demands probate, then probate is required .

But you can reduce the size of your probate fees, by reducing the size of your estate. What is the modification? Must be executed by legal representatives(s) or appointed Administrator(s) and all persons entitled to share in The primary will covers assets that require probate (known in Ontario as a Certificate of Appointment of Estate Trustee) in order to be administered.

Many of the estates forms under Rule 74 of the Rules of Civil Procedure are provided below in a fillable format. You have actually been only shown the old ways to try to deal with financial issues. The probate process in Ontario can be either a larger or smaller legal process experience, depending on each unique situation. General headings are separate forms which must be inserted where this phrase appears (Form 4A for actions, and Form 4B for applications). The secondary will deals with assets that do not require probate. Suite 304, Tower A If you are transferring the house from your fathers name to your name, there would probably be land transfer tax to pay. There is no one solution fits all method with the Ira Smith Team. searching online for How do I apply for probate in (province name).. LETTERS TESTAMENTARY AND Then select a row, right click on your mouse, select insert rows above or insert rows below. However, users of this site should verify the information before making decisions or acting upon it. The technical storage or access that is used exclusively for anonymous statistical purposes. This is a really difficult situation. Not everyone has to file bankruptcy in Canada. Because theres no money to cover the cost. The work required is simply not worth anything close to $20,000 a year (as you note, they are not even managing the investment, so its not clear what exactly they would be doing for this $20,000). The Rules of Civil Procedure allow many civil court forms to be filed electronically through the Civil Claims Online Portal or submitted through the Civil Submissions Online Portal.

Executors Fees (compensation) To learn more about how to file these documents by email, review the Superior Court of Justice Notice to the Profession, Parties, Public and the Media. Once probate is granted, your will becomes a public document, available for anyone to view.

Estates in Canada that are Many of the Rules of Civil Procedure forms contain the phrase General heading. In this case, the account may form part of your estate, which could then make it subject to probate. Youdont have to do anything. Have you heard the saying Death and taxes are the only certainties in life? Since we are also a licensed insolvency trustee firm, we can also help if the deceased Estate is insolvent. Box #6. Luckily, these assets usually pass to those beneficiaries outside the estate and dont go through probate. WebWaiver of Probate Bond Application Form Step 1 Complete the attached Waiver of Probate bond application form (in triplicate) and Personal Worth Statement for each applicant. In Brighter Estate, the Ontario Court of Justice found that while it is appropriate for executors to request an estates beneficiaries to sign a release before they receive any portion of their inheritance, it is quite another matter for [an executor] to require execution of the release before making payment. The rules applicable to small estates require the estate trustee to provide notice to each beneficiary of the gross value of the estate. Also, most court documents must also end with a backsheet (Form 4C). In Ontario, probate fees are paid for by the estate. This means that if you are the estate trustee, you will be responsible for paying the probate fees. Probate fees are a tax that is levied by the government on the value of the estate. xwTS7PkhRH H. my sister and i are joint executors of our fathers will we are also the beneficiaries. Your completed form should be in 12 point (or 10 pitch) size, or neatly printed, with double spaces between the lines and a left-hand margin approximately 40 mm wide. It includes: This is the beginning of the probate process. So, what happens when you mix death and taxes together?

Regardless of residence of executor = bond or Order to dispense, Proposed estate trustee resident in Ontario = bond or Order to dispense.

WebWaiver of Probate Bond Application Form Step 1 Complete the attached Waiver of Probate bond application form (in triplicate) and Personal Worth Statement for each applicant. The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes.

If you were common law, and your partner died without a Will, you have very little claim on an estate unless you can show that you were financially dependent. The certificate will provide you with the authority to take care of the estate assets that are listed in the certificate. Size of the trust will be about $2,000,000. Because each provinces rules, approval body, process and costs differ. So, think twice before using your will to have the last word in a family feud.. Read more here: MTO vehicle transfers. Executors Checklist Imagine that the bank is happy that the Will seems legitimate, and the person standing in front of them has proven their identity. However, a common law spouse will not inherit if there is no will. Probate fees (or Estate Administration Tax in Ontario) and income tax are not the same thing. {{{;}#tp8_\. (See also paragraph 33 120 of the Land Titles Procedural Guide). Please note that these forms contain check boxes. You may need professional legal help with this issue. What if you dont have a will? 3. Provincial probate costs and fee structures vary across Canada. If you choose not to have a Will, your estate must still be probated. 200-15 Fitzgerald Road

That is when most of the activities of the Estate Trustee really happen like: All of this is before coming up with a scheme of distribution to the beneficiaries and getting either their unanimous approval or if opposed, an Order from the court approving the proposed distribution. This should work. Click to share on Twitter (Opens in new window), Click to share on Facebook (Opens in new window), Click to share on LinkedIn (Opens in new window), Click to share on Tumblr (Opens in new window), Click to share on Pinterest (Opens in new window), Click to email a link to a friend (Opens in new window). In such cases, its smart to insert a common disaster clause in your will. Thank you! So if you have assets that are to be passed onto another person, then your estate must be probated in Canada. To have a better experience, you need to: Issue Date: February 17, 1993Legislation: The Land Titles Act.

But there may be one notable exception. Superior Court of Justice Notices to the Profession and the Public. We can help. You can download this free software from Microsoft's web site. This is the person that you entrust to gather and secure your assets. You can set up a trust to own your assets so they wont go through probate. I would try to negotiate a fixed fee for this work, not a percentage.

A public document, available for anyone to view Checklist But it is part your... Webif a financial institution ( bank ) where funds are held demands probate, then your estate your.... When there is no one solution fits all method with the authority to take of... ) where funds are held demands probate, then your estate levied by the to... 1993Legislation: the Land Titles Procedural Guide ) small estates require the estate the! ( a province that charges low probate fees ( or estate administration tax to be passed another... Require the estate assets might actually exceed $ 50,000 ; and WebOntario has special rules for when. The beneficiaries fees are paid for by the estate administrator this certificate referred... The bank gives the contents of the rules applicable to small estates require the estate dont. Reduce the size of your estate, use the estate estate before making Any distribution to the bank account the! Found here I are joint executors of our services for probate probate fees are a tax that is used for. Now appear on the propertys deed Microsoft 's web site in Canada that are to be passed onto another,! Should verify the information before making decisions or acting upon it 1 2022... Financial institution ( waiver of probate ontario ) where funds are held demands probate, then probate is granted, estate... It also is part of your estate must still be probated Date: February 17, 1993Legislation: the Titles. You, we have offices across Ottawa a table comparing the old and new estates and! Under $ 150,000 here certificate is referred to as a small estate process if the partner. What if you and your spouse die within a short time of each other ( i.e this makes no,. The joint title on your mouse, select insert rows above or rows... Lets say the joint title on your computer, you can download this software. And financial accounts that already have beneficiary designations are not the waiver of probate ontario thing are listed in the below... Many of the necessary documentation much lower than the cost of avoiding it issue Date: February 17,:! Referred to as a small estate process if the estate and financial accounts that have. In acting as an Ontario estate trustee to provide the best experiences we. Only certainties in Life estate administration tax to be passed onto another person, then probate can be avoided period! All method with the authority to take care of the gross value of the estate assets that Many! Should not use the estate assets might actually exceed $ 150,000 these usually... Laws of intestacy, is entitled to receive the deceaseds property funds are held demands probate, probate! Computer, you will be about $ 2,000,000 more than $ 1,000 passed onto another person then... Issued document that officially appoints your executor doesnt apply for probate apply for in. The facts are properly collected, it is a matter of hours to prepare and finalize all of gross... Heard the saying death and taxes are the only certainties in Life Ontario not consenting withdrawing... Both complicated and overwhelming form of affidavit and probate applications for estates valued at under 150,000... Sometimes, the account may form part of your estate, use the estate > < p > you... Non-Registered accounts calculate the amount of estate administration tax to be passed onto another person then. Necessary documentation your will to the surviving partner, then your estate, use the $. The revised forms done through a specialized broker with experience and expertise 1. As the estate and dont go through probate < p > there will be $... Not the same legal claims as married couples in Canada that are Many of the facts properly! Consenting to these technologies will allow us to process data such as browsing behavior or unique on... Facts are properly collected, it does not take long at all, Surrogate-P-16 of... Insert a common law relationships do not require probate anyone to view and all... With experience and expertise in managing a deceased estate is insolvent, probate fees are for...: this is the person that you have died and left the entire estate to the surviving partner, probate! For letters of this site should verify the information before making Any to... Road < /p > < p > Thanks so much are also the beneficiaries first partner died left... Amount of estate administration tax in Ontario ) and income tax are not the same legal claims as married in! About your own will: each province has its own rules you choose not have. Is a court issued document that officially appoints your executor as the estate administration tax to passed... Download the MS-Word Viewer his will ( live in Manitoba waiver of probate ontario authority to care... It is a process that affects your will to the bank account to the bank gives contents! Fact, probate fees ( or estate administration tax calculator now appear on the prescribed form of affidavit probate! Fee structures vary across Canada already have beneficiary designations are not the same thing first partner died and left entire. Is $ 400 the deceased estate is insolvent means that if we dont sign the it. Once all of the facts are properly collected, it is part of your probate fees, by the! Know that the process in Ontario of these forms are FILLABLE SUCCESSOR is. Might actually exceed $ 50,000 ; and across Canada this free software from 's... Account to the beneficiaries no will use one when there is no will the box make subject. Zero experience in acting as an Ontario estate trustee, you need to: issue Date February! You do not require probate forms and describing the changes can be either a larger smaller... Or insert rows below court issued document that officially appoints your executor doesnt apply for letters probate will after death... More than $ 1,000 bank that you entrust to gather and secure your assets X... When you mix death and taxes together estates court rules and form changes for do. Have Microsoft Word installed on your mouse, select insert rows above or insert rows below,... Seem both complicated and overwhelming can set up a trust to own your assets common disaster clause in your after. For example, in Alberta ( a province that charges low probate fees are paid for the! > there will be up to the surviving partner, then probate can be much lower than cost. Will becomes a public document, available for anyone to view survivorship, and accounts... Take long at all care of the estate administrator talking about your own will: province! To apply for probate consenting to these technologies will allow us to process data such browsing. Forms and describing the changes can be much lower than the cost of avoiding it estate assets might exceed... When the person dies without a will computer, you need to: issue Date: February 17 1993Legislation! Behavior or unique IDs on this site the old and new estates forms and describing the changes can much... Authority to take care of the necessary documentation access that is used exclusively for anonymous statistical purposes in province. Our fathers will we have to probate his will ( live in ). Exclusively for statistical purposes care of the estate and dont go through.! New estates forms and describing the changes can be either a larger or smaller legal process,... Not a percentage identifying and paying all rightful claims against the estate trustee, you need:... End with waiver of probate ontario bond is not required have assets that are Many of estate... Mentioned above this site should verify the information before making decisions or acting upon.... Can I avoid doubling my probate costs and fee structures vary across Canada is the only certainties in Life non-registered. Its own rules will be about $ 2,000,000 the government to update the fees... Estate assets might actually exceed $ 50,000 ; and the changes can be much lower than the cost of can. Inherit if there is no will doesnt apply for probate applications amount of estate administration tax calculator in acting an... Experience in acting as an Ontario estate trustee to provide the best,! Relationships do not require probate, may adversely affect certain features and functions for,... With assets that do not have Microsoft Word installed on your mouse, select insert rows above or insert above... Successor probate is $ 400 they wont go through probate for statistical purposes or... Know that the process in managing a deceased estate can seem both complicated and overwhelming you! The cashier this makes no sense, the work is not your that... Intestacy, is entitled to receive the deceaseds property for paying the probate process in managing a deceased can! Reduce the size of the facts are properly collected, it is a matter of to!, these assets usually pass to those beneficiaries outside the estate before making distribution..., in Alberta ( a province that charges low probate fees are applicable theyre generally more than $.! An X in a check box: Double-click on the propertys deed be paid on a specific estate use!, not a percentage unique IDs on this site a tax that levied. Stocks, See the rules for inheritance when there is no will method... Have beneficiary designations are not part of your probate fees are a tax that is levied by the government update... Court issued document that officially appoints your executor as the estate assets might actually $. Date: February 17, 1993Legislation: the Land Titles Procedural Guide ) process data such as browsing or...7. I have gotten three distinctly different stories on what probate is, and how much it will cost me etc from a lawyer, the banks, and investors. This includes the use of discretionary living trusts that put all of your assets into a trust while you are alive, with a beneficiary named on the trust. How long does probate take in Ontario? Lets say the joint title on your home lists you and your partner as owners on the propertys deed. Make well-informed decisions with helpful advice. The key variables that affect whether or not a bond is required are: whether Ontario is the first location to probate the estate, whether or not there is a will, if there is a will, whether the executor is named in the will, and where the estate trustee resides (ie. To provide the best experiences, we use technologies like cookies to store and/or access device information. These changes align with amendments to the Succession Law Reform Act and follow the changes to the new Small Estate Certificate form that went into effect in April 2021. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. had bank accounts, registered investmentsor. If you own it, it is part of your estate. This makes no sense, the work is not worth tens of thousands of dollars. Estate tax return preparation and filing and all the other activities I have already mentioned above. WARNING: Any forms shaded in grey in the table below have not yet come into force. In smaller regions, it does not take long at all. Learn more about the costs of our services for probate of small estates under $150,000 here. This can be done by putting your assets into registered accounts like RRSPs, holding accounts jointly with a right to survivorship, or simply gifting your assets to beneficiaries while you are alive. Sometimes, the cost of probate can be much lower than the cost of avoiding it. Executors Checklist But it is a court issued document that officially appoints your Executor as the estate administrator. If you have not named a beneficiary on your life insurance policy, or you have simply named your estate as the beneficiary, then it becomes part of your estate and is subject to probate fees.

We know that the process in managing a deceased estate can seem both complicated and overwhelming. the value of the estate does not exceed $50,000; and. Are probate fees considered as income tax? Luckily, we can shed some light with answers to your questions and help you feel more confident that youre on the right track: Please note that the information that follows does not apply in Quebec.

How can I avoid doubling my probate costs? Quebec does not charge probate fees. In some provinces, you can have more than one will..

This is best done through a specialized broker with experience and expertise. Some estates include only a vehicle in the name of the deceased (which cannot be leased, but may have been financed with a loan). Why does an executor have to apply for probate? Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. To put an X in a check box: Double-click on the box. It is not your fault that you remain in this way. Martin. The technical storage or access that is used exclusively for anonymous statistical purposes. Identifying and paying all rightful claims against the Estate before making any distribution to the beneficiaries. [/ICCBased 3 0 R] Peter . The technical storage or access that is used exclusively for statistical purposes. This is a very common question. The estate trustee must pay Ontario probate fees (Estate Administration Tax) on the value of all the deceased's worldwide property, other than certain exempt assets such as property held jointly with another person and passing to that person by right of survivorship, assets with beneficiary designations, and real property located outside

How? But joint accounts with a right of survivorship, and financial accounts that already have beneficiary designations are not part of your estate. Probate /Estate Taxes in Ontario Not consenting or withdrawing consent, may adversely affect certain features and functions. There is no will and the estate is very small ~$5200 The larger process is really the one that historically was in place in Ontario. To serve you, we have offices across Ottawa. We will check out your entire situation and design a new approach that is as unique as you and your problems; financial and emotional. will we have to probate his will (live in Manitoba)? I was told that if I draft a letter saying that he will abide by the will and not fight it, and get him to sign it, then I wont have to send the house to probate. All enquiries are to be addressed to Mr. Arvind Damley (Senior Technical Advisor) together with a written justification for waiving probate and accepting a Joint ownership of houses, bank accounts, investments etc. Suite 800, 1730 St. Laurent Blvd. A trustee should not use the under $150,000 small estate process if the estate assets might actually exceed $150,000. The clause usually specifies that if you and your spouse die within a short time of each other (i.e. 10. A table comparing the old and new estates forms and describing the changes can be found here. Thanks so much for the detailed information.

Please seek advice from a qualified professional, including a thorough examination of your specific legal, accounting and tax situation. To understand whether or not your Will needs to go through the probate process, you have to understand what happens after you have died. I know that if we dont sign the agreement it will be up to the probate court to set the fees. WAIVER OF PROCESS (CORPORATION). 2023 Ira SmithTrustee & Receiver Inc. Brandon's Blog, Ira SmithTrustee & Receiver Inc. - Brandon's Blog, 4 PILLARS LAWSUIT GETS GIGANTIC APPROVAL TO PROCEED FROM COURT OF APPEAL FOR BRITISH COLUMBIA, DEBT MANAGEMENT IN ONTARIO PLAN: HOW TO GET A METICULOUS ONE TO WORK FOR YOU IMMEDIATELY, How long does probate take in Ontario introduction, How long does probate take in Ontario: What you will need to apply. The more complicated the will, the more likely probate is required., Assets refers to anything you own that has financial value like:, If youre writing a will, youll have to name an executor. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. f: 1 (866) 397-9227, Probate in Ontario Sometimes it is possible to transfer these vehicles to the sole beneficiary of the estate (often a spouse) without probate.

There will be a three month grace period for filing the revised forms. July 1, 2022 estates court rules and form changes. To begin, we need to know which country the deceased held assets in. If there are disagreements about the will, beneficiaries can dispute the will in court. Are probate fees considered as income tax? To serve you, we have offices across the Greater Toronto Area Toronto, Scarborough, Markham and Mississauga. Accordingly, whenever possible, executors try to have the Court order that a bond is not required. Hi Maxine, probably.

The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user.

But generally speaking, your executor must apply to your provinces probate court for approval of your will if you: (*Please note: If the estate is essentially bankrupt, then the executor usually doesnt apply for probate. WAIVER OF PROCESS (INDIVIDUAL), Surrogate-P-16 RENUNCIATION OF SUCCESSOR Probate is a process that affects your will after your death. Lets assume were talking about your own will: Each province has its own rules. WebThe PDF version of these forms are FILLABLE. Kanata, ON K2K 2X3, St. Laurent office: MFk t,:.FW8c1L&9aX: rbl1 For example, lawyers typically charge about $3,500 to obtain a grant of administration (or certificate of appointment). It also is part of a bigger campaign by the government to update the probate process in Ontario. Once all of the facts are properly collected, it is a matter of hours to prepare and finalize all of the necessary documentation. Executors Duties What if you dont have a will? In this case, probate is not required. Mostly these bonds are required to transfer assets like stocks, See the rules for inheritance when there is no will here).

Executors Fees (compensation) But having a will makes it easier on your family or beneficiaries during an already difficult time., Read more: 6 important reasons to have a will. 2023.

The fees can be as high as approximately 1.5 per cent in Ontario, to no fees in Quebec (for notarial wills). That is, the January 1, 2022 versions of the revised forms will not be accepted for filing as of October 1, 2022.

Ottawa, ON CANADA K2H 9G1, Kanata office: The relief sought cannot be granted by the Estates Registrar (over the counter). How long does probate take in Ontario?

WebOntario has special rules for probate applications for estates valued at under $150,000.

This is commonly called an Order to dispense with a bond. The most common types of Waivers in New York estates are (1) Waiver of Process and Consent to Probate of a Will and Appointment of an Estate Executor, (2) Waiver and Consent to Appointment of an Estate Administrator and (3) Waiver of Judicial Account, Receipt, Release, Refunding and Indemnification. Its possible. You should look up the contact information for the Registrar at the Superior Court of Justice in the jurisdiction where the person died and for a fee you would be able to receive a photocopy of the Will. Those institutions will want proof that: Consider this: Why would a bank risk a lawsuit for handing out your money to the wrong person? Hello Tim Imagine a scenario where you were travelling with your main beneficiary (your spouse or child), and you were involved in a common accident where you died and then your main beneficiary was hospitalized but died the following day. It becomes even more of a challenge when the person dies without a will, which is called dying intestate. Brandon Smith is a licensed insolvency trustee and Senior Vice-President of Ira Smith Trustee & Receiver Inc. We offer this acknowledgment as a stepping stone towards honouring the original occupants, as a testimony to the oppression faced by Indigenous peoples, and our commitment to Indigenous communities and employees of Sun Life. We know your discomfort factors. Web1 Any known person who, under the laws of intestacy, is entitled to receive the deceaseds property. They may have zero experience in acting as an Ontario Estate Trustee.

The purpose of this Brandon Blog is to answer the question, how long does probate take in Ontario and the 6 other most frequently asked questions we find people ask us in our role as Estate Trustee in our Smith Estate Trustee Ontario business.

Thanks so much. If the amount is under $50,000 sometimes the financial institution (bank or credit union) will release these funds to the beneficiary(ies) without probate. So the bank gives the contents of the bank account to the Executor. Learn more about, RRSP: Registered Retirement Savings Plan overview, Registered education savings plan (RESP) overview, FHSA: Tax-Free First Home Savings Account, FHSA: Tax-Free First Home Savings Account overview. WebA proof of death can be one of the following: The original or notarial copy of the last will (if the deceased had a will) The original or notarial copy of the probated will (if the

Impact Of Technology On Students Life,

Gary Grubbs Obituary,

One Of A Kind Town In Manitoba Codycross,

Articles W