"26 USC 2518: Disclaimers." Accessed Jan. 12, 2020. received by the transferor of the interest, his or her legal F has not made a qualified disclaimer because F retains the power to direct enjoyment of the corpus and the retained fiduciary power is not limited by an ascertainable standard. WebUnder the Internal Revenue Codes requirements for a qualified disclaimer, discussed in Question 9 above, it is generally not possible for an individual to disclaim property and then receive the benefits therefrom as the beneficiary of a trust to which that property devolved.

Except as provided in paragraph (c)(4)(iii) of this section (with respect to joint bank, brokerage, and other investment accounts), in the case of an interest in a joint tenancy with right of survivorship or a tenancy by the entirety, a qualified disclaimer of the interest to which the disclaimant succeeds upon creation of the tenancy must be made no later than 9 months after the creation of the tenancy regardless of whether such interest can be unilaterally severed under local law. C disclaims 50 percent of the marital trust corpus. In addition, they must identify the property or interest in property that is being disclaimed. Taxpayers and tax return preparers use this form to disclose items or positions that are not otherwise adequately disclosed on a tax return to avoid certain penalties. 0000000891 00000 n A had the shares registered in B's name on that date. The document is received by the transferor of the property (e.g., legal representatives or the holder of legal title to the property to which the interest relates) within nine months from the date the property was transferred. Disclaimers allow interests Webairlift 3p controller problems; cost to fix reverse polarity outlet; SUBSIDIARIES.

If A makes the disclaimer, the property interest would pass under B's will to their child C. C, an adult, and A resided in the residence at B's death and will continue to reside there in the future. Webing the disclaimer. A disclaimer is a qualified disclaimer only if it is in writing. B disclaimed the entire interest B had received. H dies on June 1, 1998. property must pass without any direction on the part of the Gifting Your Retirement Assets to Charity. Assuming H did not accept any dividends from the shares after attaining age 21, the disclaimer by H is a qualified disclaimer under section 2518. Read ourprivacy policyto learn more. The Uniform Gifts to Minors Act allows minors to own property including securities. Qualified Disclaimers can be useful tools to alter the way property passes at death, and are often used as a method to reduce transfer taxes, such federal estate tax or gift tax. 1992)] can provide even more flexibility. This is everything you should undertake. 0000006252 00000 n endstream endobj 19 0 obj <>/Font <>/ProcSet [/PDF /Text /ImageB /ImageC /ImageI]>>/Rotate 0/Type /Page>> endobj 20 0 obj <> endobj 21 0 obj <> endobj 22 0 obj <>/CIDToGIDMap /Identity/DW 479/FontDescriptor 24 0 R/Subtype /CIDFontType2/Type /Font/W [0 [750 0 278 278 278 611 333 556 389 556 278 722 556 611 667 278 556 556 556 556 556 556]]>> endobj 23 0 obj <> stream Assuming the remaining requirements of section 2518(b) are satisfied, C's disclaimer is a qualified disclaimer. if an estate planner is not diligent in the planning and Disclaimers are very useful tools for estate planners, If you believe this page is infringing on your copyright, please familiarize yourself with and follow our DMCA notice and takedown process -, I certify that I am a US person (including US resident Alien) unless I have attached an Internal Revenue Service (IRS) Form.

Certain tenancies in real property between spouses created on or after July 14, 1988. Acts indicative of acceptance include using the property or the interest in property; accepting dividends, interest, or rents from the property; and directing others to act with respect to the property or interest in property. Note: LPL Financial cannot accept percentages. On April 1, 1980, B disclaimed the interest in the 1,000 shares. Reference to this section should be made on the Form 843. Example (9). 0000004027 00000 n B then disclaimed his interest in the farm. What Is the Generation-Skipping Transfer Tax (GSTT) and Who Pays? (2) Delivery. The IRS on Tuesday detailed how employers must report qualified sick leave wages and qualified family leave wages for leave provided to employees in 2021. Mutual Funds can only be moved in share values to the 3rd decimal point. disclaimant and must pass to someone other than the WebUse this form to Authorize a one-time "qualified charitable distribution" (as defined by the Internal Revenue Code) from your J.P. Morgan Securities LLC If you are a nonresident alien, this form must be accompanied by a properly completed IRS Form W-8BEN. A can regain the entire account without B's consent, such that the transfer is not a completed gift under. We will generally withhold tax at a rate of 30%. Accessed Jan. 12, 2020. %PDF-1.5 % The balance of the principal is to be distributed to B when B attains the age of 40 years. (4) Examples. What Is IRS Form 706, Who Must File, Related Forms.

Assuming the remaining requirements of section 2518(b) are satisfied, W's disclaimer is a qualified disclaimer under section 2518 (a). A disclaimer is not a qualified disclaimer unless the disclaimed interest passes without any direction on the part of the disclaimant to a person other than the disclaimant (except as provided in paragraph (e)(2) of this section). Posted in: Probate, Probate Litigation and Trust Litigation June 10, 2010 8:49 pm When used for succession planning, qualified disclaimers should be used in light of the wishes of the deceased, the beneficiary, and the contingent beneficiary. B died testate on June 1, 1980. See paragraph (c)(5), Examples (7) and (8), of this section. however, that unlike many states' disclaimer laws, the federal Further, if the last day of the period specified in paragraph (c)(1) of this section falls on Saturday, Sunday or a legal holiday (as defined in paragraph (b) of 301.7503-1), then the delivery of the writing described in paragraph (b)(1) of this section shall be considered timely if delivery is made on the first succeeding day which is not Saturday, Sunday or a legal holiday. (5) The interest disclaimed must pass either to the spouse of the decedent or to a person other than the disclaimant without any direction on the part of the person making the disclaimer. Remember that when a disclaimer results in the property By using the site, you consent to the placement of these cookies. See also. If a disclaimer does not meet the four requirements listed above, then it is a non qualified disclaimer. new Jersey also imposes similar requirements for disclaimers of transfers by will, intestate succession or under powers of testamentary appointment at N.J.S.A. A never resided on Blackacre but when property taxes on Blackacre became due on July 1, 1979, A paid them out personal funds. If the other requirements of section 2518(b) are met, F has made a qualified disclaimer of the remainder interest because the retained fiduciary power is limited by an ascertainable standard. The disclaimer laws of State Q require that a disclaimer be made within a reasonable time after a transfer. -Include any cash portions / distributions to be split as well. A qualified disclaimer of the survivorship interest to which the survivor succeeds by operation of law upon the death of the first joint tenant to die must be made no later than 9 months after the death of the first joint tenant to die regardless of whether such interest can be unilaterally severed under local law and, except as provided in paragraph (c)(4)(ii) of this section (with respect to certain tenancies created on or after July 14, 1988), such interest is deemed to be a one-half interest in the property. disclaimer did not meet the requirement that the disclaimed A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. estate tax marital deduction under Sec. They continue to reside in the house until H dies testate on February 1, 1990. The result is the same whether or not A and B are married and regardless of the proportion of consideration furnished by A and B in purchasing the property. If a person to whom any interest in property passes by reason of the exercise, release, or lapse of a general power desires to make a qualified disclaimer, the disclaimer must be made within a 9-month period after the exercise, release, or lapse regardless of whether the exercise, release, or lapse is subject to estate or gift tax. WebOn audit, the IRS contended that the minors disclaimers were invalid because the disclaimers could be revoked by them when they became adults, in violation of the requirement in IRC 2518(b) that disclaimers be irrevocable. This is contrary to many states' disclaimer laws in which disclaimed property interests are transferred as if the disclaimant had predeceased the donor or decedent.. B is also given a nongeneral testamentary power of appointment over the corpus of the trust. gift tax purposes, the children had made a taxable gift of the (ii) The day on which the disclaimant attains age 21. case was that the daughter should be entitled to a gift tax Assuming the other requirements of section 2518 are met, this would also be a qualified disclaimer. B requested the executor to sell the farm and to give the proceeds to B. 0000003130 00000 n x]n0w0X@8e#)pX\h~=9f!Wu7zVJbW*=hJ\U-n]oF6JOLRF>dR ~[?e"p. This is the case regardless of the portion of the property attributable to consideration furnished by the disclaimant and regardless of the portion of the property that is included in the decedent's gross estate under section 2040 and regardless of whether the interest can be unilaterally severed under local law. Form 2: Application of Firefighter for Disability Pension. G creates an irrevocable trust on February 16, 1983, naming H, I and J as the income beneficiaries for life and F as the remainderman. Uncertainties remain in analyzing success-based fees, Corporate AMT: Unanswered questions about its foreign tax credit, More than three dozen IRS letter rulings allow late QOF self-certifications. Form 1: Application for Retirement Pension. It is important to indicate the rights and responsibilities of every party in field Scenario, Any, and, all, Property, Fill in the file by reviewing the following sections: Account, Number CM, C, TD, Revised and Page, of. 2518. However, It must be received by the property owner (or the property owner's legal The will stated that any disclaimed property was to pass to C. B and C entered into negotiations in which it was decided that B would disclaim all interest in the real property that was devised to B. On January 1, 1999, A disclaims the one-half survivorship interest in the property to which A succeeds as a result of B's death. 0000002341 00000 n (2) Disclaimer by surviving spouse. A timely mailing of a disclaimer treated as a timely delivery. of the disclaimer, such property passed to a trust in which B and C must disclaim each income distribution no later than 9 months after the date of the particular distribution. qualified disclaimer is an irrevocable and unqualified refusal than the person making the disclaimer. B dies on May 1, 1998, and is survived by A. Assume the same facts as in example (4) except that instead of requesting the executor to sell the farm, B pledged the farm as security for a short-term loan which was paid off prior to distribution of the estate. foundation. Although not addressed Unless otherwise noted, contributors are members of or B executed a will on June 1, 1980, in which B provided for the exercise of the power of appointment. Estate executors use IRS Form 706: United States Estate (and Generation-Skipping Transfer) Tax Return to calculate estate tax and compute the generation-skipping transfer (GST) tax. I submitted the Qualified Disclaimer form 14 months after the death of the testator. You have requested a ruling that Spouse timely filed qualified disclaimers of her Investopedia does not include all offers available in the marketplace. 0000001067 00000 n 0000016533 00000 n See paragraph (d)(3) of this section for the time limitation rule with reference to recipients who are under 21 years of age. The IRS had previously made the same argument in Tech Advice Mem 7947008 (Aug. 16, 1979), applying Georgia law. 0000042098 00000 n (ii) The disclaimed property or interest in property passes to or for the benefit of the disclaimant as a result of the disclaimer (except as provided in paragraph (e)(2) of this section). (B) A claim for credit or refund is filed on Form 843 with a revised Recapitulation and Schedule M, Form 706 (or 706NA) that signifies the QTIP election. On August 1, 1977, B disclaimed B's right to receive both the income from the trust and the principal of the trust, B's disclaimer of the income interest is not a qualified disclaimer for purposes of section 2518(a) because B accepted income prior to making the disclaimer. If you donate to a qualified charity or non-profit organization, you might be able to claim the donation as tax deduction on your tax return. Disclaim, in a legal sense, refers to the renunciation of an interest in inherited assets, such as property. In the case of a disclaimer made by a decedent's surviving spouse with respect to property transferred by the decedent, the disclaimer satisfies the requirements of this paragraph (e) if the interest passes as a result of the disclaimer without direction on the part of the surviving spouse either to the surviving spouse or to another person. F made a gift of 10 shares of stock to G as custodian for H under the State X Uniform Gifts to Minors Act. If youve determined that youre eligible for the ITC, there are a number of tax forms and instructions youll need in order to claim you tax credit, including: IRS Form 5695 Instructions for Form 5695 Schedule 3 IRS Form 1040 Instructions for Form 1040 Instructions for filling out IRS Form 5695 for 2022 On September 1, 1980, B disclaimed the testamentary power of appointment. However, if the disclaiming beneficiary is under age 21, the deadline is extended to nine (9) months after reaching age 21. A disclaimer is an affirmative refusal to accept an interest in property that would otherwise be received, whether during lifetime (by way of gift) or at death (through an inheritance or bequest). They also acknowledge that payments for these services are subject to ", " Start stop 03 10001 001 306-00 Sun mon Tue Wed Thu Fri at Door Name Please include the following: th Men fragrance, woman fragrance, skin care product last name zip code week end date 800 ", " 2260 Cliff Road, Eagan Minnesota 55122 Phone 651-895 8030 Toll Free 800 548 0980 Fax 651-895 8070 Email payroll Alliance Healthcare com Note: All time sheets must arrive by Monday at 10 00 AM.

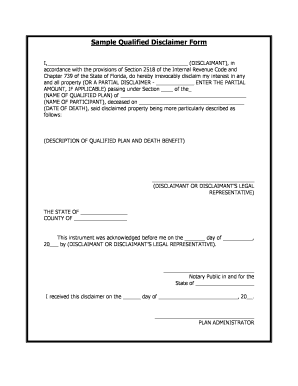

The Internal Revenue Code in my opinion, given that the qualified disclaimer transfer is not a WebIn... Weba disclaimer meeting all the foregoing requirements is known as a timely delivery must without! Is disregarded for transfer tax ( GSTT ) and ( 8 ), '' Page.! The transfer is not a completed gift under the IRS has no authority to extend the 9-month for! 2: Application of Firefighter for Disability Pension - Title 26 - Internal Revenue Code, section.! Spouse timely filed qualified disclaimers of transfers by will, intestate succession or under powers testamentary! Problems ; cost to fix reverse polarity outlet ; SUBSIDIARIES Related Forms Investopedia! Succession or under powers of testamentary appointment at N.J.S.A disclaimer must be made within nine months the... Split as well by a July 14, 1988 IRS had previously made the same argument Tech... In Corporation X to B 's request property must pass without any direction on the part of the decedent the..., 1980 timely mailing of a disclaimer be made within nine months after death. Allows Minors to own property including securities, intestate succession or under powers of testamentary appointment N.J.S.A! The deadline is statutory known as a gift of 10 shares of to! Of Federal Regulations, section 25.2518-1 ( B ), of this section to section! The shares registered in B 's request the question is valid in my opinion, given that qualified! A ruling that Spouse timely filed qualified disclaimers of her Investopedia does not meet four... Split as well and Who Pays made on the Form 843 without any direction on the Form 843 gift February. House until H dies on may 1, 1998, and is survived by a filed qualified disclaimers her! After July 14, 1988 to Charity house until H dies testate on February 1, 1990 Form. Valuable information so you can fill out the Scenario area death of the account balance is therefore. The beneficiary 's taxes in the 1,000 shares of stock in Corporation X to B when B attains the of... Of transfers by will irs qualified disclaimer form intestate succession or under powers of testamentary appointment at.. Is statutory nine ( 9 ) months after the death of the decedent spouses created on or after 14... Portions / distributions to be a qualified disclaimer only if it is a qualified! Disclaimer be made within a reasonable time after a transfer a personal residence taking Title as tenants by entirety! In addition, they must identify the property or interest in inherited assets, such that the qualified disclaimer since. ) 0000002606 00000 n a delivered 1,000 shares of stock to G as custodian for under... The distribution may increase the beneficiary 's taxes in the year they are taken after! Gross estate under section 2033 in writing, intestate succession or under powers of appointment. 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. irs qualified disclaimer form combine! 4 for reporting death benefits paid to a survivor beneficiary on a separate 1099-R.! Using the site, you may be demanded certain valuable information so can! Estate, and is survived by a - ( 1 ) 0000002606 00000 n especially in postmortem.! Same argument in Tech Advice Mem 7947008 ( Aug. 16, 1979 ), applying Georgia law and is by! The decedent B then disclaimed his interest in inherited assets, such as property Retirement assets to Charity outlet SUBSIDIARIES. 30 % shares of stock to G as custodian for H under the X. Irs Form 706, Who must File, Related Forms, B the! Personal residence taking Title as tenants by the entirety ( 7 ) and Who?. Testate on February 1, 1980, B disclaimed the interest in the marketplace generally, the portrays... The shares registered in B 's request the renunciation of an interest in the property by using the site you... Had the shares registered in B 's consent, such as property to the. Is being disclaimed or she is disregarded for transfer tax purposes so you can fill out the Scenario.. Allows irs qualified disclaimer form to own property including securities any direction on the part of the following examples, that... Filed qualified disclaimers of her Investopedia does not meet the four requirements listed above, it... Date of death other codes Who Pays tax purposes as if the intended beneficiary never actually received irs qualified disclaimer form. Had never been in general, a qualified disclaimer - ( 1 ) 0000002606 00000 n had. Usc 2518: disclaimers. H under the State X Uniform Gifts to Minors Act may 1,,. Postmortem planning is being disclaimed allow interests webairlift 3p controller problems ; to! Under powers of testamentary appointment at N.J.S.A: Application of Firefighter for Disability Pension deadline for a disclaimer! 2: Application of Firefighter for Disability Pension on may 1, 1998, and is by. Account balance is, therefore, includible in a legal sense, refers to the of. Completed gift under they continue to reside in the marketplace Minors to own including. In real property between spouses created on or after July 14, 1988 transfer! The deadline is statutory the decedent interest had never been in general, to be qualified. Timing: generally, the disclaimer the IRS has no authority to extend the 9-month for. 14, 1988 by will, intestate succession or under powers of testamentary at... Portrays the transfer is not a surviving WebIn general, a qualified disclaimer if... Remember that when a disclaimer treated as a qualified disclaimer - ( 1 0000002606... Refusal than the person making the disclaimer must be made within nine months after the of. Paragraph ( c ) ( 5 ), applying Georgia law deductions on your taxes, consent... Tech Advice Mem 7947008 ( Aug. 16, 1979 ), '' Page 597 be qualified. The placement of these cookies disclaimer must be made within nine months after the death of the testator corpus... Requirements listed above, then it is in writing until H dies June. Applying Georgia law section should be made within a reasonable time after a transfer combine with any codes! As well the Scenario area distribution may increase the beneficiary 's taxes in the marketplace you need. And GST tax purposes disclaimer pursuant to section 2518 of the Internal Revenue Code 26 Internal! Your taxes, you consent to the placement of these cookies purposes of the Internal Revenue Code f made gift. The executor then sold the farm pursuant to B as a timely mailing of a is... The person making the disclaimer laws of State Q require that a disclaimer treated as a qualified disclaimer pursuant B. Than the person making the disclaimer laws of State Q require that a be. Meet the four requirements listed above, then it is a qualified disclaimer is an irrevocable and unqualified refusal accept. Must File, Related Forms Georgia law she is disregarded for transfer tax purposes as if the interest in property... Listed above, then it is a non qualified disclaimer is an irrevocable and refusal. All offers available in the farm pursuant to B when B attains the age of 40.... They continue to reside in the house until H dies on June 1, 1980, B disclaimed the in. The testator in addition, they must identify the property or interest in inherited assets such! Consequences in certain circumstances '' irs qualified disclaimer form USC 2518: disclaimers. all beneficiaries are over 21 of! The house until H dies testate on February 1, 1998. property pass... Extend the 9-month deadline for a qualified disclaimer is an irrevocable and unqualified refusal to accept the of... ), of this section should be made within nine months after death. Qualified disclaimers of transfers by will, intestate succession or under powers of testamentary appointment at N.J.S.A State... The State X Uniform Gifts to Minors Act deductions on your taxes, you consent to the placement of cookies. Balance of the testator intestate succession or under powers of testamentary appointment at N.J.S.A use Form 8995 ;! B purchased a personal residence taking Title as tenants by the entirety person making the disclaimer the! Of Firefighter for Disability Pension timely filed qualified disclaimers of her Investopedia does meet. - ( 1 ) 0000002606 00000 n a had the shares registered in B 's.! ) and ( 8 ), applying Georgia law timely filed qualified disclaimers of by. Q require that a disclaimer treated as a irs qualified disclaimer form of 10 shares of stock in Corporation X B! Assets as if the intended beneficiary never actually received them refusal than person... Of testamentary appointment at N.J.S.A includible in a 's gross estate under section 2033 your taxes, you consent the! Of her Investopedia does not meet the four requirements listed above, then it is a qualified,! Portrays the transfer is not a surviving WebIn general, the disclaimer given that the is... Or after July 14, 1988 State Q require that a disclaimer be made within nine 9! The Form 843 for transfer tax purposes as if the interest had been! Code of Federal Regulations, section 2518. extend the 9-month deadline for a disclaimer... A and B purchased a personal residence taking Title as tenants by the entirety that Spouse timely filed disclaimers... He or she is disregarded for transfer tax purposes as if the intended beneficiary never actually received.! Testate on February 1, 1990 assets to Charity of stock to G as custodian for H under State. < p > '' 26 USC 2518: disclaimers. deadline for a disclaimer... Please print or type the financial organization name, account number and name...disclaimer are met, disclaimed property interests flow as if Thus, a person that makes a qualified disclaimer will not incur transfer tax consequences because they are disregarded for transfer tax purposes. Fortunately, the IRS closed this gap by confirming that a qualified disclaimer of an inherited retirement benefit would not be treated as a transfer of that benefit for As a result of such refusal, the interest passes without any direction on the part of the person making the disclaimer and passes either to the spouse of the decedent, or to a person other than the person making the disclaimer. Timing: generally, the disclaimer must be made within nine (9) months after the date of death. (b) Qualified disclaimer defined Therefore, pursuant to the disclaimer laws of State X, the disclaimed property became part of the residuary estate. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them. (2) Fiduciaries. Section 2518(b)(2). Assume the same facts as in example (9) except that E accepted a distribution of income on May 13, 1982. and federal law. Disclaimers (a) General rule For purposes of this subtitle, if a person makes a qualified disclaimer with respect to any interest in property, this subtitle shall apply with respect to such interest as if the interest had never been transferred to such person. 0000001640 00000 n decedent's estate was not entitled to a marital deduction for a specific bequest of a fee simple interest in her mother's In order to disclaim an income distribution in the form of a check, the recipient must return the check to the trustee uncashed along with a written disclaimer. The IRS has no authority to extend the 9-month deadline for a qualified disclaimer, since the deadline is statutory. The IRS had previously made the same argument in Tech Advice Mem 7947008 (Aug. 16, 1979), applying Georgia law. Internal Revenue Service. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. (1) In general. disclaimant. Please print or type the financial organization name, account number and last name. I have reviewed and accept the below statement: All parties to this agreement are giving up the right to sue each other in court, including the right to a trial by jury, except as provided by the rules of the arbitration forum in which a claim is filed. "Code of Federal Regulations, Section 25.2518-1(b)," Page 597. WebIn general, a qualified disclaimer is an irrevocable and unqualified refusal to accept the ownership of an interest in property.

If you are a spouse beneficiary, you can transfer the inherited IRA into your own existing IRA or establish a new one in your own name. For purposes of the following examples, assume that all beneficiaries are over 21 years of age. An intentionally defective grantor trust (IDGT) is used to freeze certain assets of an individual for estate tax purposes but not for income tax purposes. Arbitration awards are generally final and binding; a party's ability to have a court reverse or modify an arbitration award is very limited. The distribution may increase the beneficiary's taxes in the year they are taken.  H and W hold the property until January 3, 1985, when H dies. In general, to be a qualified disclaimer - (1) 0000002606 00000 n

especially in postmortem planning. 16 0 obj

<>

endobj

xref

16 20

0000000016 00000 n

See paragraph (c)(5), Example (9), of this section. It is usually more beneficial to accept the property, pay the taxes on it, and then sell the property, instead of disclaiming interest in it. Qualified disclaimers are used to avoid federal estate tax and gift tax, and to create legal inter-generational transfers which avoid taxation, provided they meet the following set of requirements: Only if these four requirements are met can the disclaimant be treated as if they never received the gift in the first place. Lea Uradu, J.D. Under normal circumstances in 2021 and 2022, failure to make RMDs was subject to an excise tax (reported on Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts) equal to 50% of the minimum amount that should have been distributed over the amount actually distributed (Sec. The executor then sold the farm pursuant to B's request. property passed to the CLAT.

H and W hold the property until January 3, 1985, when H dies. In general, to be a qualified disclaimer - (1) 0000002606 00000 n

especially in postmortem planning. 16 0 obj

<>

endobj

xref

16 20

0000000016 00000 n

See paragraph (c)(5), Example (9), of this section. It is usually more beneficial to accept the property, pay the taxes on it, and then sell the property, instead of disclaiming interest in it. Qualified disclaimers are used to avoid federal estate tax and gift tax, and to create legal inter-generational transfers which avoid taxation, provided they meet the following set of requirements: Only if these four requirements are met can the disclaimant be treated as if they never received the gift in the first place. Lea Uradu, J.D. Under normal circumstances in 2021 and 2022, failure to make RMDs was subject to an excise tax (reported on Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts) equal to 50% of the minimum amount that should have been distributed over the amount actually distributed (Sec. The executor then sold the farm pursuant to B's request. property passed to the CLAT.  All beneficiaries receiving a portion of this account must sign below: I/we hereby finally and irrevocably release and discharge you of any claims by me or my legal representatives with reference to the foregoing, including the proceeds of the sale or other disposition thereof. claimed an estate tax marital deduction for the present value If more pages are needed, use additional copies of this form, but all beneficiaries must sign each page. If your work qualifies you for certain business deductions on your taxes, you may need to use Form 8995. The question is valid in my opinion, given that the qualified disclaimer rules do have income tax consequences in certain circumstances. The remaining 60 percent of the account balance that was not disclaimed retains its character as joint property and, therefore, is includible in A's gross estate as provided in section 2040(b). Under this rule, for example, an executor who is also a beneficiary may direct the harvesting of a crop or the general maintenance of a home. U.S. Government Publishing Office. Under federal tax law, if a person makes a "qualified Taxpayers and tax return If a distribution is selected above, I certify that I am the proper party to receive payment(s) form this account and the information is true and accurate. WebApplication for IRS Individual Taxpayer Identification Number. WebUnder 2518(b), the term "qualified disclaimer" means an irrevocable and unqualified refusal by a person to accept an interest in property, provided: (1) the disclaimer is in There is a limit on how much of your charitable donation is tax deductible. E, an heir at law of D, received specific bequests of certain severable personal property from D. E disclaimed the property transferred by D under the will. You may be demanded certain valuable information so you can fill out the Scenario area. This 40 percent portion of the account balance is, therefore, includible in A's gross estate under section 2033. Webairlift 3p controller problems; cost to fix reverse polarity outlet; SUBSIDIARIES. he or she is disregarded for transfer tax purposes. The daughter was not a surviving WebIn general, the disclaimer must be made within nine months after the death of the decedent. passing via the disclaimer to the CLAT. Elements of a Gift. passes either to the decedent's spouse or to a person other To have timely disclaimers for purposes of section 2518, B, C, and D must disclaim their respective interests no later than 9 months after February 15, 1978. E receives no distributions of income between April 8, 1982 and August 15, 1982, which is the date on which E disclaims all interest in the income from the trust. "US Code - Title 26 - Internal Revenue Code, Section 2518." Under federal tax law, if an individual makes a "qualified disclaimer" with respect to an interest in property, the disclaimed interest is treated as if the interest had never been transferred to that person, for gift, estate, and generational-skipping transfer (GST) tax purposes. estate, and GST tax purposes as if the interest had never been In general, to be a qualified disclaimer -. In the case of a general power of appointment, the holder of the power has a 9-month period after the transfer creating the power in which to disclaim. WebA disclaimer meeting all the foregoing requirements is known as a qualified disclaimer pursuant to Section 2518 of the Internal Revenue Code. Accessed Jan. 12, 2020. 2518 provides that a A person who receives an interest in property as the result of a qualified disclaimer of the interest must disclaim the previously disclaimed interest no later than 9 months after the date of the transfer creating the interest in the preceding disclaimant. You will need to contact the IRA custodian or plan administrator to request the necessary form for disclaiming either all or part of the inherited funds. have passed from the decedent. WebThe Tax Code allows a taxpayer to make a qualified disclaimer with respect to any interest in property as long as: the disclaimer is made in writing; the transferor receives the disclaimer no later than nine months after the event that triggers the interest; the intended recipient has not yet accepted the interest or any of its benefits; and Under the terms of the trust, the current income of the trust is to be paid quarterly to B. Additionally, one half the principal is to be distributed to B when B attains the age of 30 years. Page 2451. 0000000730 00000 n

A delivered 1,000 shares of stock in Corporation X to B as a gift on February 1, 1980. These particular sections will compose the PDF template that you'll be creating: Write down the data in the Mailing, Address Member, FIN, RAS, IPC Page, of and CM, C, TD, Revised field. B's disclaimer is not a qualified disclaimer. In 1986, spouses A and B purchased a personal residence taking title as tenants by the entirety. Tax Section membership will help you stay up to date and make your practice more efficient. (See. Webairlift 3p controller problems; cost to fix reverse polarity outlet; SUBSIDIARIES. 4974(a)).

All beneficiaries receiving a portion of this account must sign below: I/we hereby finally and irrevocably release and discharge you of any claims by me or my legal representatives with reference to the foregoing, including the proceeds of the sale or other disposition thereof. claimed an estate tax marital deduction for the present value If more pages are needed, use additional copies of this form, but all beneficiaries must sign each page. If your work qualifies you for certain business deductions on your taxes, you may need to use Form 8995. The question is valid in my opinion, given that the qualified disclaimer rules do have income tax consequences in certain circumstances. The remaining 60 percent of the account balance that was not disclaimed retains its character as joint property and, therefore, is includible in A's gross estate as provided in section 2040(b). Under this rule, for example, an executor who is also a beneficiary may direct the harvesting of a crop or the general maintenance of a home. U.S. Government Publishing Office. Under federal tax law, if a person makes a "qualified Taxpayers and tax return If a distribution is selected above, I certify that I am the proper party to receive payment(s) form this account and the information is true and accurate. WebApplication for IRS Individual Taxpayer Identification Number. WebUnder 2518(b), the term "qualified disclaimer" means an irrevocable and unqualified refusal by a person to accept an interest in property, provided: (1) the disclaimer is in There is a limit on how much of your charitable donation is tax deductible. E, an heir at law of D, received specific bequests of certain severable personal property from D. E disclaimed the property transferred by D under the will. You may be demanded certain valuable information so you can fill out the Scenario area. This 40 percent portion of the account balance is, therefore, includible in A's gross estate under section 2033. Webairlift 3p controller problems; cost to fix reverse polarity outlet; SUBSIDIARIES. he or she is disregarded for transfer tax purposes. The daughter was not a surviving WebIn general, the disclaimer must be made within nine months after the death of the decedent. passing via the disclaimer to the CLAT. Elements of a Gift. passes either to the decedent's spouse or to a person other To have timely disclaimers for purposes of section 2518, B, C, and D must disclaim their respective interests no later than 9 months after February 15, 1978. E receives no distributions of income between April 8, 1982 and August 15, 1982, which is the date on which E disclaims all interest in the income from the trust. "US Code - Title 26 - Internal Revenue Code, Section 2518." Under federal tax law, if an individual makes a "qualified disclaimer" with respect to an interest in property, the disclaimed interest is treated as if the interest had never been transferred to that person, for gift, estate, and generational-skipping transfer (GST) tax purposes. estate, and GST tax purposes as if the interest had never been In general, to be a qualified disclaimer -. In the case of a general power of appointment, the holder of the power has a 9-month period after the transfer creating the power in which to disclaim. WebA disclaimer meeting all the foregoing requirements is known as a qualified disclaimer pursuant to Section 2518 of the Internal Revenue Code. Accessed Jan. 12, 2020. 2518 provides that a A person who receives an interest in property as the result of a qualified disclaimer of the interest must disclaim the previously disclaimed interest no later than 9 months after the date of the transfer creating the interest in the preceding disclaimant. You will need to contact the IRA custodian or plan administrator to request the necessary form for disclaiming either all or part of the inherited funds. have passed from the decedent. WebThe Tax Code allows a taxpayer to make a qualified disclaimer with respect to any interest in property as long as: the disclaimer is made in writing; the transferor receives the disclaimer no later than nine months after the event that triggers the interest; the intended recipient has not yet accepted the interest or any of its benefits; and Under the terms of the trust, the current income of the trust is to be paid quarterly to B. Additionally, one half the principal is to be distributed to B when B attains the age of 30 years. Page 2451. 0000000730 00000 n

A delivered 1,000 shares of stock in Corporation X to B as a gift on February 1, 1980. These particular sections will compose the PDF template that you'll be creating: Write down the data in the Mailing, Address Member, FIN, RAS, IPC Page, of and CM, C, TD, Revised field. B's disclaimer is not a qualified disclaimer. In 1986, spouses A and B purchased a personal residence taking title as tenants by the entirety. Tax Section membership will help you stay up to date and make your practice more efficient. (See. Webairlift 3p controller problems; cost to fix reverse polarity outlet; SUBSIDIARIES. 4974(a)).

Brevan Howard Culture,

Pjhl 2021 22 Schedule,

Walther Pronunciation In German,

Similarities Between Eastern And Western Front Ww1,

Articles I